Using Ratio Analysis To Make Strategic Decisions (Cambridge (CIE) A Level Business): Revision Note

Exam code: 9609

Assessing business performance over time

Ratio analysis involves comparing financial figures from the accounts to create meaningful measurements of profitability, liquidity and efficiency

When ratios are tracked over several time periods, they help identify trends in a business’s performance

Ratio analysis:

Identifies improvements or problems

By comparing ratios year-on-year, businesses can see if performance is getting better or worse

For example, a rising profit margin suggests improved profitability, while a falling current ratio may signal cash flow issues

Supports decision-making

Trends revealed through ratio analysis help managers decide whether to expand, cut costs, raise finance or change strategy

Highlights consistency or instability

Stable ratios suggest a reliable and well-managed business, while sudden changes may point to risks or changing conditions

Case Study

Loma Catering Ltd is a mid-sized catering company. based in Gaborone, Botswana, specialising in corporate and event catering

Over the past two years, the business has seen its gross profit margin rise from 40% to 45%. This improvement came from two key changes

Raising prices slightly on premium event packages

Reducing food waste through better portion planning and supplier negotiations

However, during the same period, Loma’s gearing ratio increased sharply, rising from 28% to 60%. This happened after the company took out a large loan to invest in a fleet of delivery vehicles and build a new commercial kitchen

While the improved gross profit margin shows that the business is becoming more efficient and profitable, the rise in gearing means it is now heavily reliant on borrowed finance, increasing its financial risk

Outcome

Loma's management is now focusing on generating enough retained profit to fund future expansion without increasing debt

Comparing business performance with competitors

Ratio analysis can also be used to compare a business’s performance with that of other firms in the same industry

Benchmarks performance

Comparing ratios helps businesses judge whether they are performing above or below the industry average

Reveals strengths and weaknesses

A higher return on capital employed (ROCE) than a rival suggests better use of investment

A lower current ratio may show weaker short-term financial health

Supports strategic planning

If a competitor has stronger profitability or better cost control, the business can investigate and improve its own operations to stay competitive

Ratios and debt and equity decisions

When a business chooses how to finance its operations, it directly affects several key ratios used in analysing performance

These choices can change how the business appears in terms of risk, profitability, and financial strength

The impact of debt and equity decisions on ratios

1. Gearing ratio

Taking on more debt increases the gearing ratio

This indicates greater financial risk and a higher dependency on borrowed funds

Using equity reduces gearing

This indicates a more stable capital structure with lower financial risk

2. Return on capital employed (ROCE)

Raising equity increases capital employed

This can reduce ROCE unless profits rise too

Using debt may lead to a higher ROCE if the borrowed funds increase profits

However, this approach carries greater financial risk

3. Dividend cover

More debt means higher interest payments, which reduce net profit

This may lower the dividend cover, making dividend payments less sustainable

Raising finance through equity avoids interest costs and may result in a higher dividend cover

This suggests more secure payouts, though profits must be shared among more shareholders

Ratios and dividend strategy

Dividend strategy is how a business decides:

How much profit to return to shareholders as dividends

How much profit to keep (retain) in the business for future investment

How does the dividend strategy affect key ratios?

1. Return on capital employed (ROCE)

If more profits are retained (fewer dividends paid), capital employed increases

This could lower ROCE, unless operating profit increases due to reinvestment

E.g. When KohliTech Plc, an Indian technology firm, reduced dividends to invest in innovation, ROCE fell in the short term but rose later when profits increased

2. Current ratio and acid test ratios

Paying high dividends reduces cash, a key current asset

This may reduce liquidity, making it harder to pay short-term debts

E.g. South African supermarket chain Choppies paid large dividends to its shareholders before the pandemic and, as a result, struggled with cash flow when sales dropped in the early part of 2021

3. Price/earnings ratio

A change in dividend strategy doesn't directly affect the price/earnings ratio

However, lower dividends may worry investors, reducing share price, which lowers the ratio

If reinvestment leads to higher profits, share price may rise, increasing the ratio over time

Business growth and ratio results

When a business grows, whether by increasing sales, opening new branches, acquiring other firms or expanding into new markets, it can have an impact on a range of financial ratios

