Efficiency Ratios (AQA A Level Business): Revision Note

Exam code: 7132

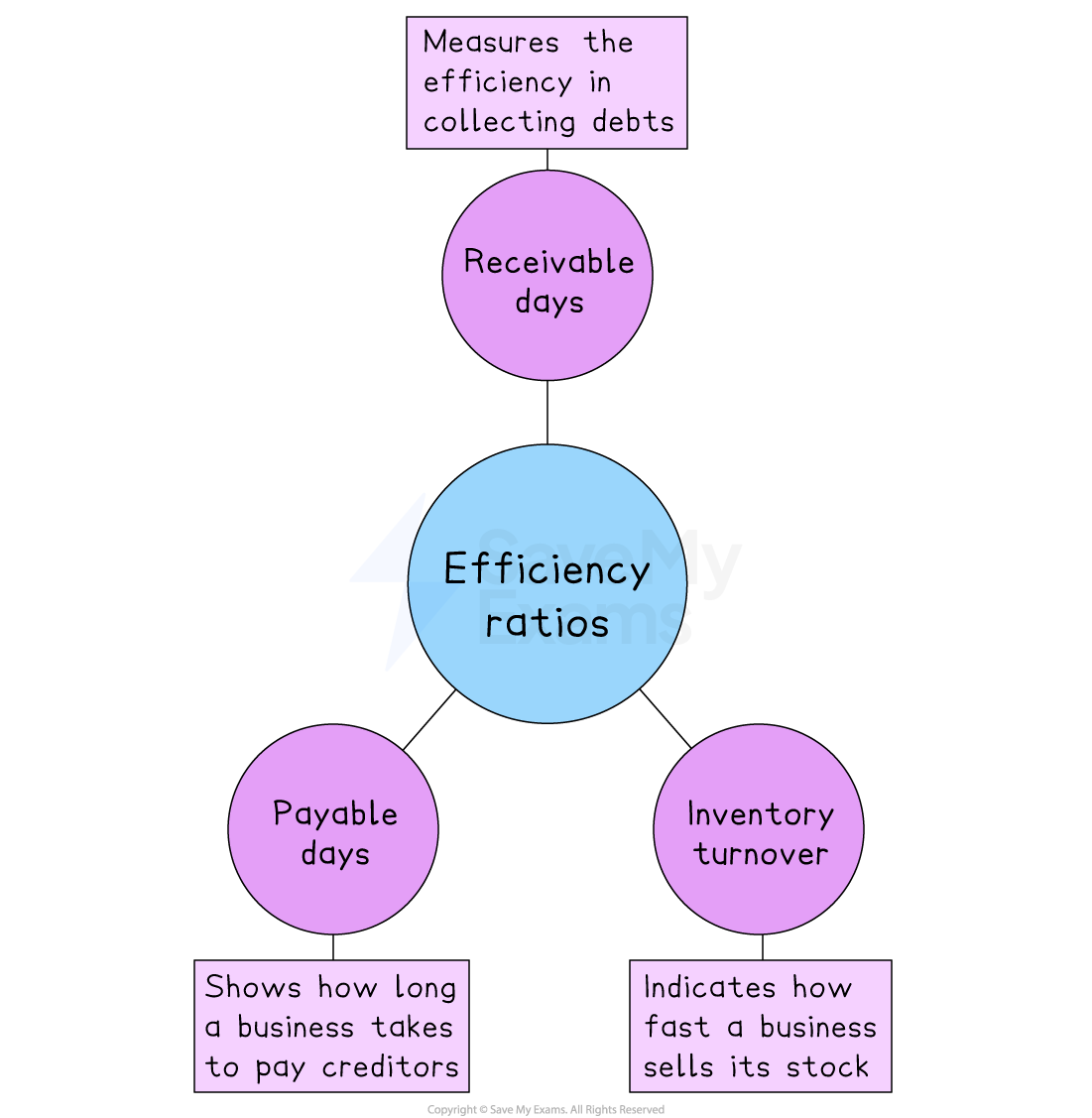

Introducing efficiency ratios

Efficiency ratios are valuable because they highlight how well a business manages its resources and operations, helping to identify areas where performance and cash flow can be improved

