Using Budgets Effectively (Cambridge (CIE) A Level Business): Revision Note

Exam code: 9609

An introduction to budgets

A budget is a financial plan that a business (or department in the business) sets regarding costs and revenue

The budget is usually closely aligned with the business objectives

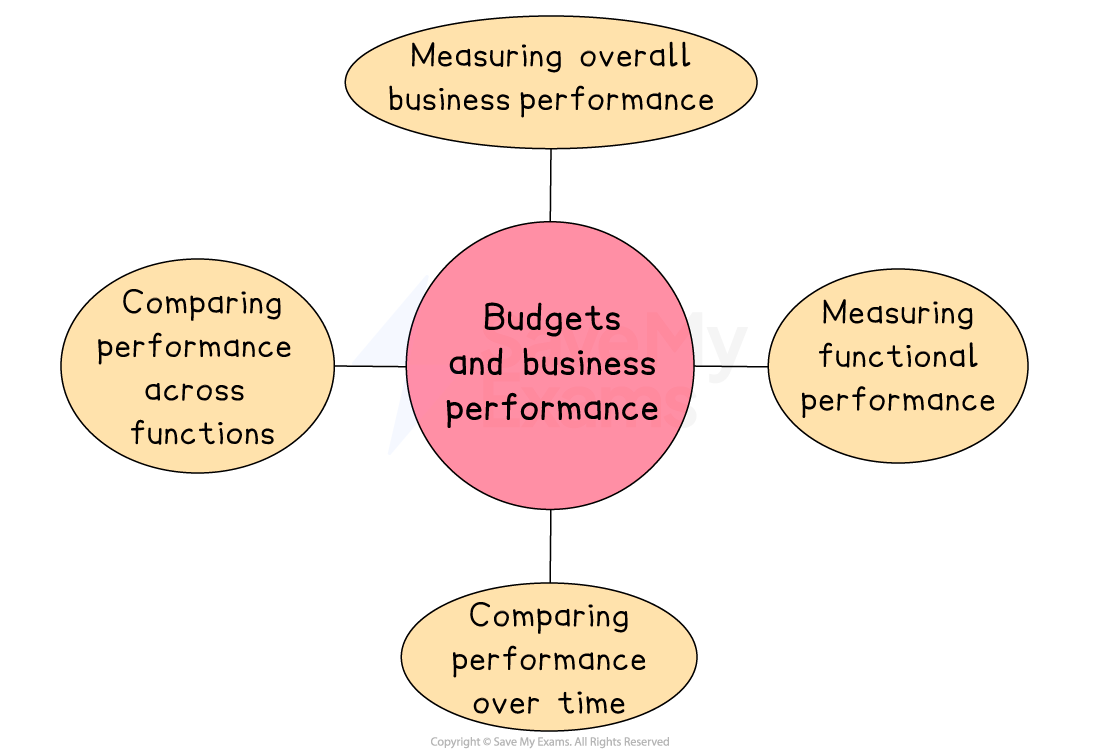

Measuring performance with budgets

Measuring overall business performance

Budgets allow managers to assess how well the whole business is performing

Compare actual income and expenses with budgeted figures to identify profit levels, cost control, or overspending

Helps judge if the business is meeting its financial goals, such as revenue targets or profit margins

Variances help explain good or poor performance

Measuring functional performance

Each function, e.g. marketing, operations, HR, usually has its own budget

Comparing actual department spending and results with the budget shows how well each area is performing

Helps hold managers accountable for cost control and meeting targets

Encourages efficient use of resources within each function

Comparing performance over time

Budgets help track performance year-on-year or month-on-month

Businesses can spot trends, such as rising costs or improving efficiency

Helps with long-term planning and forecasting

Comparing performance across functions

Budgets help compare different departments at the same time, even if their roles are different

This supports fair decision-making on things like bonuses, promotions or extra funding

Types of budgets

1. Incremental budgets

An incremental budget is based on last year’s figures, with small adjustments made to reflect expected changes

Changes could include inflation, wage rises or modest increases in sales and costs

Evaluating the use of incremental budgets

Advantages | Disadvantages |

|---|---|

|

|

|

|

2. Flexible budgets

A flexible budget is adjusted depending on the level of output or sales

Instead of using one fixed figure, it shows what income and expenses should look like at different levels of activity

Evaluating the use of flexible budgets

Advantages | Disadvantages |

|---|---|

|

|

|

|

3. Zero budgeting

Zero budgeting is when every department or manager must justify all spending

Rather than using the previous year’s budget as a starting point, each cost must be reviewed and approved individually

Evaluating the use of zero budgeting

Advantages | Disadvantages |

|---|---|

|

|

|

|

The use of budgets

Budgets can play an important role in the day-to-day management of a business

They help with planning, decision-making, control, and monitoring of non-financial performance

Ways budgets are used

Allocating resources

Budgets help businesses decide where money and resources should be focused

Each department receives funding based on its needs and priorities, ensuring efficient use

Control within a business

Budgets set clear financial limits to help prevent overspending

Managers are accountable for staying within their budget, which improves discipline and control

Monitoring non-financial performance

Budgets can track spending on non-financial goals like customer service, training, or sustainability

This ensures resources support wider business objectives

Variances

Once budgets have been set, managers carry out variance analysis to compare actual performance to the targets set in the budget

A budget variance is a difference between the figure budgeted and the actual figure achieved by the end of the budgetary period

Variance analysis seeks to determine the reasons for the differences between the actual figures and the budgeted figures

Types of variance

Favourable (F) | Adverse (A) |

|---|---|

|

|

Calculating and interpreting variances

A budget variance is calculated by subtracting the budgeted figure from the actual figure

Worked Example

Selected financial information for Barwicks PLC (2024)

| £m |

|---|---|

Budgeted sales revenue | 12,460 |

Actual sales revenue | 13,718 |

Budgeted total costs | 8,420 |

Actual total costs | 10,627 |

Using the data, calculate the total profit variance for Barwicks PLC in 2024. You are advised to show your working.

(4)

Step 1: Calculate budgeted profit for 2024

(1)

Step 2: Calculate actual profit for 2024

(1)

Step 3: Subtract budgeted profit from the actual profit for 2024

(1)

Step 4: Identify the nature of the variance

In this case, the variance is adverse because the actual profit for 2024 is lower than the budgeted profit for the year

The correct answer is £949 A (1)

Evaluating budgets

Budgets can be useful management tools because they help maintain financial control by monitoring income and expenditure

This allows managers to spot potential overspending or cash flow problems early

Budgets also help measure performance by setting financial targets that can be compared with actual results

This makes it easier to assess how well a department or the whole business is performing and whether corrective action is needed.

However, budgets are based on forecasts and assumptions, which means managers make inappropriate decisions if market conditions change or if estimates are wrong

Strict budgets may reduce flexibility

Managers may feel restricted and unable to respond quickly to unexpected opportunities or urgent problems if they are required to stick closely to a fixed spending plan

Advantages and disadvantages of budgeting

Advantages | Examples |

|---|---|

|

|

|

|

|

|

Unlock more, it's free!

Was this revision note helpful?