Cash Flow Forecasts (Cambridge (CIE) A Level Business): Revision Note

Exam code: 9609

The meaning and purpose of cash flow forecasts

A cash flow forecast is a prediction of the anticipated cash inflows and outflows, usually for a six- to twelve-month period

Cash inflows include income from sales, loan sums received from the bank, interest received or capital injected into a business by owners

Cash outflows include payments for stock, staff wages and salaries, rent and utility bills and repayments of bank loans

Examiner Tips and Tricks

You may be asked to identify an example of a cash inflow or a cash outflow from a list

Inflows can be remembered using the acronym SLIC (Sales, Loans, Interest, Capital) while outflows can be remembered using the acronym SWURRS (Stock, Wages, Utilities, Rent, Repayments Salaries)

A detailed business plan usually includes a cash flow forecast

It provides evidence for investors or lenders that finance is required

It allows owners or managers to make plans to cover cash shortfalls

Cash flow forecasts are particularly useful in the following situations:

Starting up a business

Identifying how much cash is needed in the first few months

Running an existing business

Recognising where a fall in sales may require use of an overdraft facility

Supporting applications for borrowing

Determining the size of loan or overdraft needed, when and for how long it is needed and by when it is likely to be fully repaid

Managing transactions

Identifying how much or how little cash is deposited at the bank can determine when bills should be paid

