Methods of Investment Appraisal (Cambridge (CIE) A Level Business): Revision Note

Exam code: 9609

The need for investment appraisal

Investment appraisal involves comparing the expected future cash flows of an investment with the initial expenditure on that investment

A business may want to analyse

How soon the investment will recoup the initial outlay

How profitable the investment will be

Before an investment can be appraised key data will need to be collected, including

Sales forecasts

Fixed and variable costs data

Pricing information

Borrowing costs

The collection and analysis of this data is likely to take some time

It requires significant experience to interpret the data appropriately before the investment appraisal can take place

Payback period

The payback period is a calculation of the amount of time it is expected an investment will take to pay for itself

The payback period is calculated using the formula

Worked Example

Gomez Carpets is considering an investment in a new storage facility at a cost of $200,000. It expects additional net cash flow of $30,000 per year as a result of the investment.

Calculate the payback period for the investment.

(3)

Step 1: Substitute the values into the formula

(1)

Step 2: Convert the outcome to years and months

(1)

Evaluating the use of the payback method

Advantages | Disadvantages |

|---|---|

|

|

Average rate of return

The average rate of return compares the average profit per year generated by an investment with the value of the initial capital cost

The average rate of return is calculated using the formula and is expressed as a percentage

This makes it easy to compare different investment options

Worked Example

Creative Frames, a small artwork framing business based in Bermuda, is considering an investment of $40,000 in new machinery. Megan, the business owner, believes that total returns over a 6-year period will be $76,000

Calculate the average rate of return of the proposed investment.

(4)

Step 1 - Deduct the capital cost from the total returns

(1)

Step 2 - Divide the outcome by the number of years of use

(1)

Step 3 - Substitute the values into the formula

(1)

Step 4 - Multiply the outcome by 100 to find the percentage

(1)

Evaluating the use of average rate of return

Advantages | Disadvantages |

|---|---|

|

|

The meaning of net present value

The net present value (NPV) takes into account the effects of interest rates and time

It recognises

The fact that that money received in the future is often worth less than money received today (inflation)

The opportunity cost of not having the money available for other uses

Calculation of net present value

To calculate the NPV of an investment, the value of all future net cash flows in today’s terms need to be calculated first and then discounted using a table

The cost of the initial investment is deducted from the total of the discounted net cash flows

If future net cash flows minus the initial investment are positive, then the investment is likely to be worthwhile

If the sum of future net cash flows minus the initial investment is negative, then the investment is unlikely to be worthwhile

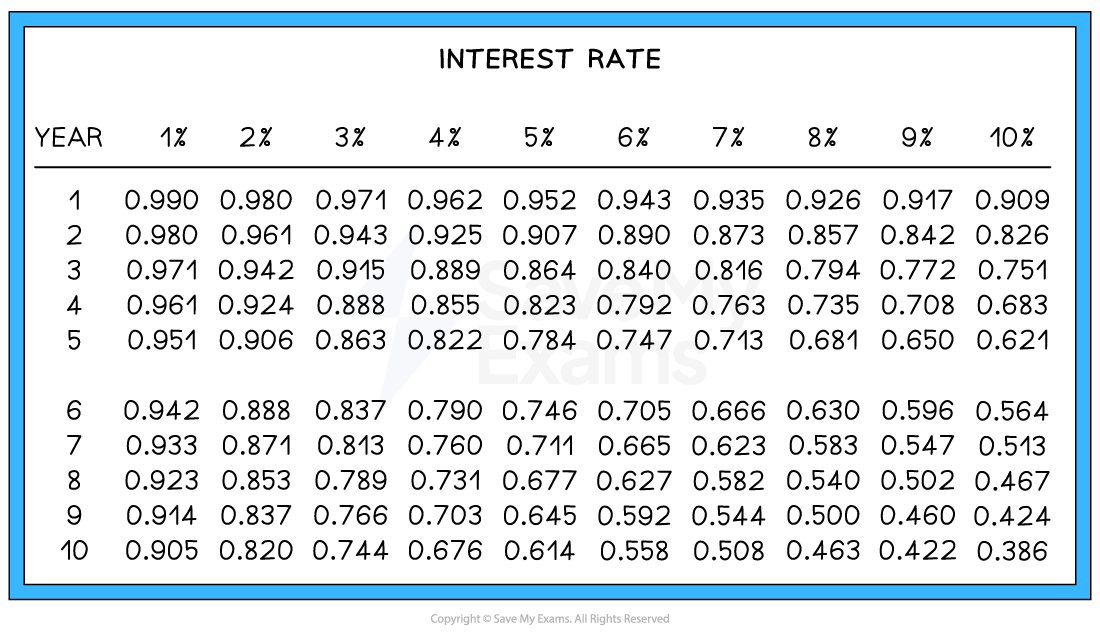

Discounted cash flows are calculated using discount tables, which allow future cash flows to be expressed in today’s terms

Discount factors at different rates of interest

Worked Example

Brownsea Sightseeing Tours Ltd is considering purchasing a new pleasure craft at a cost of £325,000. It expects the investment to achieve the following net cash flows over five years of operation

Year | Net cash flow (£) | 10% discount factor (2dp) |

|---|---|---|

0 | (325,000) | 1.00 |

1 | 110,000 | 0.91 |

2 | 90,000 | 0.83 |

3 | 75,000 | 0.75 |

4 | 65,000 | 0.68 |

5 | 60,000 | 0.62 |

Using a 10% discount factor, calculate the NPV of the leisure craft investment.

(4 )

Step 1: Calculate the discounted cash flow for each year by multiplying the net cash flow by the discount factor

(3)

Step 2: Add together the discounted cash flow values for each year, including Year 0

(1)

The net present value of the investment is -£12,550

Interpretation of net present value

The outcome of the NPV calculation often determines the decision a business makes about an investment

Net present value outcomes

NPV result | Interpretation |

|---|---|

Positive |

|

Zero |

|

Negative |

|

However, care should be taken when assessing NPV outcomes

The discount rate matters

Choosing a higher rate makes future cash inflows seem smaller

NPV uses estimated figures

These forecasts may not be accurate

Case Study

SoluTech Energy is a medium-sized renewable energy company based in Indonesia. The business is focused on providing sustainable power solutions to rural communities and small businesses

The management team is considering a new investment: installing a set of high-efficiency solar panels at one of their key partner sites. The goal is to reduce long-term energy costs and demonstrate the company’s commitment to clean energy

The initial investment required is $50,000

After forecasting cash inflows and applying a suitable discount rate (to account for risk and time value of money), SoluTech estimates that the project will generate $60,000 in present value terms over the next few years

Net present value calculation

Business decision

Since the NPV is positive, SoluTech concludes that the investment will add value to the business

The project is expected to generate a return above its cost, so the company decides to go ahead with the investment

Unlock more, it's free!

Was this revision note helpful?