Break-Even Analysis (AQA A Level Business): Revision Note

Exam code: 7132

The value of break-even analysis

Break-even analysis is a financial tool used to determine the point at which the business revenue equals its expenses, resulting in neither profit nor loss

It helps businesses understand the minimum level of sales or output they need to achieve to cover all costs

This helps managers make informed decisions about pricing and production volumes

It is particularly useful for communicating with stakeholders, including investors or lenders

It demonstrates the financial viability of the business and gives an insight into potential return on investment

Revenue and costs

Break-even analysis takes into account three main components

The components of break-even analysis

Sales revenue

Sales revenue is the value of the units sold by a business over a period of time

E.g. the revenue earned by Apple Music from sales of music downloads

Sales revenue is a key business performance measure and must be calculated to identify profit

Sales revenue is calculated using the formula

Sales revenue increases as the sales volume increases

Costs

In preparing goods and services for sale, businesses incur a range of costs

Some examples of these costs include purchasing raw materials, paying staff salaries and wages and paying utility bills, such as electricity

These costs can be broken into different categories

Fixed costs (FC) are costs that do not change as the level of output changes

These have to be paid whether the output is zero or 5,000

Variable costs (VC) are costs that vary directly with the output

These increase as output increases and vice versa

Total costs (TC) are the sum of the fixed and variable costs

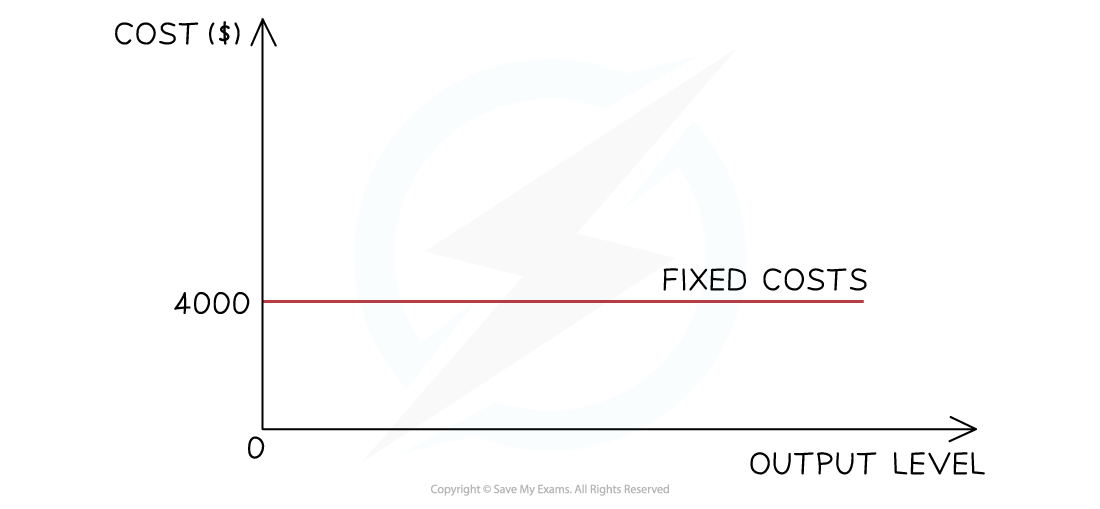

Fixed costs

The firm has to pay its fixed costs, which do not change, irrespective of whether the output is zero or 100,000 units