Payables days

Payables days measures the average number of days a business takes to pay invoices owed to creditors

It is calculated using the formula

Businesses generally aim for a high or increasing ratio

This indicates skills of negotiation in arranging extended credit terms with suppliers

Delaying payments to suppliers can improve cash flow

However, taking longer than agreed to pay outstanding invoices may have negative consequences

Relationships with important suppliers may worsen

They are less likely to extend further trade credit

Penalties may be issued for late payment

Orders may be delayed until payment is received

Creditworthiness may worsen

A business may fail credit checks

Unable to place orders with other suppliers

Less chance of obtaining trade credit elsewhere

Could impact applications for borrowing e.g. loans

Worked Example

YakPur Fashions is a manufacturer and exporter of high quality fashion outerwear

A selection of YakPur Fashions' financial performance indicators are shown in the table

Selected Financial Performance Data 2024 YakPur Fashions | |

|---|---|

| £ |

Inventory held on 1st January 2024 | 47,600 |

Credit Sales Revenue | 241,200 |

Cost of Sales | 112,400 |

Inventory held on 31st December 2024 | 26,000 |

Receivables on 31st December 2024 | 31,200 |

Payables on 31st December 2024 | 28,500 |

Calculate YakPur Fashion's payables days ratio for 2024.

[2]

Step 1: Multiply payables by 365

(1)

Step 2: Divide the outcome by cost of sales

(1)

Yakpur takes an average of 92.55 days to settle supplier invoices

Improving the payables days ratio

Method | Explanation |

|---|---|

Develop close relationships with suppliers |

|

Improve the business's credit rating |

|

Seek suppliers that offer extended trade credit terms |

|

Receivables days

Receivables days measures the average number of days it takes for a business to collect money from its debtors

Businesses often provide a period of trade credit to customers

In the UK 30 to 60 days is typical

The growth of promotional 'buy now, pay later' deals has increased the level of debtors for some businesses

It is calculated using the formula

Businesses aim for a low or reducing ratio

This indicates efficiency in collecting outstanding debts from credit customers

Collecting debts promptly can improve cash flow

Worked Example

YakPur Fashions is a manufacturer and exporter of high quality fashion outerwear

A selection of YakPur Fashions' financial performance indicators are shown in the table

Selected Financial Performance Data 2024 YakPur Fashions | |

|---|---|

| £ |

Inventory held on 1st January 2024 | 47,600 |

Credit Sales Revenue | 241,200 |

Cost of Sales | 112,400 |

Inventory held on 31st December 2024 | 26,000 |

Receivables on 31st December 2024 | 31,200 |

Payables on 31st December 2024 | 28,500 |

(a) Calculate YakPur Fashion's receivables days ratio for 2024.

(2 marks)

Step 1: Multiply receivables by 365

(1)

Step 2: Divide the outcome by revenue

(1)

It takes YakPur Fashions an average of 47.21 days to collect money owing from debtors

Ways to reduce the receivables days ratio

Method | Explanation |

|---|---|

Streamline invoicing and credit control processes |

|

Establish and monitor creditworthiness of customers |

|

Improve payment systems |

|

Provide incentives for early payment |

|

If these methods fail to persuade customers to pay their invoices on time a business has a range of further options. These methods should be pursued with caution as relationships with customers may be damaged

Further ways to reduce the receivables days ratio

Method | Explanation |

|---|---|

Refuse to provide further goods unless outstanding debts are paid |

|

Threaten to take legal action |

|

Comparing payables days and receivables days

Comparing receivables days and payables days helps assess how well a business manages its cash flow and short-term liquidity

