Market Research Data (Cambridge (CIE) A Level Business): Revision Note

Exam code: 9609

Reliability of market research data

Market research is a valuable tool that helps businesses make informed choices about, for example, product development, pricing and promotion

However, if the data collected is unreliable, it can lead to poor decisions that waste time, money and resources

Why market research data can be unreliable

Reason | Explanation | Example |

|---|---|---|

Respondents may not give truthful or accurate answers |

|

|

Questions may be poorly designed or unclear |

|

|

Secondary data may be outdated or collected for a different purpose |

|

|

Data collection methods may be inconsistent or poorly managed |

|

|

Analysis of quantitative and qualitative market research data

Quantitative data

Quantitative data is based on numbers

It could include financial reports (e.g. sales, costs), market data (e.g. market share) or summaries of data gained from primary research (e.g. on a scale of 1–10, rate our customer service)

It is beneficial for a range of reasons

Percentages, scores, or yes/no answers are straightforward to organise, compare and present using graphs or charts

Large amounts of numerical data can reveal clear patterns in customer behaviour over time

E.g. A clothing retailer may notice that online sales increase by 20% every November, helping them plan future promotions

Analysis of quantitative data using mean, median, mode and range

Term | Definition | How to calculate | Example |

|---|---|---|---|

Mean |

|

| |

Median |

|

| |

Mode |

|

| |

Range |

|

|

Qualitative data

Qualitative data gathers descriptions or explanations

These can be based on conversations, discussions, impressions and emotional feelings and are usually gathered through primary research

It helps businesses understand not just what customers do, but why they do it

By listening to detailed customer feedback, businesses can make meaningful improvements to products or services based on real user experiences

E.g. A technology company might learn from a focus group that users find a mobile app too complicated, leading to changes in layout and features

Analysis of qualitative data

Businesses often analyse qualitative data through a process called coding

This is where similar responses or themes are grouped together, so the business can identify patterns and common issues

Each theme is given a code to make it easier to sort and compare

Case Study

Coding in action

A mobile phone company collects hundreds of open-ended survey responses asking customers what they like or dislike about a new handset

Marketing researchers read through the comments and assign codes:

“BAT” for battery life

“CAM” for camera quality

“EAS” for ease of use

“DES” for design and appearance

After coding the responses, they may notice that many customers mention “BAT” (battery life) negatively

The business can then use this insight to improve the battery in the next version of the product

They may also adjust their marketing to focus on features that customers value more positively

Limitations of quantitative and qualitative research data

Limitations of quantitative data | Limitations of qualitative data |

|---|---|

|

|

Interpretation of tables, charts and graphs

1. Tables

Tables summarise data in an organised form

The table shows that:

Flashmaster generates the highest sales in each period

Sales of LumoLens are lower at the end of the year than at the start of the year

2. Graphs and charts

Data contained in graphs and charts can be important sources of marketing research

Data may be presented in a range of forms

Bar charts

Bar charts show data that are independent of each other, such as sales per store

Pie charts

Pie charts show how a whole is divided into different elements, such as total sales divided amongst different product types

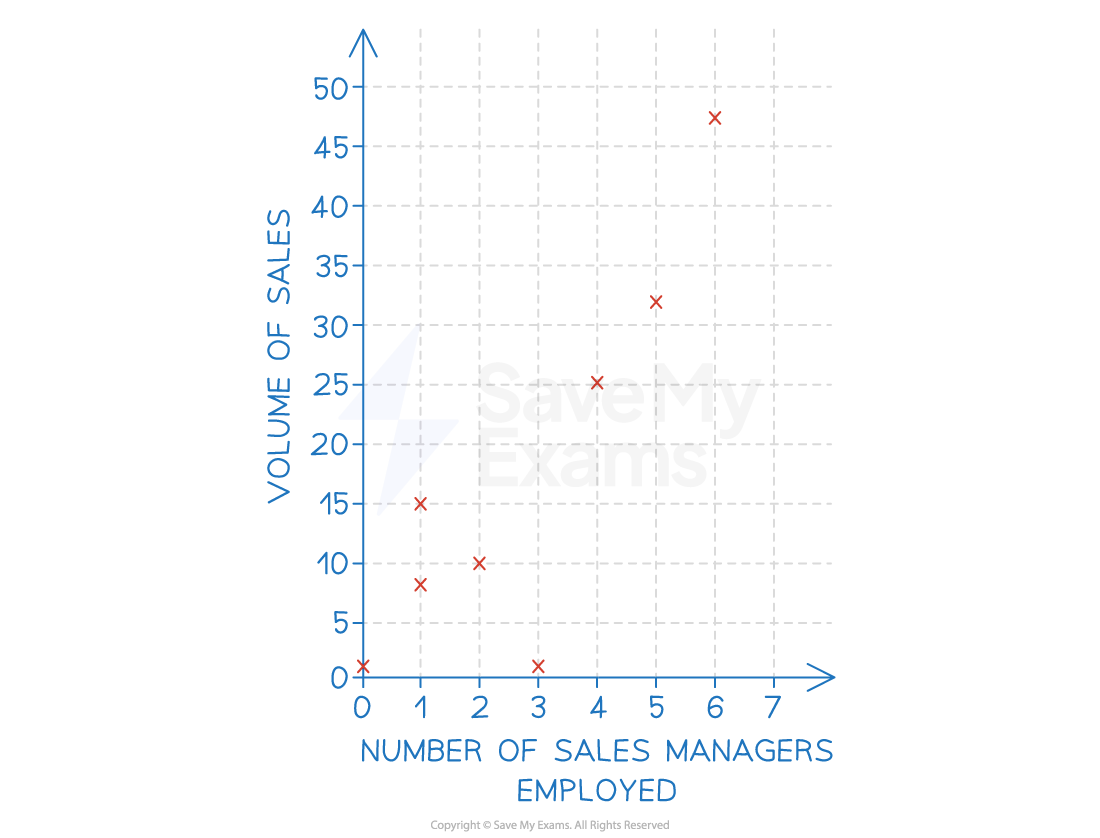

Scatter graphs

Scatter graphs allow businesses to compare two variables, such as sales volume and advertising, to establish if there is any correlation between them

