Interpreting Marketing Data (AQA A Level Business): Revision Note

Exam code: 7132

Interpreting graphs and charts

Data contained in graphs and charts can be important sources of marketing research

Data may be presented in a range of forms

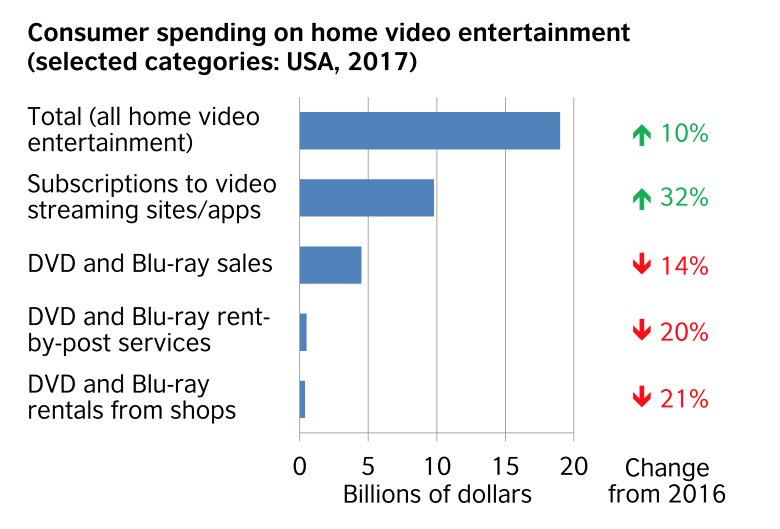

Bar charts

Bar charts show data that are independent of each other, such as sales per store

(Source: British Council (opens in a new tab))

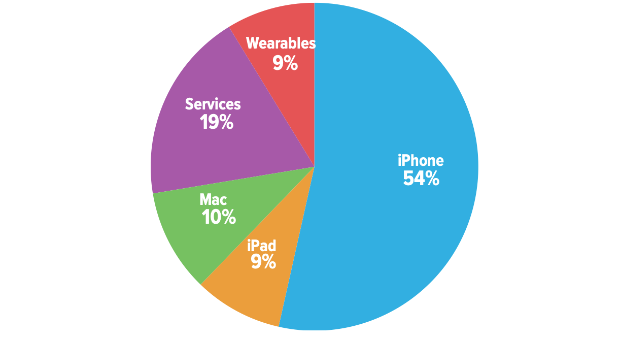

Pie charts

Pie charts show how a whole is divided into different elements, such as total sales divided amongst different product types

(Source: Six Colours (opens in a new tab))

