Statement of Profit or Loss (Cambridge (CIE) A Level Business): Revision Note

Exam code: 9609

The purpose of the statement of profit or loss

The statement of profit or loss shows the income and expenditure of a business over a period of time - usually a year - and identifies the amount of profit made

Statement of profit or loss: key terminology and calculations

Term | Explanation |

|---|---|

Sales revenue |

|

Cost of sales |

|

Gross profit |

|

Expenses |

|

Profit from operations |

|

Taxation |

|

Profit for the year |

|

Dividends |

|

Retained earnings |

|

The structure of the statement of profit or loss

The statement of profit or loss is divided into three parts

The trading account

The profit and loss account

The appropriation account

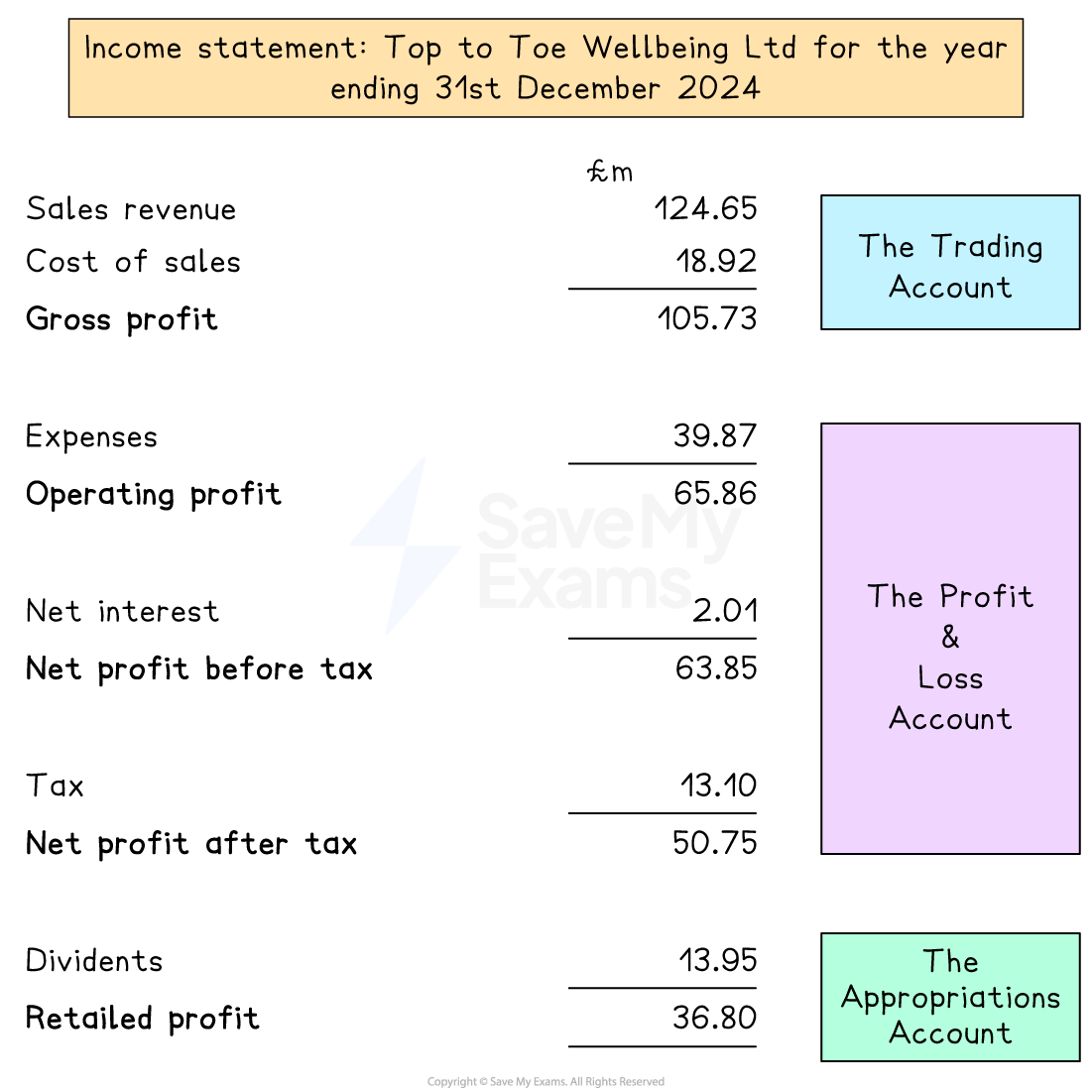

An example income statement

The trading account

The trading account is where the cost of sales is deducted from sales revenue to calculate the gross profit

In 2024 Top to Toe Wellbeing Limited's sales revenue was £124.65m and its cost of sales were £18.92m

The gross profit for the period was therefore

The profit and loss account

The profit and loss account deducts a series of expenses to determine the operating profit for the period

In 2024 gross profit was £105.73m and expenses were £39.87m

The operating profit was therefore

The business also paid £2.01m interest

The profit before tax was therefore

The business also paid £13.10m tax

The profit after tax for the period was therefore

The appropriations account

The appropriations account shows how profits are distributed for the period

In 2024 Head to Toe Wellbeing Limited distributed £13.95m to shareholders as dividends

