Break-Even Analysis (Cambridge (CIE) A Level Business): Revision Note

Exam code: 9609

The meaning and importance of break-even analysis

Break-even analysis is a financial tool used to determine the point at which the business revenue equals its expenses, resulting in neither profit nor loss

It helps businesses understand the minimum level of sales or output they need to achieve to cover all costs

This helps managers make informed decisions about pricing and production volumes

It is particularly useful for communicating with stakeholders, including investors or lenders

It demonstrates the financial viability of the business and gives an insight into potential return on investment

Components of break-even analysis

Sales revenue

Sales revenue is the value of the units sold by a business over a period of time

E.g. the revenue earned by Apple Music from sales of music downloads

Sales revenue is a key business performance measure and must be calculated to identify profit

Sales revenue is calculated using the formula

Sales revenue increases as the sales volume increases

Costs

In preparing goods and services for sale, businesses incur a range of costs

Some examples of these costs include purchasing raw materials, paying staff salaries and wages and paying utility bills, such as electricity

These costs can be broken into different categories

Fixed costs (FC) are costs that do not change as the level of output changes

These have to be paid whether the output is zero or 5,000

Variable costs (VC) are costs that vary directly with the output

These increase as output increases and vice versa

Total costs (TC) are the sum of the fixed and variable costs

Calculating the break-even point

Breakeven is calculated using the formula

Contribution per unit is used to calculate the breakeven point

It is calculated using the formula

It is called contribution, as once the variable cost of the unit has been paid, the remainder of the selling price contributes to paying the fixed costs of the business

Worked Example

Selected cost and revenue data for Cannock Chase Glamping

| £ |

|---|---|

Revenue per pod per night | 95 |

Variable costs per pod per night | 19 |

Annual fixed costs | 55,000 |

Using the information in the table, calculate how many pods need to be occupied each year for Cannock Chase Glamping to break even

(4)

Step 1: State the formula to calculate the breakeven point

(1)

Step 2: Calculate the contribution

(1)

Step 3: Apply the formula to calculate the breakeven point

(1)

Step 4: Always round UP to the nearest whole number because only whole products can be sold

(1)

Uses and limitations of break-even analysis

Uses of break-even analysis

1. Profitability assessment

It helps identify the level of sales required to avoid losses and provides a target for achieving profits

2. Cost control

Break-even analysis helps in identifying fixed and variable costs and their impact on the business

By understanding the cost structure, businesses can evaluate their spending patterns and reduce unnecessary expenses

3. Pricing decisions

Break-even analysis provides insights into pricing decisions by helping businesses determine the minimum price required to cover costs and achieve the desired level of profit

4. Financial planning

Break-even analysis assists in financial planning by providing a reference point for target setting, such as realistic sales targets and plans for necessary expenses

5. Sensitivity analysis

It allows businesses to evaluate the impact of changes in variables such as costs, prices and sales volumes on the breakeven point

This helps in understanding the potential risks and uncertainties, such as a new competitor entering the market or suppliers increasing prices

6. Decision-making

Break-even analysis provides a basis for informed decision-making

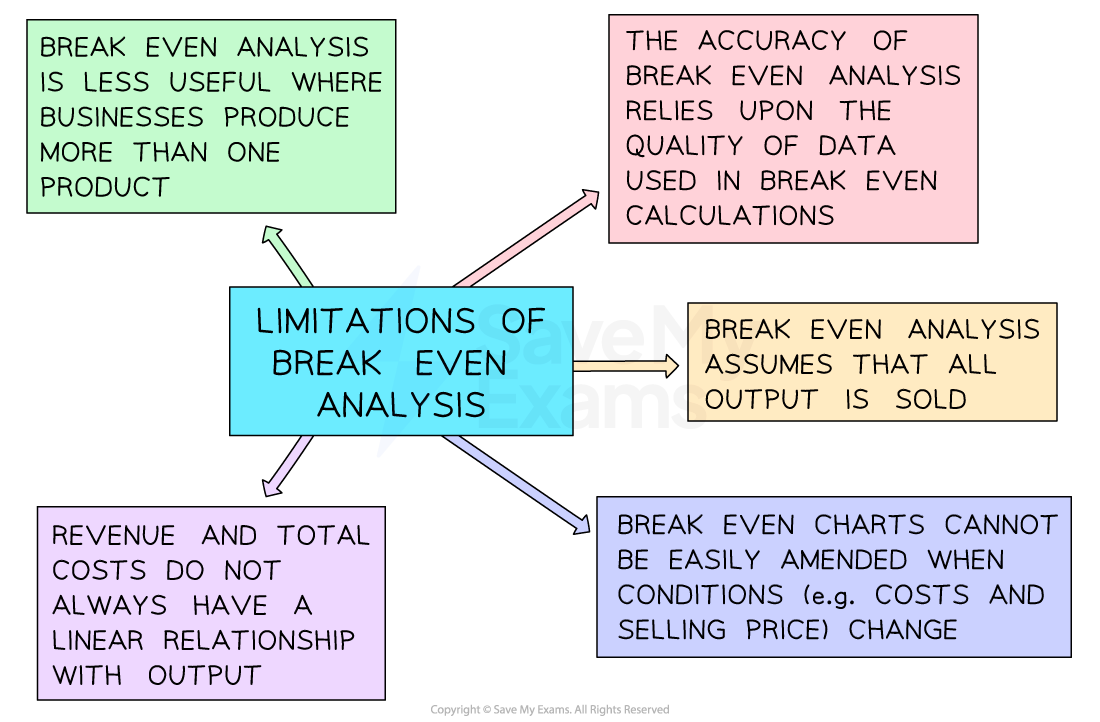

Limitations of break-even analysis

Unlock more, it's free!

Was this revision note helpful?