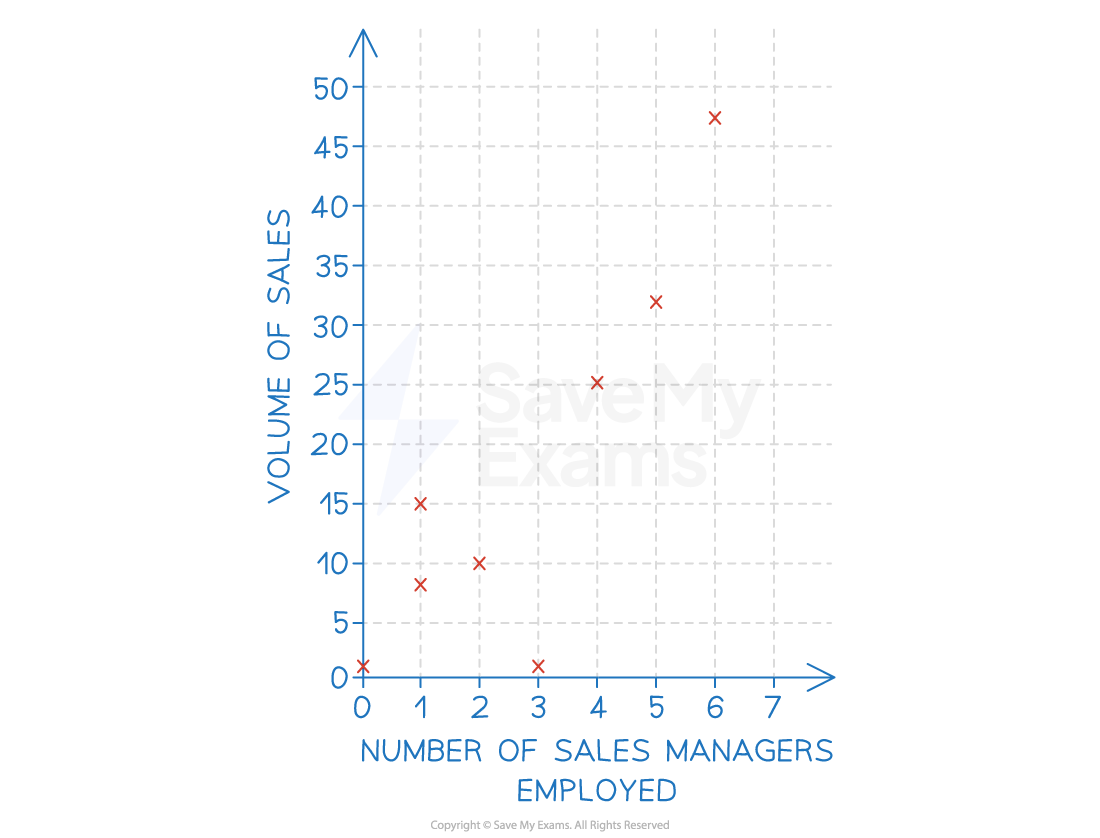

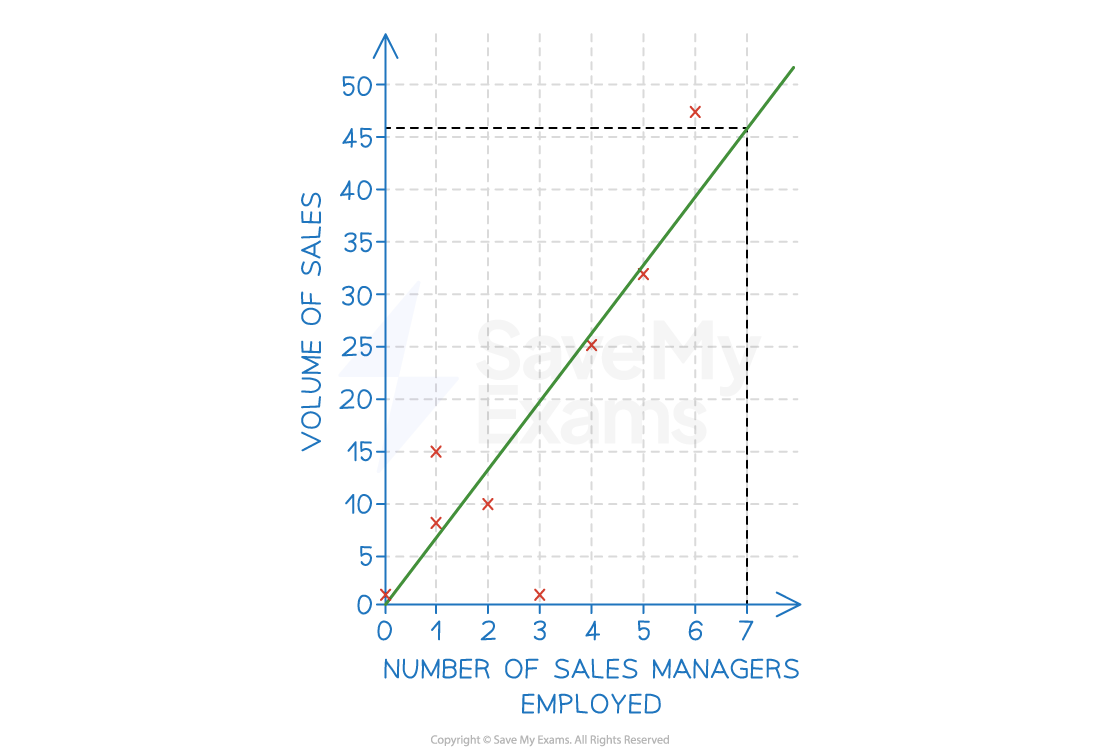

Scatter graphs

Scatter graphs allow businesses to compare two variables, such as sales volume and advertising, to establish if there is any correlation between them