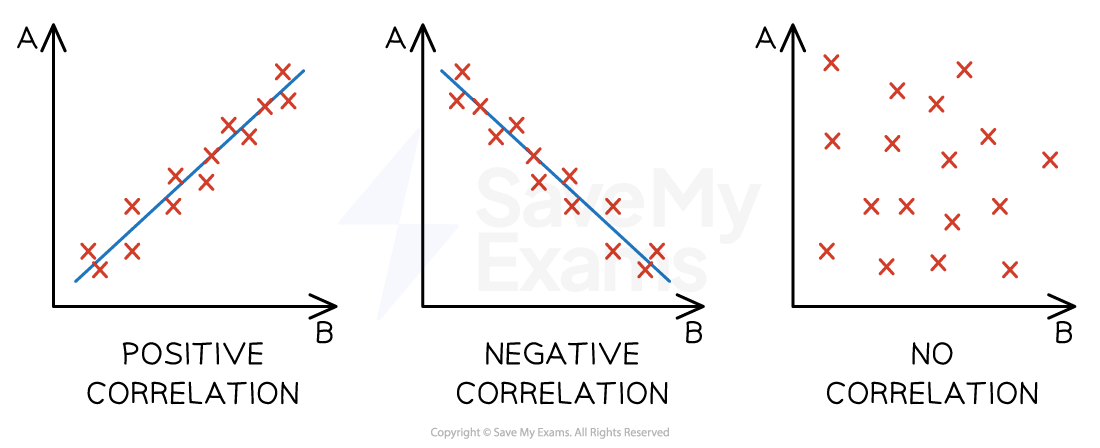

A correlation exists where there is a relationship or connection between the two variables in a scatter graph

A positive correlation means that as one variable increases, so does the other variable

A line of best fit that slopes upwards can be identified

A negative correlation means that as one variable increases, the other variable decreases

A line of best fit that slopes downwards can be identified

No correlation means that there is no connection between the two variables

It is not possible to identify a line of best fit

Correlation types

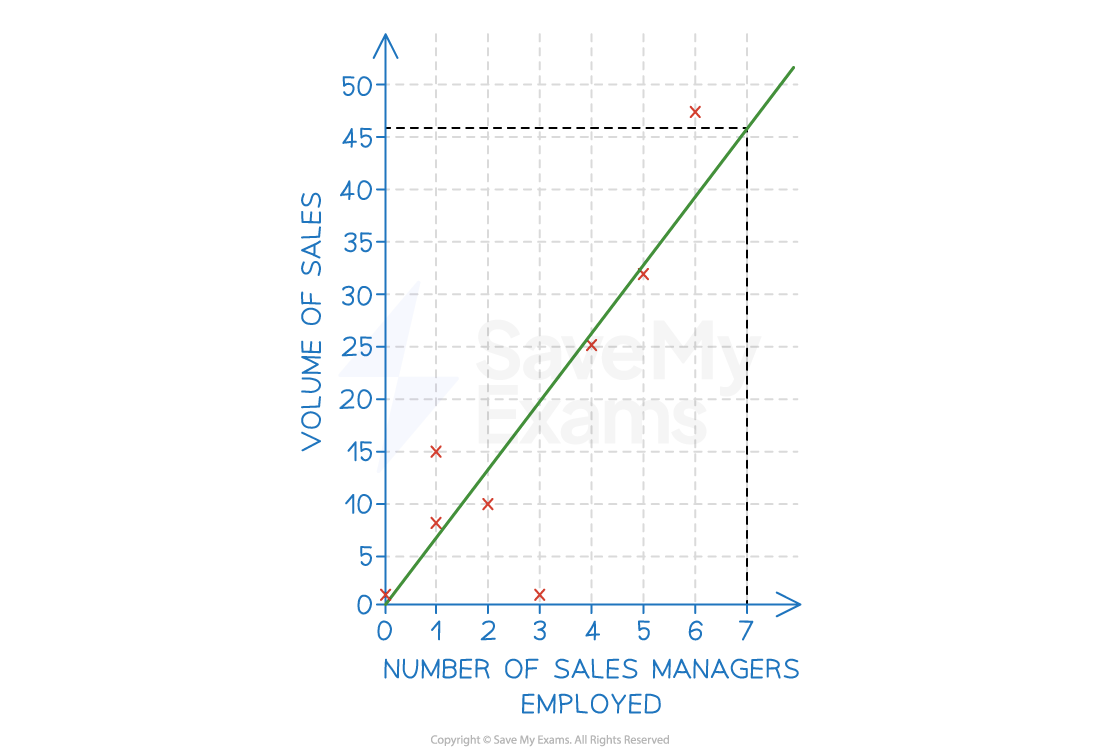

Where a line of best fit can be identified and when causation is determined, a business can extrapolate data to make predictions around changes to either of the variables

E.g. extrapolation of the line of best fit in the example below means that the business could predict that employing seven sales managers would likely result in sales of 46 units

Extrapolation using a line of best fit

Examiner Tips and Tricks

When drawing a line of best fit, you should try to include as many data points above the line as below the line

Watch out for outlying data — if there is more than one outlier above the line, adjust your line of best fit upwards

Similarly, if there is more than one outlier below the line, adjust your line of best fit downwards. Just one outlier should not influence your line of best fit

Unlock more, it's free!

Was this revision note helpful?