If receivables days are greater than payables days, the business waits longer to collect cash than it does to pay suppliers

This creates a cash outflow gap that must be financed from cash reserves or borrowing, reducing liquidity

Conversely, if payables days are greater than receivables days, suppliers effectively finance the business

This eases the pressure on liquidity, so the business can meet its short-term obligations without running out of cash

Inventory turnover

The inventory turnover ratio shows how well a business converts its stock into sales

Before calculating inventory turnover it is first necessary to calculate the average value of stock held by a business in a given period

It is calculated using the formula

Calculating the inventory turnover ratio

Inventory turnover can then be calculated in two ways

The number of times a business sells all of its stock during a period (usually a year)

Businesses aim for a high or increasing ratio

More stock sold means that it is generating profit more efficiently

Perishable goods are less likely to be wasted

The number of days taken to sell all of its stock

Businesses aim for a low or falling ratio

Selling stock quickly means profit is achieved swiftly

Less likely to hold obsolete stock that may need to be sold at a loss

Worked Example

YakPur Fashions is a manufacturer and exporter of high quality fashion outerwear

A selection of YakPur Fashions' financial performance indicators are shown in the table

Selected Financial Performance Data 2024 YakPur Fashions | |

|---|---|

| £ |

Inventory held on 1st January 2024 | 47,600 |

Credit Sales Revenue | 241,200 |

Cost of Sales | 112,400 |

Inventory held on 31st December 2024 | 26,000 |

Receivables on 31st December 2024 | 31,200 |

Payables on 31st December 2024 | 28,500 |

(a) Calculate YakPur Fashions' inventory turnover ratio for 2022

(i) in terms of the number of times inventory was sold during the year

(ii) in terms of the number of days taken to sell all inventory.

[4]

Step 1: Calculate the average value of inventory

(1)

Step 2: Calculate the number of times stock sold during the year

(1)

Step 3: Calculate the number of days taken to sell stock

(2)

Improving the inventory turnover ratio

Hold less inventory | Reduce the cost of sales |

|---|---|

|

|

Inventory turnover variations

There is no ideal ratio for stock turnover

Some businesses will have a very low stock turnover ratio as they sell few products - usually at a high price

Examples include jewellers, luxury vehicles and specialist equipment or services

Other businesses have a very high stock turnover ratio as they sell large volumes of low or moderately-priced products

Their business model often requires this - for example, they may sell perishable goods

Examples include supermarkets, florists or takeaway food businesses

Examiner Tips and Tricks

When calculating financial ratios, check that you are using the correct units.

In some cases, financial data is presented as raw figures (e.g. £14,520) but in most cases, you will be working in thousands (£000) or millions (£m).

Ensure that you convert correctly, e.g. £0.39m is equal to £390,000 and £34.9 (000) is equal to £34,900

Make sure the decimal place is in the correct place

Calculate to two decimal places unless stated otherwise

Evaluation of ratio and efficiency analysis

A range of factors can affect how useful ratio analysis is in supporting business decision-making

The business’s market position

A market leader’s ratios (e.g. high profit margins) may look very different to those of a small rival, so comparing them directly can be misleading without adjustments for size

Quality of management decision making

Strong management can boost key ratios by making choices like cutting costs that may hide longer-term problems

Poor decisions can worsen ratios even if the wider market is performing well

Workers’ and management skills

A highly skilled workforce and experienced managers improve productivity and efficiency ratios, such as inventory turnover

The economic environment

In a recession, profitability and liquidity ratios tend to fall for most businesses, so low ratios may reflect the wider economy rather than internal failings

Market conditions

Industry-specific factors such as seasonal demand swings, intense price competition or new regulations, can skew ratios, making it hard to tell if a ratio change is a company problem or an industry trend

Advantages and disadvantages of using ratio analysis to assess business performance

Advantages | Disadvantages |

|---|---|

|

|

|

|

|

|

Unlock more, it's free!

Was this revision note helpful?