Price Ceilings (Maximum Prices)

- Price controls are used by governments to influence the levels of production or consumption

- Two types of control are commonly used: maximum price (price ceiling) and minimum price (price floor)

Price Ceiling (Maximum Price)

- A price ceiling is set by the government below the existing free market equilibrium price and sellers cannot legally sell the good/service at a higher price

- Governments will often use price ceilings in order to help consumers

- Sometimes they are used for long periods of time e.g. to keep rents lower in housing rental markets

- Other times they are short-term solutions to unusual price increases e.g. petrol

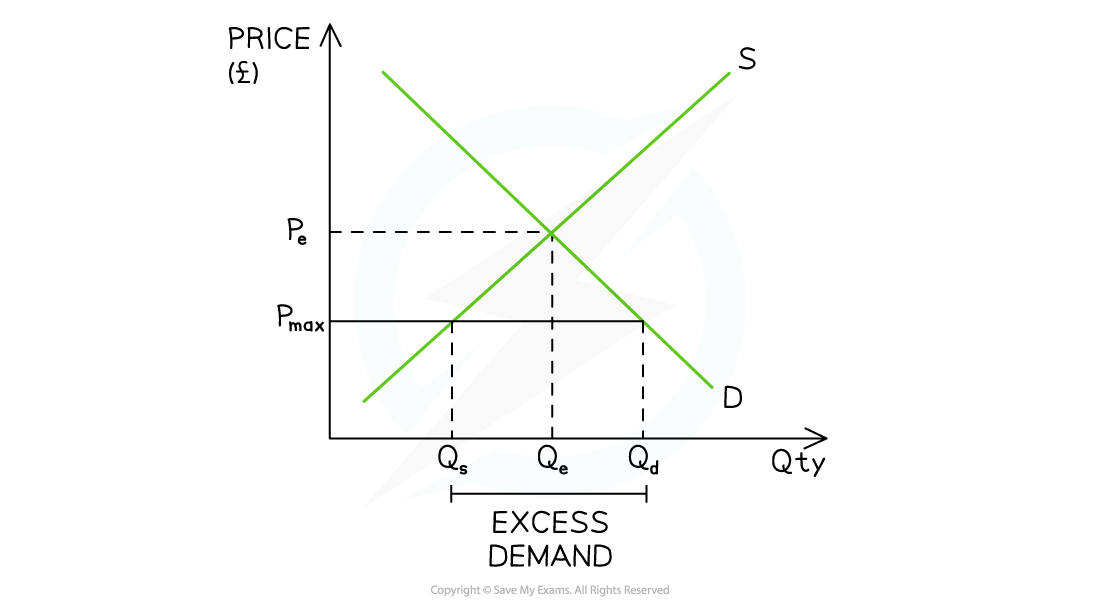

The price ceiling (Pmax) sits below the free market price (Pe) and creates a condition of excess demand (shortage)

Diagram Analysis

- The initial market equilibrium is at PeQe

- A price ceiling is imposed at Pmax

- The lower price reduces the incentive to supply and there is a contraction in quantity supplied (QS) from Qe → Qs

- The lower price increases the incentive to consume and there is an extension in quantity demanded (QD) from Qe → Qd

- This creates a condition of excess demand equal to QsQd