Economic: Government Macroeconomic Objectives (Cambridge (CIE) A Level Business): Revision Note

Exam code: 9609

An introduction to macroeconomic objectives

Macroeconomic objectives are the main goals that a government tries to achieve in the wider economy to keep the economy stable and growing

Successfully meeting the objectives helps improve living standards and create a strong business environment

Macroeconomic objectives usually include

Economic growth – increasing the total output of goods and services in the country (measured by GDP)

Low unemployment – making sure most people who want to work can find a job

Low and stable inflation – keeping prices from rising too quickly

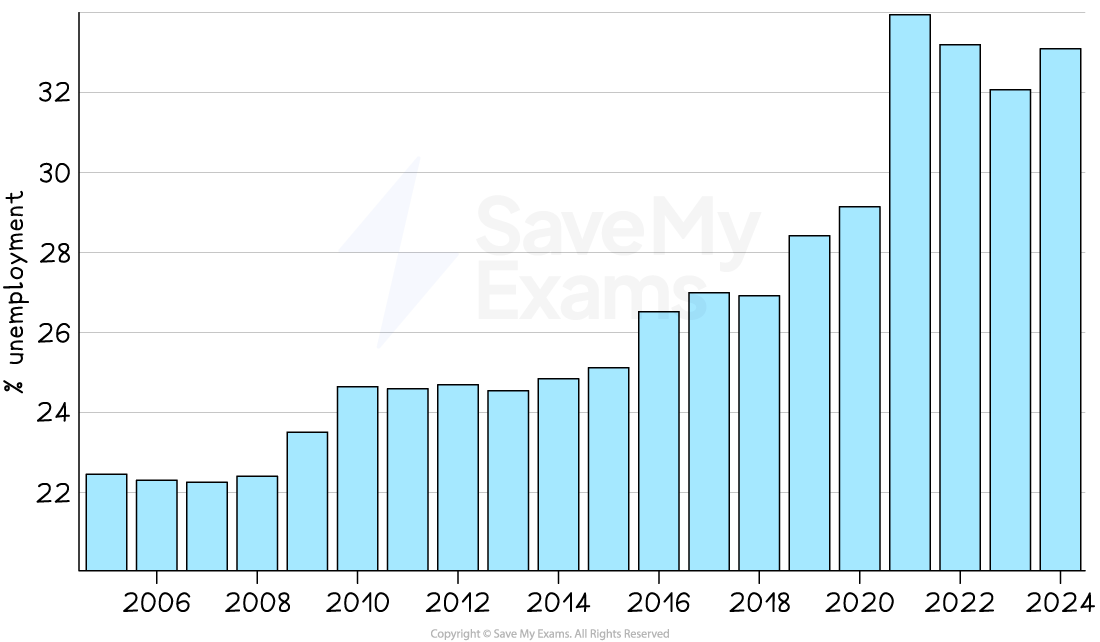

Low unemployment

The target unemployment rate for many economies is between 2-5%

In December 2022 the unemployment rate in the USA was 3.7% and in Singapore it was 2.6%

Low unemployment rates like this are close to the full employment level of labour

There will always be a level of frictional, seasonal and structural unemployment

This makes it impossible to achieve 100% employment

Different economies have different unemployment rates that are considered to be close to the full employment level of labour

E.g. Japan's level is about 2.5% while India's is about 5.7%

There is an increased emphasis on the unemployment rate within different sections of the population

E.g. Youth unemployment, ethnic/racial unemployment by group

In 2021, black unemployment in the UK was 11% and white unemployment was 4.%

Unemployment tends to be inversely proportional to real GDP growth

When real GDP increases, unemployment falls

When real GDP decreases, unemployment rises

Impact on business activity

Higher employment levels mean more people have income to spend, which increases consumer demand for goods and services

Lower unemployment reduces the availability of labour, making it harder for firms to recruit – this may push up wage costs

High employment increases business confidence, encouraging firms to invest and expand

In areas or sectors with high unemployment, demand may fall, leading to lower sales and possible business closures

Businesses may be able to recruit workers more cheaply during periods of high unemployment, improving labour cost competitiveness

