Statement of Financial Position (Cambridge (CIE) A Level Business): Revision Note

Exam code: 9609

The purpose of the statement of financial position

The statement of financial position provides a snapshot of a business’s financial position at a given point in time

It is often called the balance sheet

It shows what the business owns (assets), what it owes (liabilities), and how it is funded (capital and reserves)

It contains the financial information required to draw conclusions about the liquidity of the business

The structure of the statement of financial position

The statement of financial position details the following elements at a specific point in time

Assets |

|---|

|

Liabilities |

|---|

|

Capital structure |

|---|

|

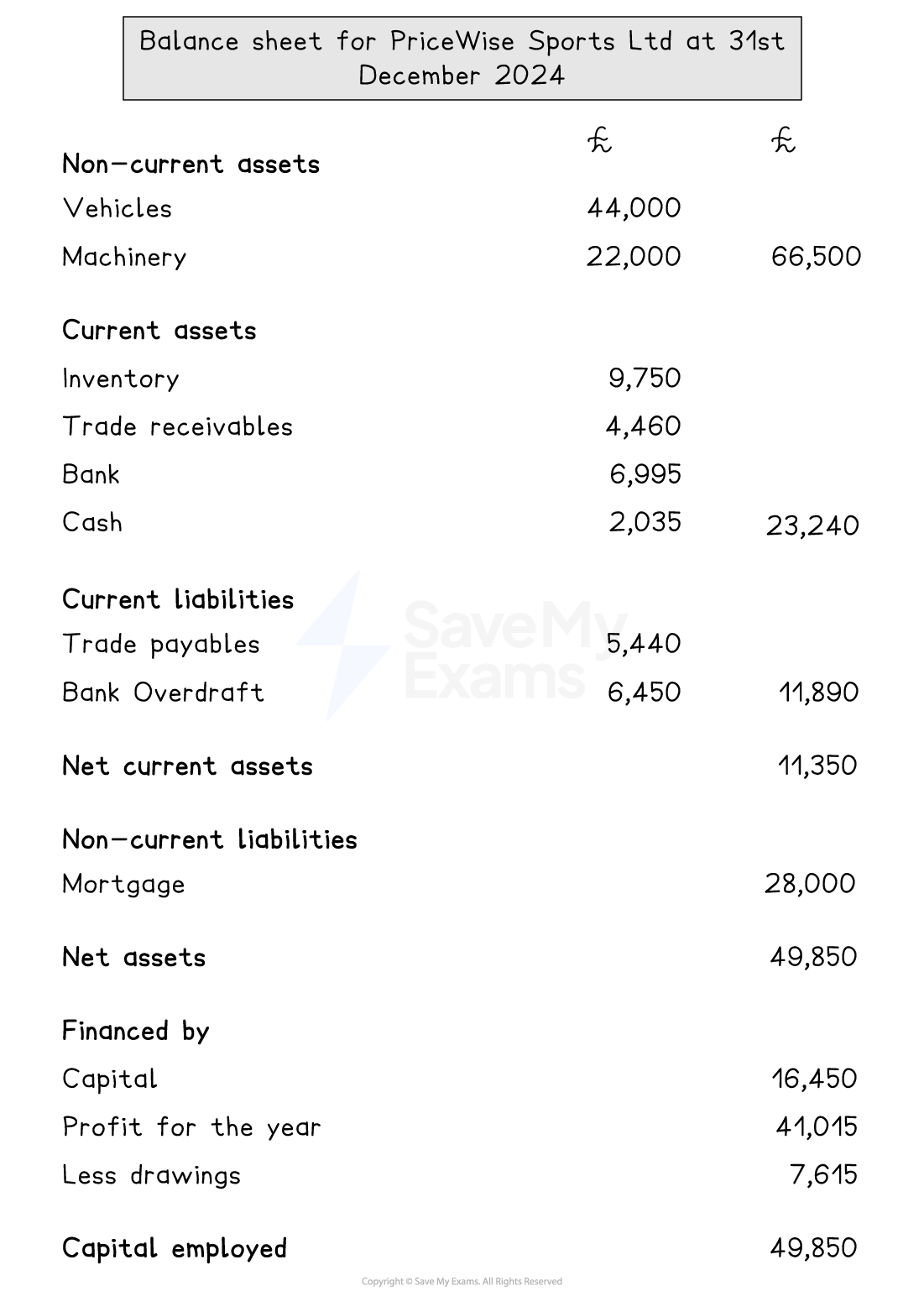

A statement of financial position showing key elements

In this example, drawings refers to the money (capital) removed from the business by its owner(s)

Amending the statement of financial position

A change to one section of the statement of financial position has an impact on other sections

Worked Example

Pershore Plumbers Ltd's accountant has sent the interim statement of financial position to Helen, the business owner. She has been asked to check the statement before it is sent to Companies House

