Internal Sources of Finance (Cambridge (CIE) A Level Business): Revision Note

Exam code: 9609

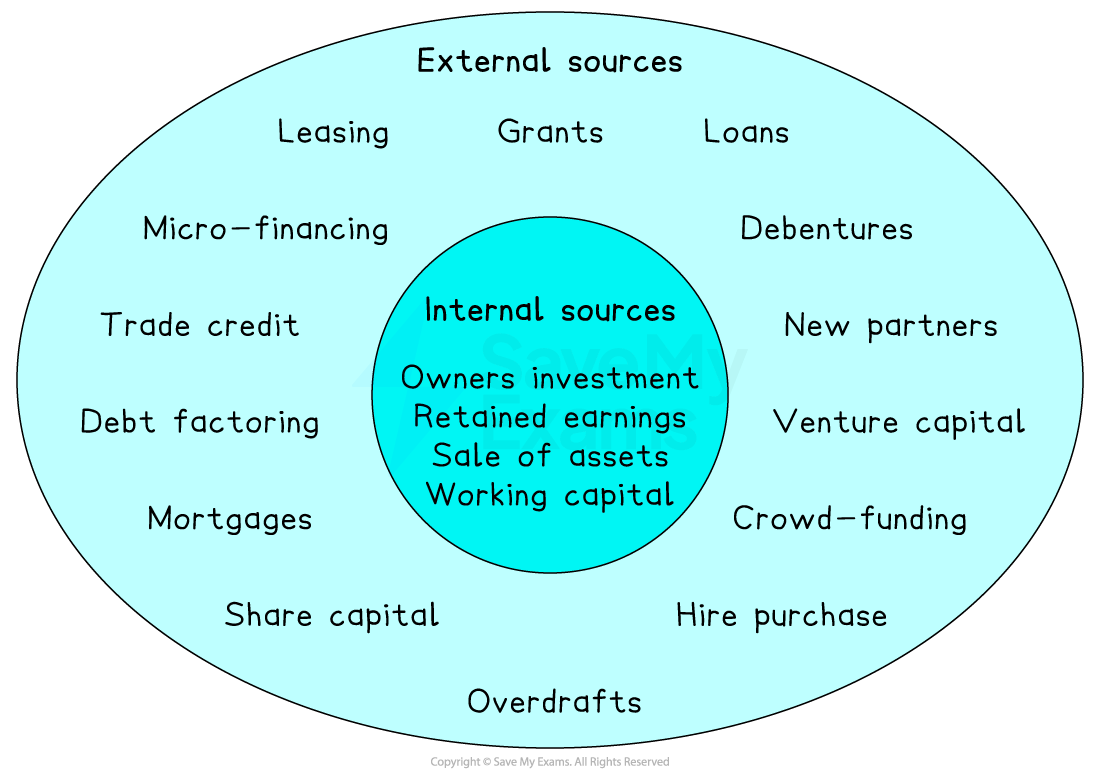

An introduction to sources of finance

Businesses have different sources of finance available to them

When the finance comes from inside the business, it is called an internal source of finance

When the finance comes from outside the business, it is called an external source of finance

Internal and external sources of finance

Owner's investment

Owners' investment is a key source of funds when a business starts up

Owners may introduce their savings or another lump sum, e.g. money received following a redundancy

Owners may invest more as the business grows or if there is a specific need, e.g. a short-term cash-flow problem

Evaluating owner's investment

Advantages | Disadvantages |

|---|---|

|

|

Retained earnings

This is profit generated in previous years and not distributed to owners that is reinvested in the business

This is a cheap source of finance, as it does not involve borrowing and associated interest and arrangement fees

The opportunity cost of investing the money back into the business is that shareholders do not receive extra profit for their investments

Evaluating the use of retained earnings

Advantages | Disadvantages |

|---|---|

|

|

Sale of unwanted assets

Selling fixed assets that are no longer required, such as machinery, land or buildings, generates finance

Businesses use this method for a range of reasons

To raise cash quickly without taking on debt

To free up capital tied up in unused or outdated assets

To support short-term cash flow needs or fund new investment

Evaluating raising finance by selling unwanted assets

Advantages | Disadvantages |

|---|---|

|

|

Sale and leaseback of non-current assets

A non-current asset is an interchangeable term with fixed asset

A sale and leaseback arrangement may be made if a business wants to continue to use an asset but needs cash

The business sells an asset, such as a building, for which it receives cash

The business then rents the asset from the new owners or a specialist leasing company

E.g. in early 2023, Sainsbury’s announced that it was in talks to sell some of its prime retail property for £500m, which it would then lease back from the new owners, LXi Reit

Evaluating sale and leaseback of non-current assets

Advantages | Disadvantages |

|---|---|

|

|

Working capital

Working capital is the money a business has available for day-to-day operations, such as paying wages, suppliers, and utility bills

A business can adjust the way it manages working capital to free up cash and improve its short-term financial position without needing to borrow money

Delaying payment to suppliers gives the business more time to hold onto cash

Reducing stock levels means less money is tied up in unsold goods

Speeding up payments from customers brings in cash more quickly

Using existing cash reserves to cover expenses

Evaluating working capital as a source of finance

Advantages | Disadvantages |

|---|---|

|

|

Further notes on managing working capital can be reviewed here

Internal sources of finance and business ownership

The type of business ownership, such as a sole trader, partnership, or limited company, can influence which internal sources of finance are available and suitable

Sole traders and partnerships tend to rely more on owner's investment and working capital because they often have limited retained profit and fewer fixed assets to sell

Case Study

Ali’s Mobile Repairs

Ali’s Mobile Repairs is a small sole trader business based in Nairobi

Ali needs money to buy new tools but doesn’t want to take out a loan

As a sole trader, he decides to use his own savings (owners’ investment) and delays a stock order by a week to free up some working capital

Companies are more likely to use retained profit, sale of fixed assets, or sale and leaseback, as they operate on a larger scale and have more internal resources

Case Study

Ecosap Ltd

Ecosap Ltd is a medium-sized Netherlands-based fruit wholesaler

The private limited company wants to upgrade its cold storage systems

It decides to fund this by using retained profit from the previous year and selling an unused delivery van (sale of fixed assets)

Unlock more, it's free!

Was this revision note helpful?