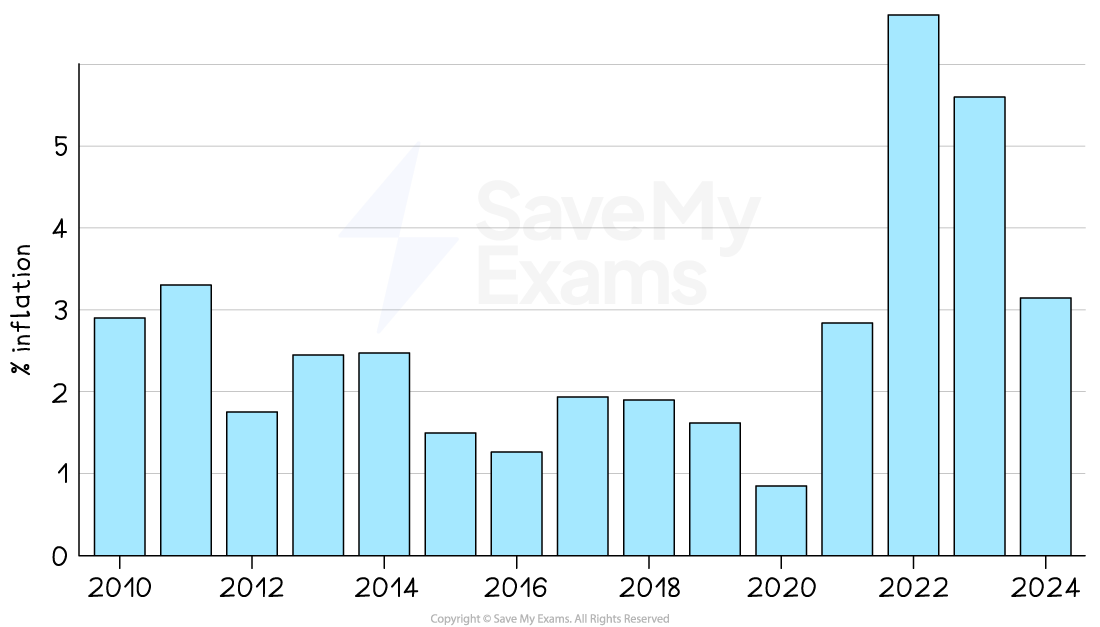

Low and stable inflation

Many economies have a target inflation rate of 2% using the Consumer Price Index (CPI)

A low and stable rate of inflation is desirable, as it is a symptom of economic growth

The different causes of inflation (cost push or demand pull) require different policy responses from the Government

Demand-side policies ease demand pull inflation

Supply-side policies ease cost push inflation

In the UK, a significant deviation from the target of 2% would not be considered stable

An inflation ratea of 3% is considered to be unstable, eroding household purchasing power

By October 2022 the inflation rate in Australia had risen to 6.59%

A low and stable rate of inflation is important as it

Allows firms to confidently plan for future investment

Offers price stability to consumers

Impact on business activity

Low and stable inflation helps businesses plan ahead with greater confidence in costs and pricing strategies

High inflation increases input costs (e.g., wages, raw materials), reducing profit margins unless firms can raise prices

Unstable inflation creates uncertainty, making it harder to budget, forecast, or make investment decisions

Inflation may erode consumer purchasing power, reducing demand for non-essential goods and services

In countries with high inflation, businesses may face pressure to increase wages, which can increase overall operational costs

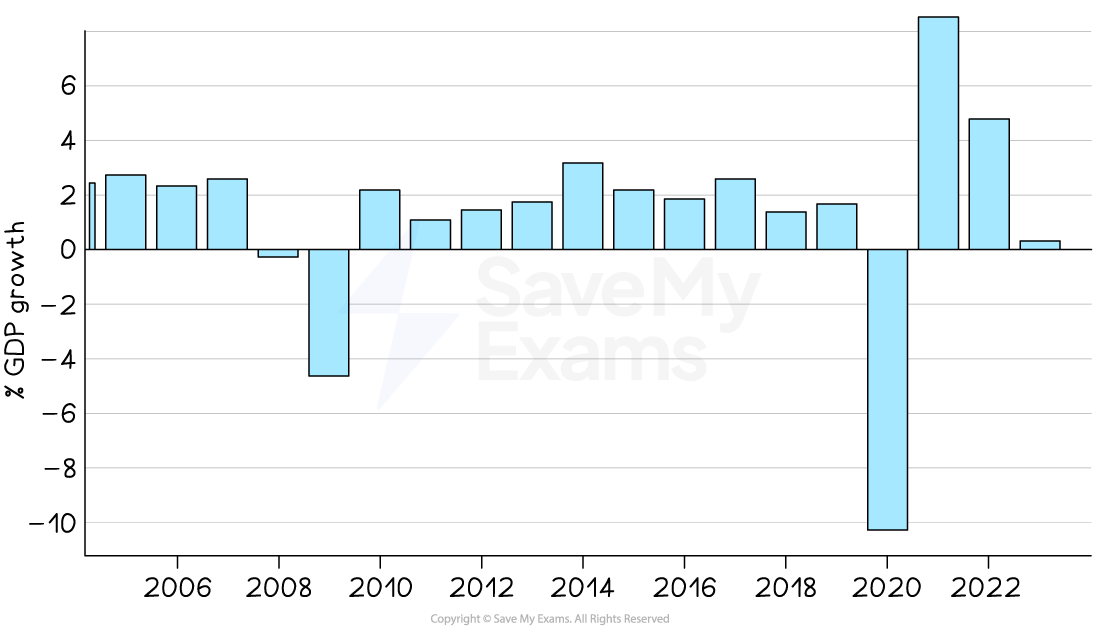

Economic growth

Economic growth is a central macroeconomic aim of most governments

Many developed nations have an annual target rate of 2-3%

This is considered to be sustainable growth

Growth at this rate is less likely to cause excessive demand pull inflation

Politicians use the economic growth rate as a measure of the effectiveness of their policies and leadership

Economic growth has positive impacts on confidence, consumption, investment, employment, incomes, living standards and government budgets

Economic growth trends in the UK since 1998

1998 - 2007

Steady growth fluctuating between 2-4%

2008 - 2015

Global financial crisis followed by a rapid bounce back due to government intervention - and then steady growth

2016 - 2019

Gradual disinflation possibly due to future expectations regarding the impact of the Brexit vote

2020 - 2021

Covid resulted in significant economic slumps on a global basis during 2020

These created a deep recession (short-lived due to government intervention)

Many economies rebounded in 2021

2022 - 2025

Supply chain issues due to Covid and Brexit continued

Increases in the interest rate reduced the level of economic activity

Impact on business activity

Growth boosts consumer incomes and spending power, increasing demand for most goods and services

Rising demand encourages businesses to expand capacity, hire more workers, and invest in new products or technology

Economic booms can lead to higher profits for firms, improving shareholder returns and business sustainability

High growth can also cause overheating, leading to labour shortages or inflationary pressures, which may affect input costs

A lack of growth (or recession) can lead to lower consumer confidence, reduced investment, and declining business revenues

Unlock more, it's free!

Was this revision note helpful?