Interpreting cash flow forecasts

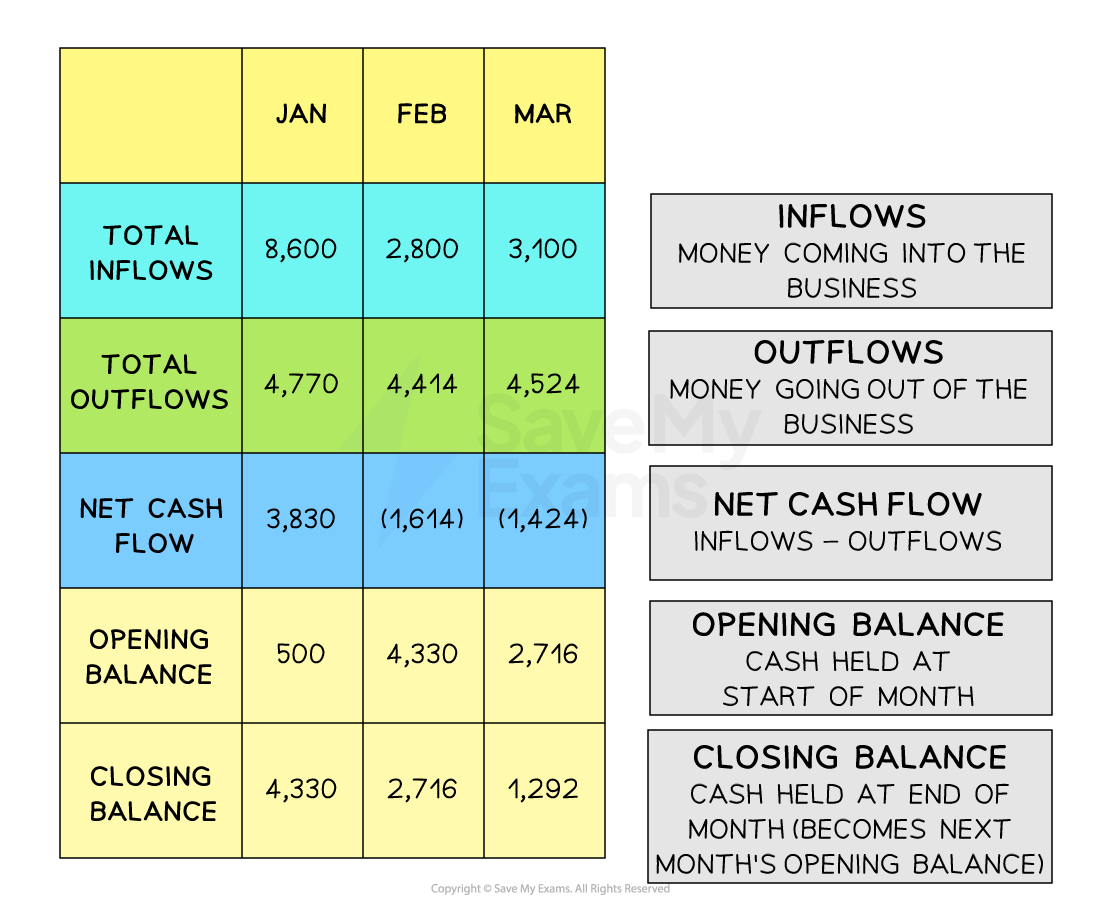

The cash flow forecast structure

Compiles expected cash inflows and cash outflows, month by month,

Takes into account cash present at the beginning of the period

Determines the cash flow position at the end of each month over a period of time

Although the layout can vary, a typical cash flow forecast includes each of the key elements

Example three-month cash flow forecast

Key terminology

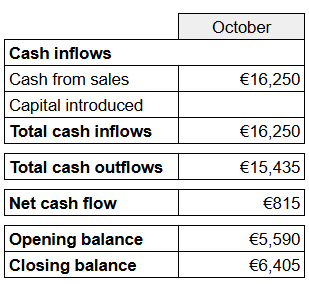

The opening balance is the cash position at the beginning of each month

In the first month, this is usually

Cash carried forward from any earlier trading

Cash introduced by the owner or from loans received

In later months, the opening balance is the closing balance carried forward from the previous month

Net cash flow is the difference between cash inflows and cash outflows during a month

Calculating net cash flow

The closing balance is the sum of the month's net cash flow and the opening balance

The closing balance is calculated using the formula

Calculating and amending cash flow forecasts

A business must first gather information about all cash inflows and cash outflows it expects to encounter over the period

The following steps should then be taken to construct the cash flow forecast

Step 1: Calculate total cash inflows

In this instance, the business expects to receive cash inflows from sales in March, April and May

Owners' capital of €6,000 will be introduced in March

The total for each month is calculated by adding cash from sales to capital introduced

