The Income Statement (AQA A Level Business): Revision Note

Exam code: 7132

An introduction to the income statement

The income statement tracks a business's revenue, expenses, profit or loss (see Analysing Profitability) during a set period, usually a year

Stakeholder interest in the income statement

Stakeholder | Interest |

|---|---|

Shareholders |

|

Employees |

|

Managers and directors |

|

Suppliers |

|

Government |

|

Local community |

|

The structure of the income statement

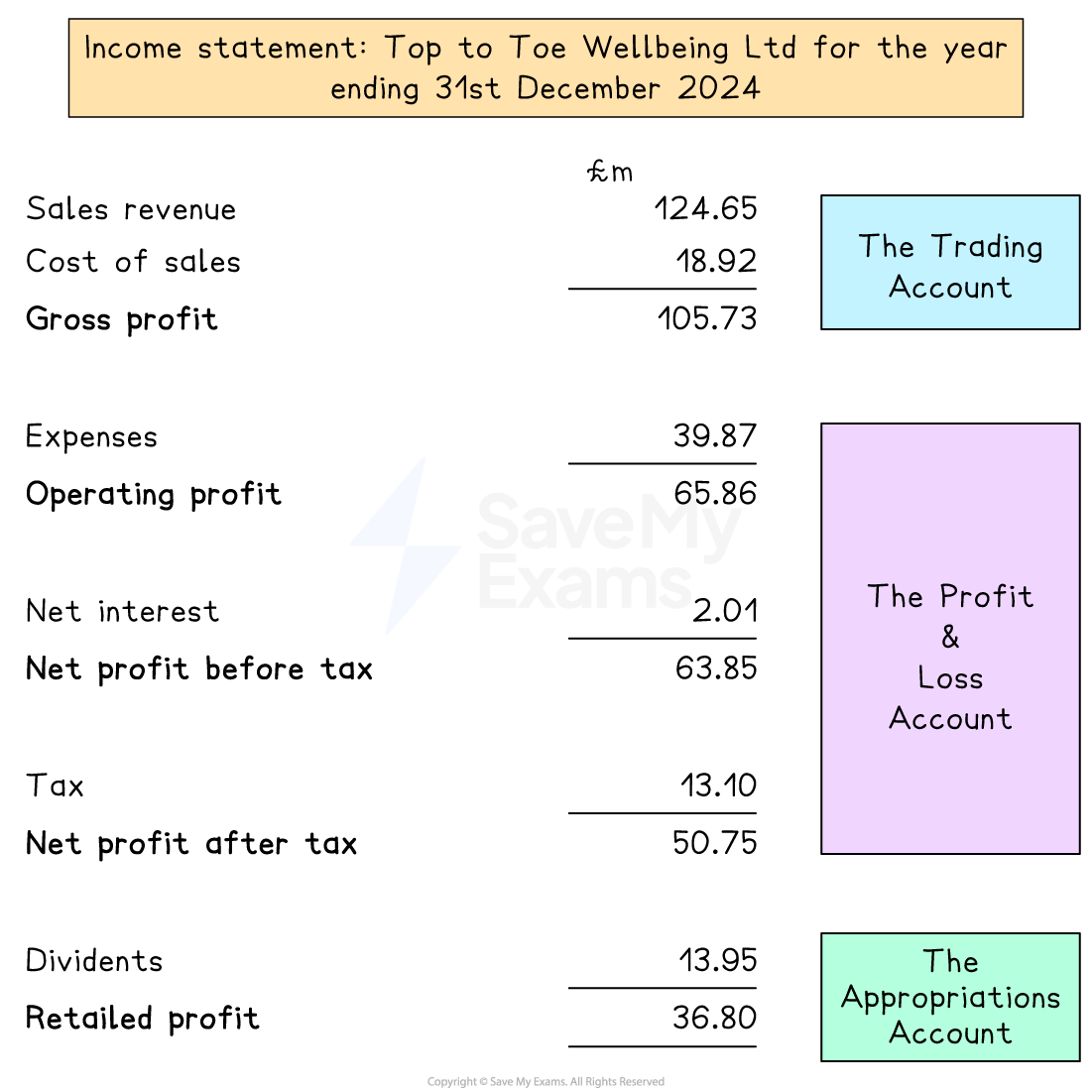

The income statement is divided into three parts

The trading account

The profit and loss account

The appropriation account

An example income statement

The trading account

The trading account is where the cost of sales is deducted from sales revenue to calculate the gross profit

In 2024 Top to Toe Wellbeing Limited's sales revenue was £124.65m and its cost of sales were £18.92m

The gross profit for the period was therefore

The profit and loss account

The profit and loss account deducts a series of expenses to determine the operating profit for the period

In 2024 gross profit was £105.73m and expenses were £39.87m

The operating profit was therefore

The business also paid £2.01m interest

The profit before tax was therefore

The business also paid £13.10m tax

The profit after tax for the period was therefore

The appropriations account

The appropriations account shows how profits are distributed for the period

In 2024 Head to Toe Wellbeing Limited distributed £13.95m to shareholders as dividends

£36.80m was therefore retained as profit

Notes to the accounts

Public limited companies are required by law to include details of

Depreciation of non-current assets

Directors' earnings

Audit details, including the identity and costs of the appointed auditor

Employee details, such as the size of the workforce, wage and salary costs, pension liabilities and national insurance contributions

Extraordinary items, which are significant one-off items of income or expenditure that are unlikely to be repeated, such as the relocation of a head office

Exceptional items, which are significant one-off items of income or expenditure that are unusual but a part of normal trading activities, such as a very large order placed by a customer

Profit quality

Profit quality measures how reliable and sustainable a company’s reported profit really is

It considers whether profit comes from normal, cash-generating activities or from one-off, non-cash or unreliable sources

High-quality profit | Poor-quality profit |

|---|---|

|

|

Unlock more, it's free!

Was this revision note helpful?