Cost Information (Cambridge (CIE) A Level Business): Revision Note

Exam code: 9609

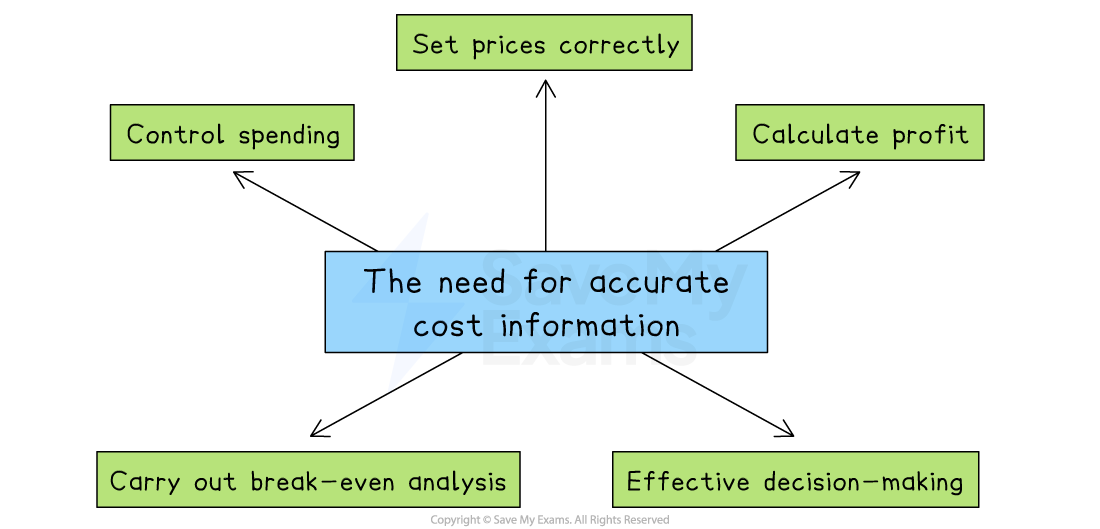

The need for accurate cost information

Cost information refers to data about all the costs involved in producing and selling a product

Why is accurate cost information needed?

To set prices correctly

If a business underestimates its costs, it may set prices too low and make a loss

Overestimating costs may lead to prices that are too high, reducing demand

To calculate profit

Accurate costs help calculate gross profit and net profit, important for judging performance

For decision-making

Managers use cost data to decide whether to

Launch a new product

Continue or stop production

Change suppliers or production methods

To carry out break-even analysis

This helps decide how many units need to be sold to cover all costs.

Accurate costs make break-even analysis more reliable

To control spending

Comparing actual costs with budgets helps identify areas of overspending and take action

Types of costs

In preparing goods and services for sale, businesses incur a range of costs

These costs can be broken into different categories

Fixed costs

Fixed costs do not change according to output

These have to be paid whether the output is zero or 5,000

Examples include rent, management salaries, insurance and bank loan repayments

Fixed costs in this instance are $4,000

Variable costs

Variable costs rise proportionally with output

These increase as output rises and decrease as output falls

Examples include raw material costs and wages of workers directly involved in production and packaging

At some point, a business may benefit from a purchasing economies, so the rise will no longer be proportional

Total costs

Total costs is the combination of all fixed and variable costs involved in producing a certain level of output

Total costs cannot be zero, as all organisations have some level of fixed costs

An alternative way to classify costs

Direct costs

These are costs that can be directly traced to a specific product, service, or department

They relate specifically and exclusively to the production of a particular item

Direct costs can be fixed or variable

For example, a one-off licence fee for a software product is a direct fixed cost if it applies only to that product

Examples of direct costs include:

The cost of raw materials used to make a table

Wages paid to factory workers assembling a specific product

Packaging for a single product line

Indirect costs

Indirect costs are costs that cannot be traced directly to a specific product, job, or service

They support overall operations and are shared across departments or products

These costs are necessary for production or business operations, but they are not directly linked to any one unit of output

Indirect costs can also be fixed or variable

For example, the monthly rent paid for a shared office space is an indirect fixed cost, as it supports multiple departments but does not vary with output