Infographics

Infographics are easy-to-understand visual representations of data

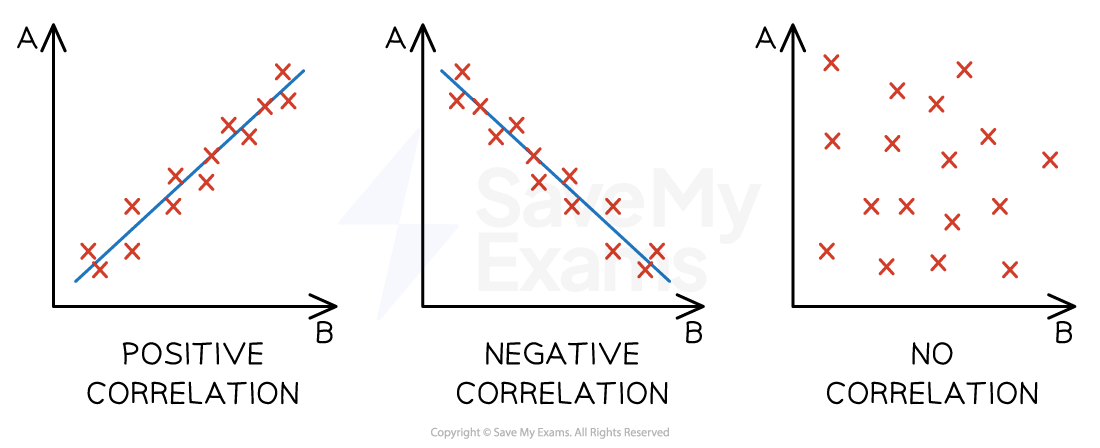

Correlation

A correlation exists where there is a relationship or connection between two variables

A positive correlation means that as one variable increases, so does the other variable

A line of best fit that slopes upwards can be identified

A negative correlation means that as one variable increases, the other variable decreases

A line of best fit that slopes downwards can be identified

No correlation means that there is no connection between the two variables

It is not possible to identify a line of best fit

Diagrams of correlation types

Correlation does not always indicate a relationship or causation between two sets of variables

Businesses must conduct research to determine whether a relationship exists and the strength of that relationship

Examiner Tips and Tricks

When you forecast sales, use historic data to spot the trend, then project it forward — that’s extrapolation

Don’t confuse this with correlation, which only shows a link between two variables

Extrapolation

Extrapolation is the assumption that what has happened in the past will be the same as what will happen in the future

Where a line of best fit can be identified and when causation is determined, a business can extrapolate data to make predictions around changes to either of the variables

E.g. extrapolation of the line of best fit in the example below means that the business could predict that employing seven sales managers would likely result in sales of 46 units

Extrapolation using a line of best fit

Examiner Tips and Tricks

When drawing a line of best fit, you should try to include as many data points above the line as below the line

Watch out for outlying data — if there is more than one outlier above the line, adjust your line of best fit upwards

Similarly, if there is more than one outlier below the line, adjust your line of best fit downwards. Just one outlier should not influence your line of best fit

Confidence intervals

The confidence level is the amount of certainty a business can have that its marketing research data results are accurate

E.g. a 95% confidence level means that if the same survey were repeated 20 times, the results would be the same on 19 occasions

The confidence interval is the range of values possible for a given confidence level

E.g. a 98% confidence level that the level of sales will be somewhere between £1.2m and £1.3m

Examples of confidence intervals

The Office for Budget Responsibility (OBR) publishes regular predictions of economic performance, such as GDP growth, inflation and interest rates

Here is the actual GDP growth from 2015 to 2024, with a prediction of UK GDP growth up to 2029

The lighter the shading, the more confident the OBR is that the actual level of GDP growth will fall between these values

In this case, the OBR is 100% certain that GDP growth will be between -2.9% and 5.8% in 2029

The confidence interval is

A high confidence level

A lower confidence level

The darker the shading, the less confident the OBR is that the actual level of GDP growth will fall between these values

In this case, the OBR is 80% certain that GDP growth will be between -1.0% and 4.6% in 2029

The confidence interval is

Why confidence levels and intervals help businesses

These show how much to trust the marketing research data

Managers see the possible error, not just one headline figure

Office for National Statistics (ONS) household surveys publish 95% confidence intervals

Marketing planners know where results may vary and can take this into account when making decisions

Guide the sample size

If the interval is too wide, the firm can survey more people to narrow it

Bigger samples shrink the interval, giving clearer answers upon which to make marketing decisions

Support decisions

A narrow interval gives managers the confidence to make a key marketing decision, such as launching or dropping a product

Using data to plan and make marketing decisions

Using data from marketing research turns marketing guesses into facts a business can act upon

Examples of data informing marketing decisions

Decision | Example |

|---|---|

Designing the right product |

|

Setting a price customers will pay |

|

Targeting promotions |

|

Choosing the best place to sell |

|

Unlock more, it's free!

Was this revision note helpful?