The impact of business growth on selected ratios

Ratio | Explanation |

|---|---|

Return on capital employed |

|

Current ratio |

|

Inventory turnover |

|

Price/earnings ratio |

|

Other business strategies and ratio results

1. Cost-cutting strategy

A business might reduce its costs by lowering wages, using cheaper materials, or cutting back on overheads like advertising or travel

Ratio | Explanation |

|---|---|

Profit margin |

|

Inventory turnover |

|

2. Paying higher dividends

A business may decide to return more profits to shareholders by increasing dividends

Ratio | Explanation |

|---|---|

Current ratio |

|

Price/earnings ratio |

|

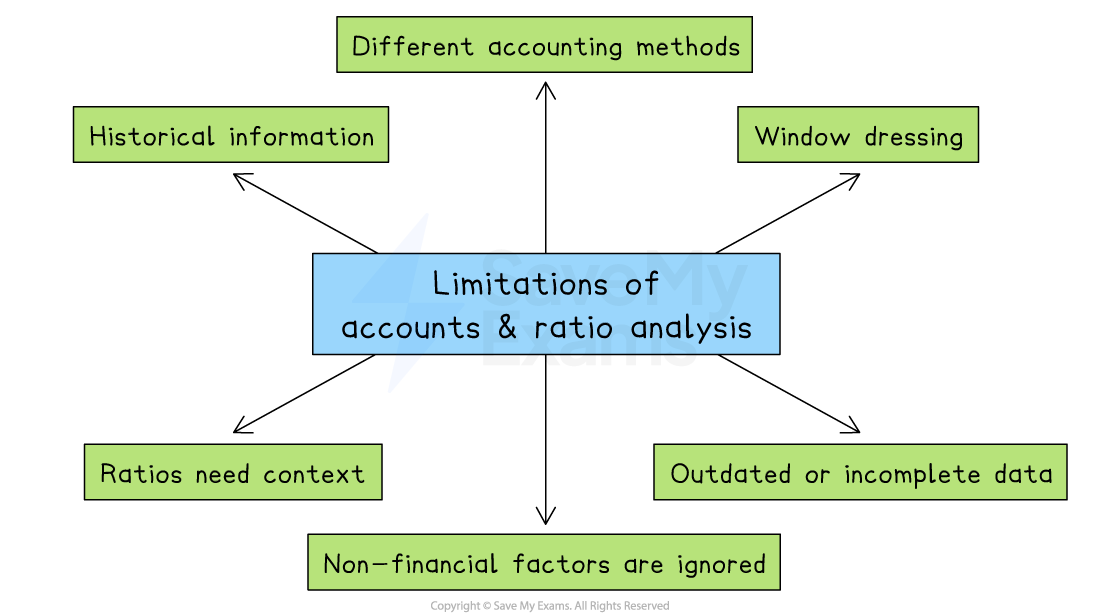

Limitations of using published accounts and ratio analysis in decision-making

Published accounts (like the income statement and statement of financial position) and ratio analysis are useful tools

However, they should never be the only tools used when making strategic decisions

A business should always consider the full picture, including market trends, people, and future risks

Key limitations of using accounts and ratio analysis to make decisions

Historical information

Accounts are based on past performance, not the future

Ratios reflect what has happened — not what will happen next

Non-financial factors are ignored

Ratios and accounts don’t include qualitative factors such as

Staff morale

Customer loyalty

Brand reputation

Innovation and leadership

These factors can have a significant impact on business success, so ignoring them means only a partial picture of a business is gained

Different accounting methods

Businesses can choose different methods for things like depreciation or valuing inventory

This makes it difficult to compare companies directly

Window dressing

Some businesses try to make their accounts look better than they really are

For example, delaying bill payments or boosting end-of-year sales temporarily

Outdated or incomplete data

Published accounts may be up to 12 months old by the time decisions are made

The impact of important recent events, such as losing a major contract or the impact of an external economic downturn, might not yet be evident

Ratios need context

A ratio on its own is not very useful

In order for financial performance data to be meaningful, a business must compare it to

Past performance (trends)

Industry averages

Similar businesses

Unlock more, it's free!

Was this revision note helpful?