Main Functions of a Central Bank

- A central bank is the government's bank that issues currency and controls the supply of money in the economy

- Central banks play a vital role in maintaining stability in the financial system

- The policy tools at their disposal help to meet government macroeconomic objectives

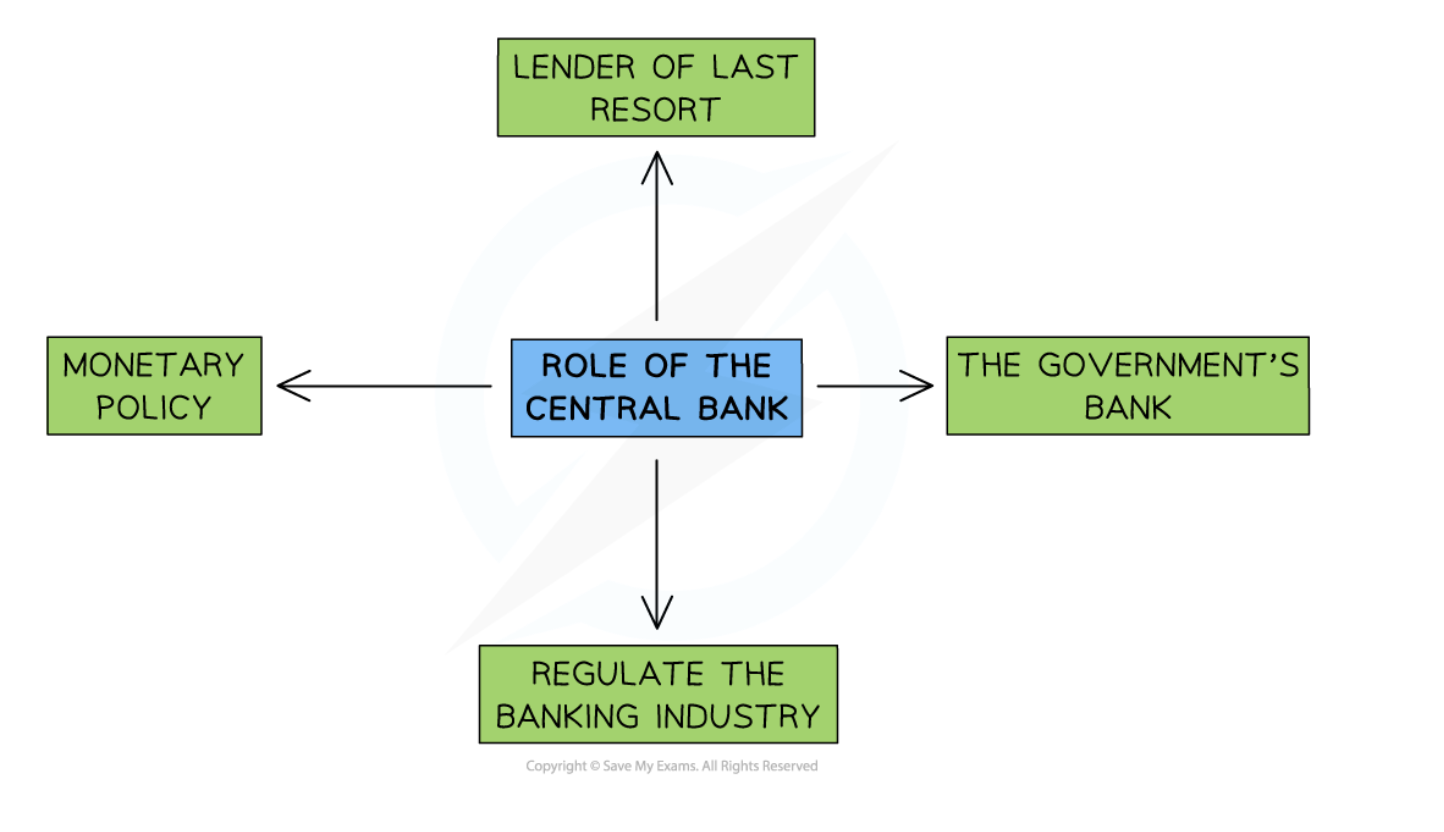

Diagram: Role of the Central Bank

Central Banks play four important roles in the economy

1. Banker to the government: The government sets the annual budget, but it is the Central Bank that manages the tax receipts and payments. In 2022, there were 5.7 million public sector workers in the UK who had to be paid each month

2. Banker to the banks—lender of last resort: Commercial banks are able to borrow from the Central Bank if they run into short-term liquidity issues. Without this help, they might go bankrupt, leading to instability in the financial system and a potential loss of savings for many households

3. Regulation of the banking industry: The high level of asymmetric information in financial markets, it requires that commercial banks be regulated in order to protect consumers. One of the key regulatory actions to manage the money supply and promote stability in the financial system is the implementation of required reserve ratios.. Raising the ratio decreases the money supply in the economy, and vice versa

4. Implementation of monetary policy: This involves the Central Bank taking action to influence interest rates, the money supply, credit and the exchange rate