£36.80m was therefore retained as profit

Amending the statement of profit or loss

Making a change to one section of the statement of profit or loss has an impact on other sections

Worked Example

Pershore Plumbers Ltd's accountant has sent the interim statement of profit and loss to Helen, the business owner. She has been asked to check the statement before it is sent to Companies House

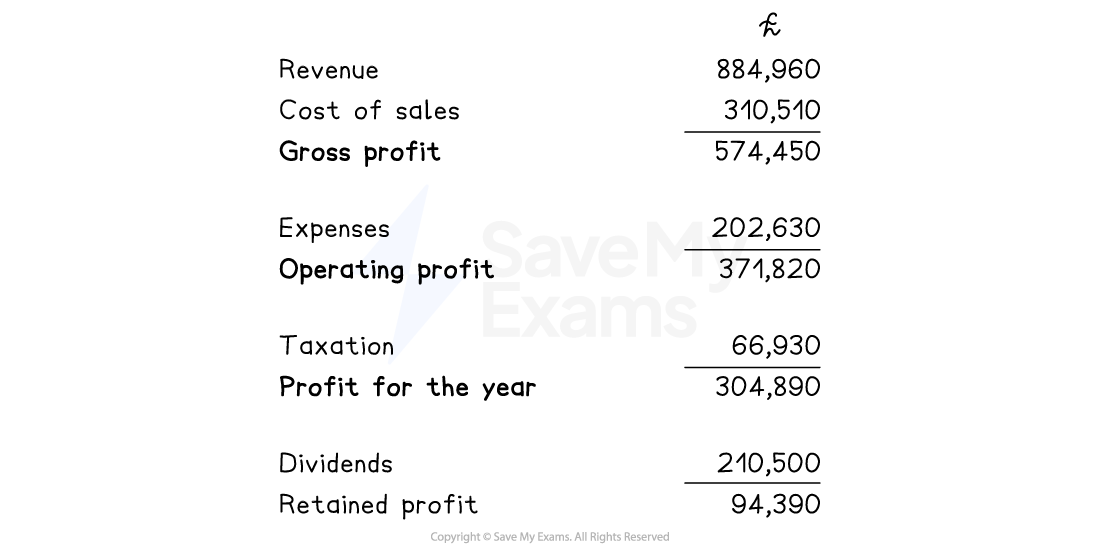

Pershore Plumbers Ltd - Statement of profit or loss for the year ending 31st March 2025

Helen identifies three errors

Sales revenue for the period was actually £889,540

The business received a tax refund of £12,220 during the year

The business paid dividends of £220,500 to shareholders

Recalculate the statement of profit or loss to reflect these changes.

(4)

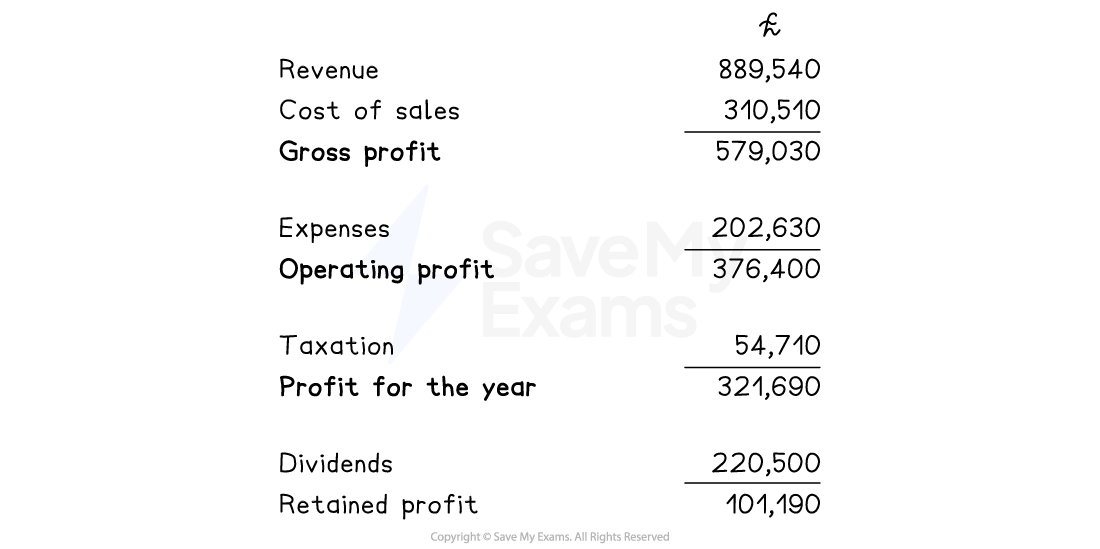

Step 1: Calculate gross profit given the updated revenue figure

(1)

Step 2: Recalculate operating profit

(1)

Step 3: Calculate profit for the year given the tax refund

(1)

Step 4: Calculate retained profit given updated dividends

(1)

Pershore Plumbers Ltd - Updated statement of profit or loss for the year ending 31st March 2025

Unlock more, it's free!

Was this revision note helpful?