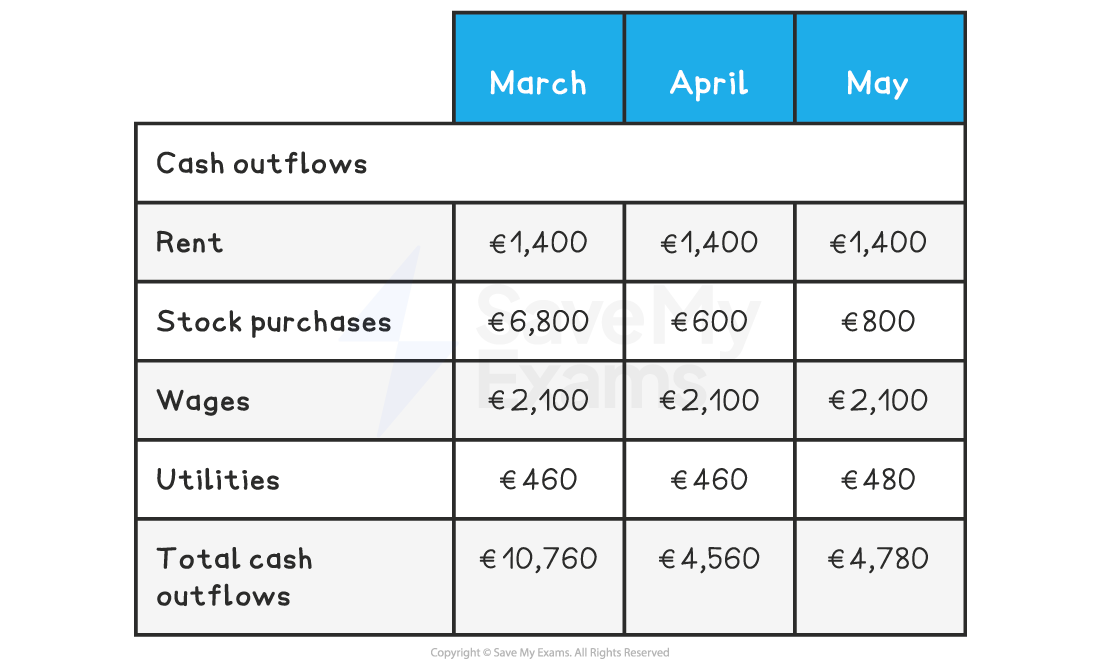

Step 2: Calculate total cash outflows

In this instance, the business expects to pay rent of €1,400 in March, April and May

It will purchase a significant amount of stock in March, with smaller amounts in April and May

Wages are expected to be €2,100 in each month

Utilities of €460 will be paid in March and April, increasing to €480 in May

Total cash outflows each month is calculated by adding these together

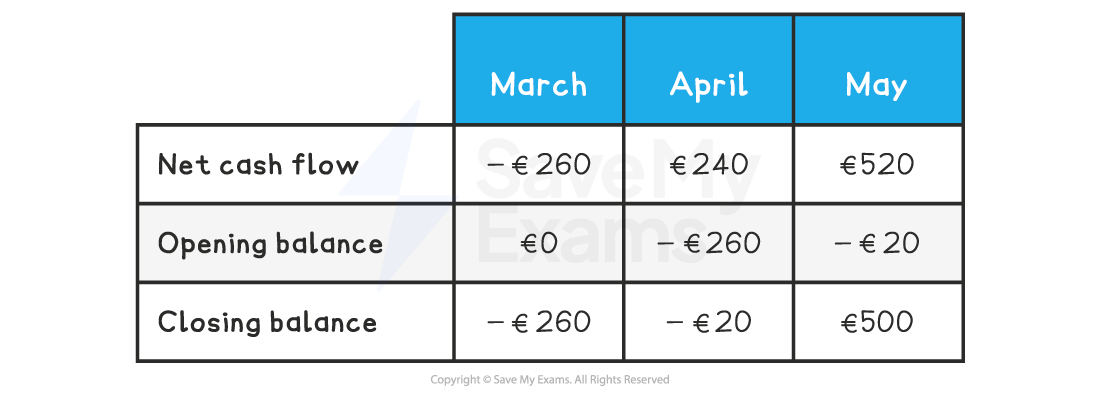

Step 3: Calculate net cash flows

Net cash flow is calculated by subtracting total cash outflows from total cash inflows

In March the net cash flow is €10,500 - €10,760 = €(260)

Net cash flow is negative as cash outflows are greater than cash inflows

In April the net cash flow is €4,800 - €4,560 = €240

In May the net cash flow is €5,300 - €4,780 = €520

In both months, net cash flow is positive as cash inflows are greater than cash outflows

Step 4: Calculate opening and closing balances

The opening balance is the previous month’s closing balance carried forward

The closing balance is calculated by adding the net cash flow to the opening balance

In March the opening balance of €0 is added to the net cash flow of €(260) to leave a closing balance of €(260)

In April the closing balance from March is carried forward to become its opening balance of €(260)

This opening balance is added to April's net cash flow of €240 to leave a closing balance of €(20)

In May the closing balance from April is carried forward to become its opening balance of €(20)

This opening balance is added to May's net cash flow of €520 to leave a closing balance of €500

The complete cash flow forecast

Overall, this cash flow forecast shows low cash inflows and significant outflows initially, which lead to negative net cash flow in March and April

Healthy sales mean that from April, inflows are greater than outflows and the business has a positive net cash flow

Amending cash flow forecasts

Cash flow forecasts can be amended if cash inflows or outflows are predicted to change