The fixed costs for this firm are $4,000

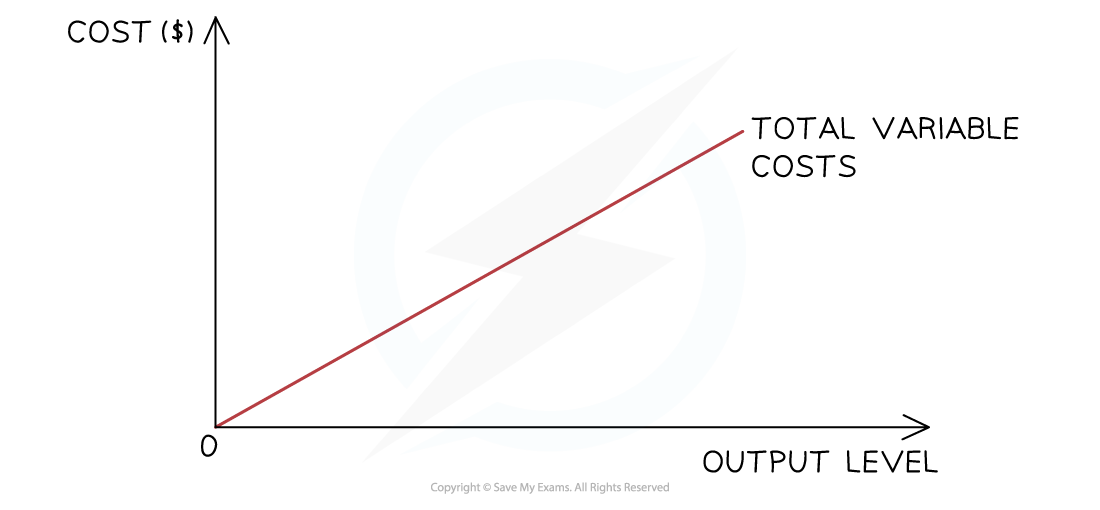

Variable costs

The variable costs initially rise proportionally with output, as shown in the diagram

At some point, the firm will benefit from a purchasing economy of scale, and the rise will no longer be proportional

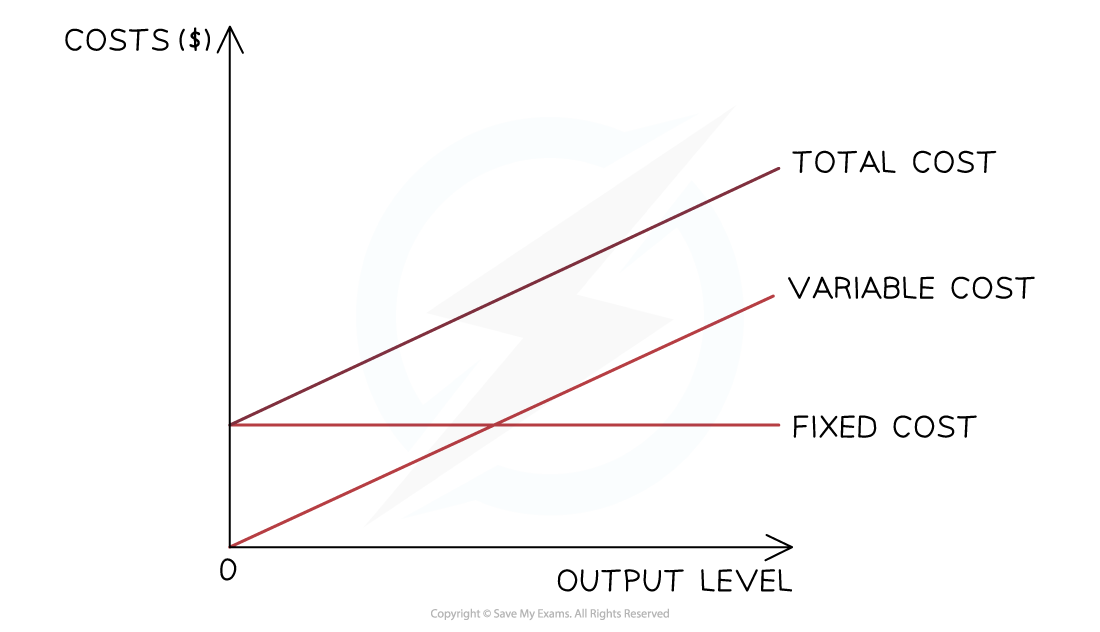

Total costs

The total costs are the sum of the variable and fixed costs at each level of output

Total costs cannot be zero, as all firms have some level of fixed costs

Constructing and interpreting breakeven charts

A breakeven chart is a visual representation of the breakeven point and is used to identify the following:

Fixed costs, total costs and revenue over a range of output

The breakeven point — where total costs are equal to revenue

Profit or loss made at each level of output

The margin of safety

Diagram: Breakeven chart

Diagram analysis

Fixed costs do not change as output increases

A2B Limited's fixed costs are £8,000, and these do not change, whether the business produces zero units or 500 units

Total costs are made up of fixed and variable costs

At zero units of output, they are made up exclusively of fixed costs

At 500 units, the total variable costs equate to £11,800

This line slopes upwards because total variable costs increase as output increases

The revenue line also slopes upwards

At zero units of output, the revenue is £0

At 500 units, the total revenue equates to £11,800

Revenue will increase with the output

The line will slope more steeply than the total costs and will cross the total costs line at some point

The breakeven point is the point at which the total costs and the revenue lines cross each other

The breakeven level of output for A2B Limited is 324 units

The margin of safety can be identified as the difference on the x-axis between the actual level of output (in this case, 450 units) and the breakeven point (324 units)

The profit made at a specific level of output can be identified as the space between the revenue and total costs lines