Examples of indirect costs include:

Rent and utility bills for a factory or office

Salaries of supervisors or administrative staff

Office supplies and insurance

Depreciation of machinery used across several product lines

Comparison: direct vs indirect costs

Feature | Direct costs | Indirect costs |

|---|---|---|

Traceability |

|

|

Examples |

|

|

Can be fixed or variable? |

|

|

Using cost information to make decisions

Cost data helps businesses make key decisions

Total costs (TC)

Total costs information can be used to assess how much money is needed to produce at a certain level and is vital for budgeting and cash flow forecasting

Worked Example

SupaJuice produces 12,400 bottles of its premium fruit juice drink each month.

It incurs monthly fixed costs (e.g. rent, salaries) of $25,700

Variable costs per unit (e.g. bottles, fruit) of $1.24

Calculate the business's annual total costs.

(3)

Step 1: Calculate monthly variable costs

(1)

Step 2: Calculate monthly total costs

(1)

Step 3: Calculate annual total costs

(1)

Average costs (AC)

Average cost is the cost of producing one unit of output, calcualted using the formula

The average cost helps a businesses set prices that cover costs and leave room for profit

It is also used to compare efficiency over time or between different products

Worked Example

Supajuice has been approached by a large supermarket chain that wants to buy a large volume of its juice each month. The supermarket chain is willing to pay $2.95 for each bottle.

Explain whether SupaJuice should accept the supermarket's offer.

(3)

Step 1: Calculate the average cost of producing each bottle

(1)

Step 2: State your answer and give a reason

SupaJuice should not accept the supermarket's offer (1), as it would make a loss of $0.36 ($2.95 - $3.31) on each bottle (1)

Marginal cost (MC)

Marginal cost is the cost of producing one extra unit of output, calculated using the formula

The marginal cost helps a business decide whether producing extra units is profitable

It is a key consideration for decisions about increasing production, pricing, and entering new markets

It can also be used for special order pricing and decisions about increasing output

Worked Example

SupaJuice is considering increasing its output from 12,400 to 13,000 bottles per month. This will increase monthly total costs by $2,750.

Explain whether SupaJuice should increase its output if it sells each bottle of juice for $4.75.

Step 1: Calculate the marginal cost

(1)

Step 2: State your answer and give a reason

SupaJuice should increase output (1), as the marginal cost is $0.17 ($4.75 - $4.58) less than the selling price, allowing a profit to be made on each bottle sold (1)

Using cost information to make pricing decisions

Cost information can help shape a business’s entire pricing strategy, including how to respond to competition, customer demand and market conditions

Cost information and pricing decisions

Setting a minimum price point

Accurate cost data ensures prices are set above total or marginal cost

This prevents selling at a loss and is especially important for new products where cost estimates may change as production increases

E.g. A small electronics company launching a smart speaker knows its unit cost is $40 and avoids pricing below that, even during a promotion

Choosing between pricing strategies

Businesses choose strategies like penetration pricing, skimming, or competitive pricing

Cost information helps assess whether these options are financially sustainable

Adjusting prices when costs change

When input costs, such as raw materials or wages, rise, cost data helps decide whether to increase prices or reduce other costs while keeping prices stable

Responding to competitors' prices

Cost information helps businesses know how low they can reduce prices in response to rivals without making a loss

This is essential in price wars or competitive markets

Planning discounts and promotions

Even during sales or promotions, businesses must at least cover variable costs

Accurate cost information prevents making a loss as a result of short-term discounts

Using cost information to monitor and improve business performance

Cost information is a vital tool for monitoring business performance

It helps businesses

Track profitability

Set and measure performance targets

Identify problems early

Make better decisions for the future

Become more efficient and competitive

Uses of cost information in relation to business performance

Use | Explanation |

|---|---|

Calculate and monitor profits |

|

Calculate profit margins |

|

Set performance targets |

|

Identify areas of inefficiency |

|

Support decision-making and planning |

|

Reduce waste and improve efficiency |

|

Unlock more, it's free!

Was this revision note helpful?