Each change will have an impact on the period's total inflows or outflows, net cash flow, closing balance and the subsequent opening balance

Worked Example

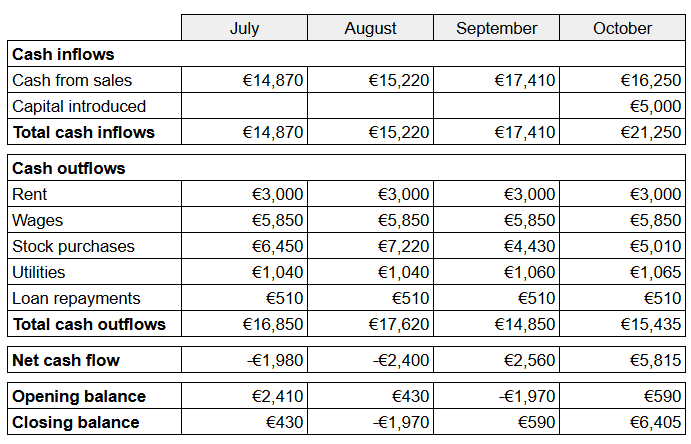

Rêve d'Or is a start-up gift shop in Lille. Its owner, Elodie, has constructed a 4-month cash flow forecast that highlights a potential cash flow problem in August.

Elodie has approached an investor, who has committed to invest £5,000 in the business in October. However, she fears this may be too late to prevent the failure of Rêve d'Or. She is therefore considering persuading the investor to inject this cash in August instead.

Rêve d'Or 4-month cash flow forecast

Explain the impact of receiving the investment in August, rather than in October.

(4)

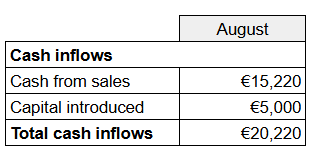

Step 1 - Recalculate cash inflows for August

(1)

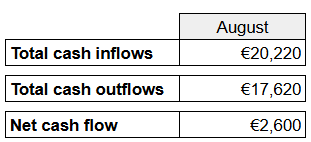

Step 2 - Recalculate net cash flow for August

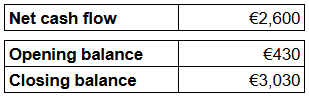

Step 3 - Recalculate closing balance for August

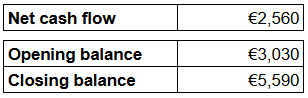

Step 4 - Change the September opening balance and recalculate the closing balance

Step 5 - Change the October total cash inflows and opening balance, then recalculate the closing balance

(1)

Step 6 - Explain the impact

If the £5,000 investment is made in August rather than October, Rêve d'Or will avoid its cash flow problems (1), with all closing balances for the period remaining positive (1)

Methods of improving cash flow

The best way to improve cash flow is to manage the business better

Identify potential cash flow issues before they arise and take appropriate action

Budget effectively and consider adopting zero budgeting to carefully control spending

Set clear financial objectives and look for ways to reduce outflows and increase inflows wherever possible

E.g. global conglomerate 3M, maker of Post-it notes, announced in early 2023 that it intends to raise prices and cut about 6,000 jobs to improve its profits and cash flow position

A business can also have too much cash

If a business is holding large amounts of cash, it is likely to be missing out on the benefits of investing it in fixed assets or investments

This may represent a significant opportunity cost, especially when interest rates are high

Methods to improve cash flow

Method | Explanation |

|---|---|

Reduce the credit period offered to customers |

|

Ask suppliers for an extended repayment period, e.g. an extension from 60 to 90 days |

|

Make use of overdraft facilities or short-term loans |

|

Sell off excess inventory |

|

Sell assets and lease fixed assets instead (e.g. sale and leaseback ) |

|

Introduce new capital and reduce drawings from the business |

|

Unlock more, it's free!

Was this revision note helpful?