In this instance, the profit made at 450 units of output is £14,400 - £11,250 = £3,150

Illustrating changes to price, output and costs on the breakeven chart

Changing any of the variables of breakeven (selling price, variable cost per unit or total fixed costs) changes the breakeven point and level of profit the business can expect to achieve

Changes in variables and the breakeven point

Increased selling price

An increase in the selling price increases revenue at each level of output from R1 to R2

The breakeven point falls from BEP1 to BEP2

The profit on each unit of output is greater than the amount the breakeven point increases by

Increased variable costs

An increase in variable costs increases total costs at each level of output from TC1 to TC2

The breakeven point rises from BEP1 to BEP2

The profit on each unit of output is greater than the amount the breakeven point reduces by

Decreased variable costs

A decrease in variable costs reduces total costs at each level of output from TC1 to TC2

The breakeven point falls from BEP1 to BEP2

The profit on each unit of output is greater than the amount the breakeven point increases by

Increased fixed costs

An increase in fixed costs increases total costs at each level of output from TC1 to TC2

The breakeven point increases from BEP1 to BEP2

The profit on each unit of output is greater than the amount the breakeven point decreases by

Decreased fixed costs

A decrease in fixed costs reduces total costs at each level of output from TC1 to TC2

The breakeven point falls from BEP1 to BEP2

The profit on each unit of output is greater than the amount the breakeven point reduces by

The benefits and limitations of break-even analysis

Benefits of break-even analysis

Use | Explanation |

|---|---|

Profitability assessment |

|

Cost control |

|

Pricing decisions |

|

Financial planning |

|

Sensitivity analysis |

|

Decision-making |

|

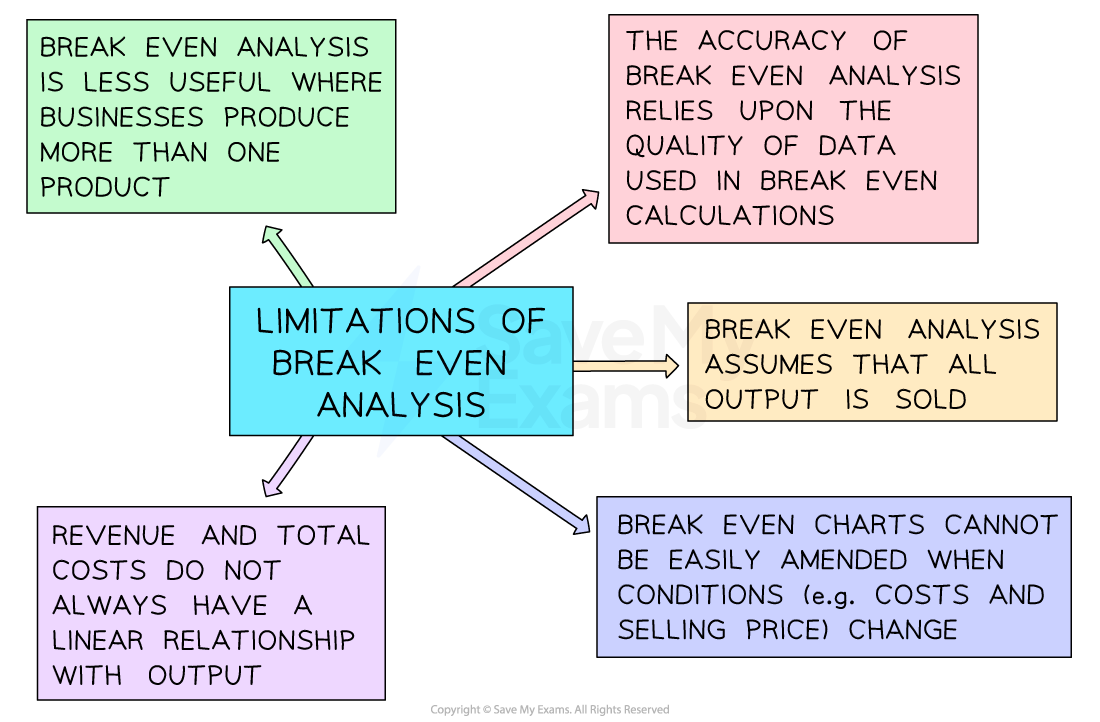

Limitations of break-even analysis

Using break-even analysis to inform decisions

Use in decision-making | Why breakeven helps | Example |

|---|---|---|

Pricing |

|

|

Product launch or withdrawal |

|

|

Cost-saving decisions |

|

|

Unlock more, it's free!

Was this revision note helpful?