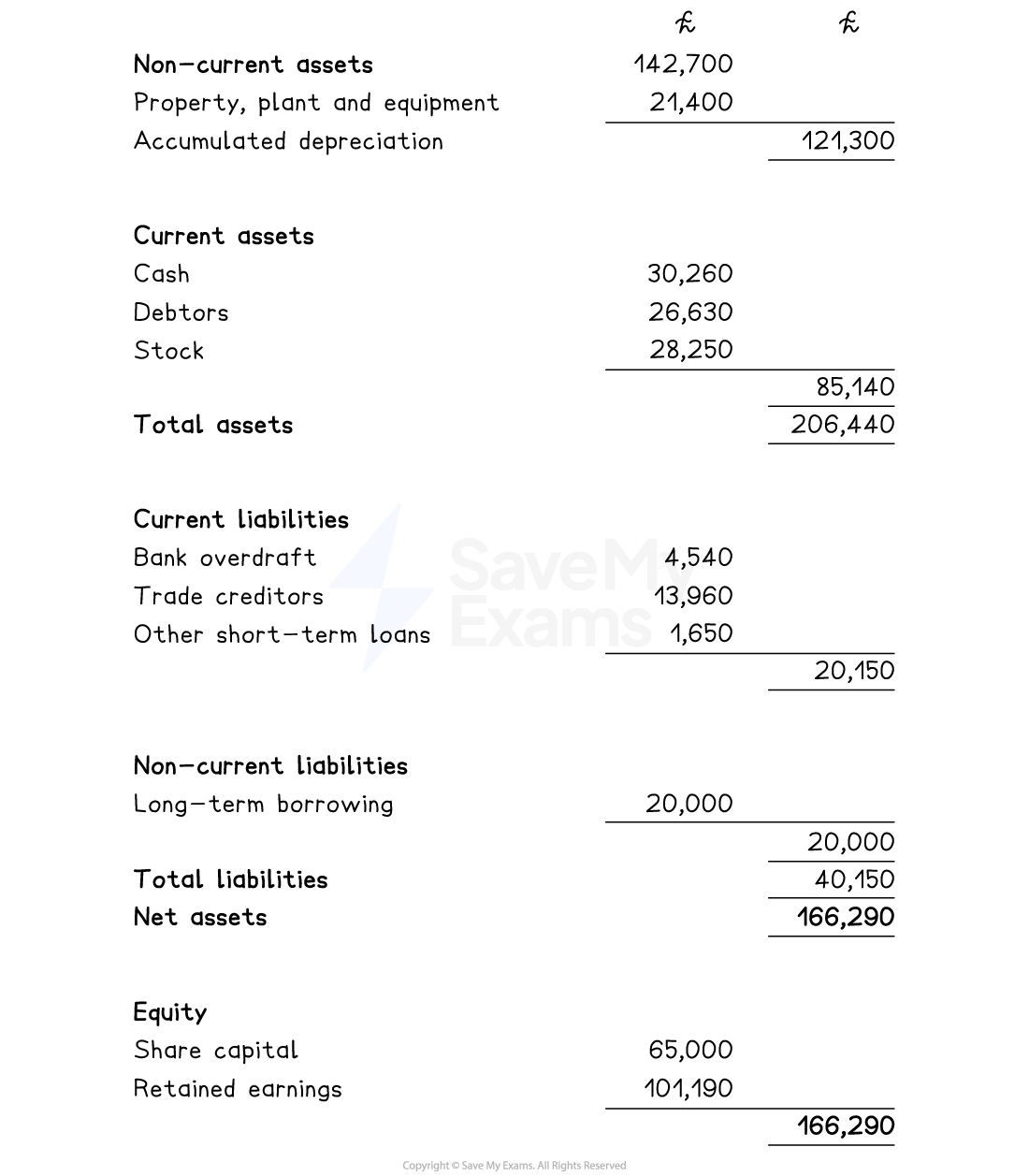

Pershore Plumbers Ltd - Statement of financial position at 31st March 2025

Helen identifies three errors

Depreciation was £24,100

An inventory check on 31st March 2025 valued stock at £26,400

Long-term borrowing increased to £25,000 as the business took out a further small loan

Recalculate the statement of financial position to reflect these changes.

