Sources of Government Revenue

- The main sources of government revenue include taxation, the sale of goods/services by government owned firms, and the sale of government owned assets (privatisation)

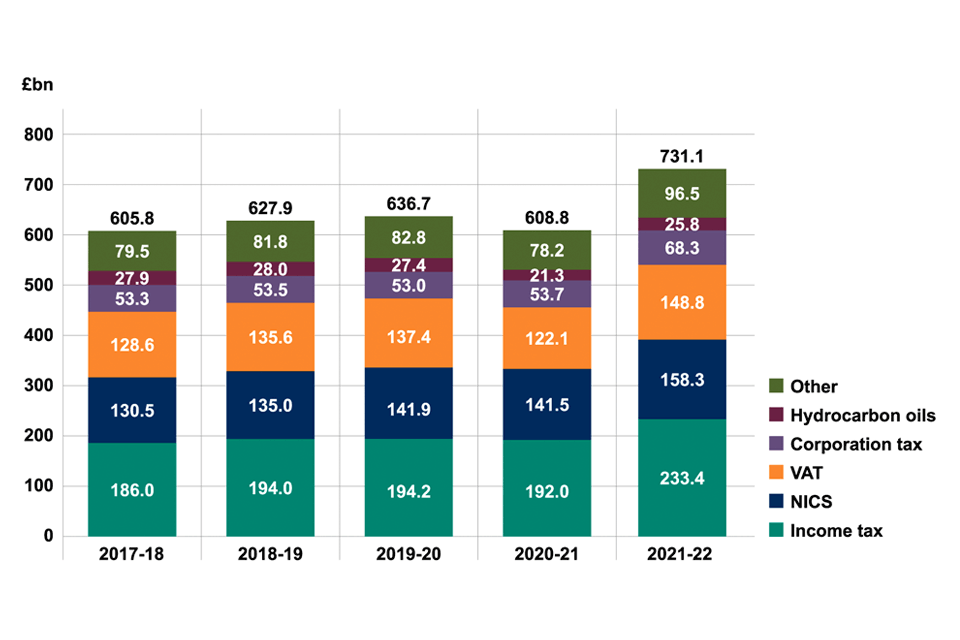

1. Taxation

- Direct taxes are taxes imposed on income and profits

- They are paid directly to the government by the individual or firm

- E.g. Income tax, corporation tax, capital gains tax, national insurance contributions, inheritance tax

- They are paid directly to the government by the individual or firm

- Indirect taxes are imposed on spending

- The supplier is responsible for sending the payment to the government

2. Sale of goods and services

- Government owned firms sometimes charge for the goods/services that they provide

- E.g. Charges on public transport and fees paid to access some medical services

3. The sale of government owned assets

- Privatisation can generate significant government revenue during the year in which the government sells the asset

- Most assets can only be sold once e.g. national airlines or railways

- Some assets, such as the right for mobile phone operators to use the airwaves, can be sold every few years (the airway licence is for a defined period of time)