(6)

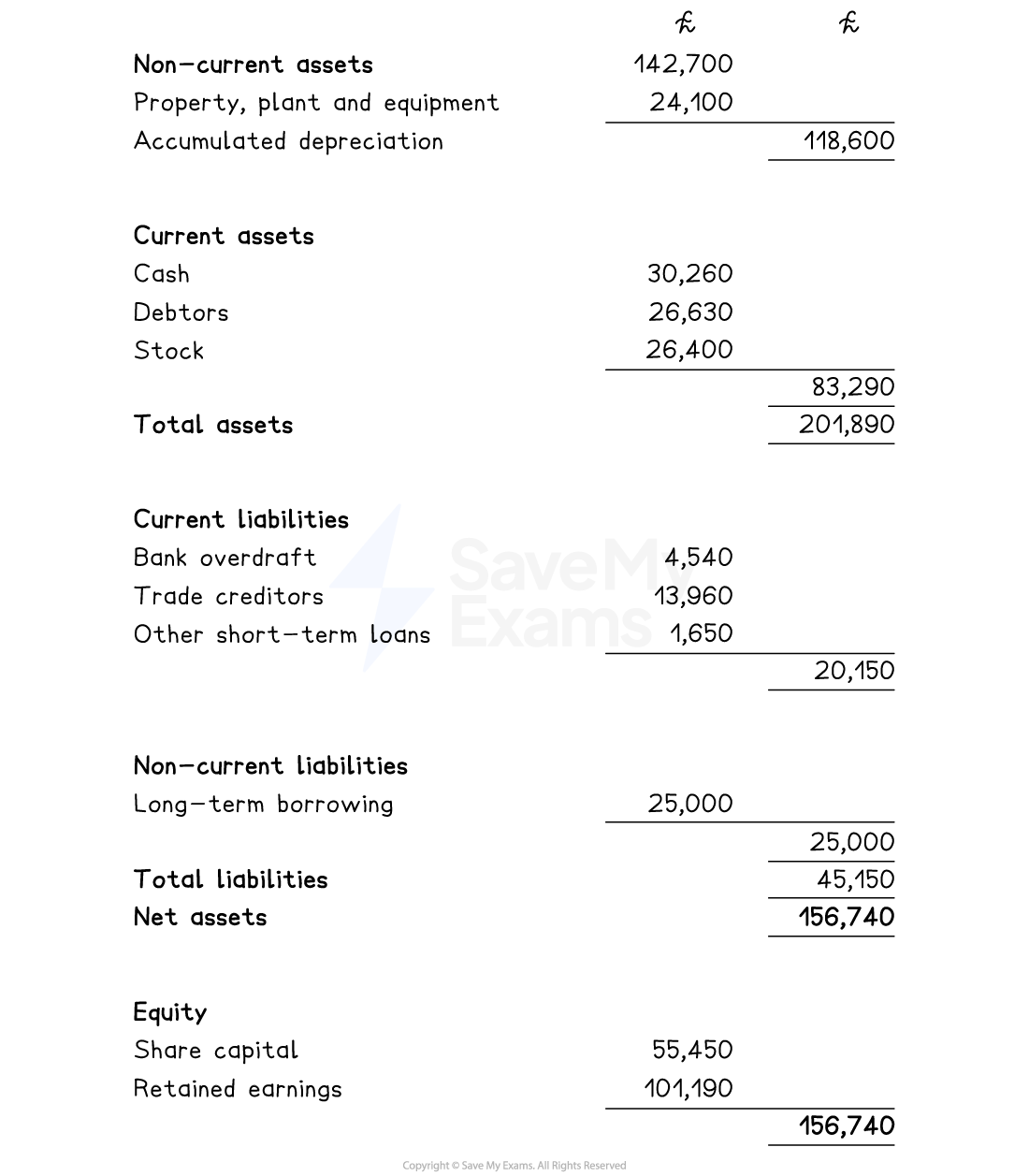

Step 1: Update non-current liabilities given the change to depreciation

(1)

Step 2: Update current assets given the change in stock valuation

(1)

Step 3: Update total assets given these changes

(1)

Step 4: Update non-current liabilities given the increase in long-term borrowing

Step 5: Update total liabilities

(1)

Step 6: Update net assets given these changes

(1)

Step 7: Update share capital to balance equity with net assets

(1)

Pershore Plumbers Ltd - Updated statement of financial position at 31st March 2025

The relationship between the statement of profit and loss and the statement of financial position

The statement of profit and loss and the statement of financial position are closely linked, and several items appear in both or affect each other

E.g. Profit identified in the statement of profit and loss is transferred to the equity section of the statement of financial position under retained earnings (profit)

Profit or loss made in one period directly affects equity in the statement of financial position.

Items like depreciation, taxation and sales don’t just affect profit, they also change the values of assets and liabilities

Relationships between items

Item | Where it appears | Relationship |

|---|---|---|

Profit for the year |

|

|

Dividends |

|

|

Retained earnings |

|

|

Expenses (e.g. depreciation) |

|

|

Taxation |

|

|

Sales revenue |

|

|

Purchases / cost of sales |

|

|

Unlock more, it's free!

Was this revision note helpful?