Economic Influences (Cambridge (CIE) A Level Business): Revision Note

Exam code: 9609

How government might intervene to help businesses and encourage enterprise

Governments often intervene in the economy to:

Promote economic growth

Create jobs

Encourage innovation and enterprise

Increase international competitiveness

By helping businesses, especially start-ups and small firms, governments aim to build a strong and stable economy

Ways governments support businesses and encourage enterprise

Support | What it involves | Example |

|---|---|---|

Finance |

|

|

Training and education |

|

|

Infrastructure investment |

|

|

Cutting red tape |

|

|

Export and trade support |

|

|

How government might intervene to constrain business activity

Governments also have a duty to protect the public, the environment, and the economy

They may limit or control certain business activities that are seen as harmful, unfair, or against the wider interests of society

These interventions can increase business costs, limit certain actions or block business plans altogether

Examples of government interventions

Intervention | What it involves | Example |

|---|---|---|

Legal regulation |

|

|

Competition law enforcement |

|

|

Taxation policy |

|

|

Planning and zoning controls |

|

|

Trade restrictions |

|

|

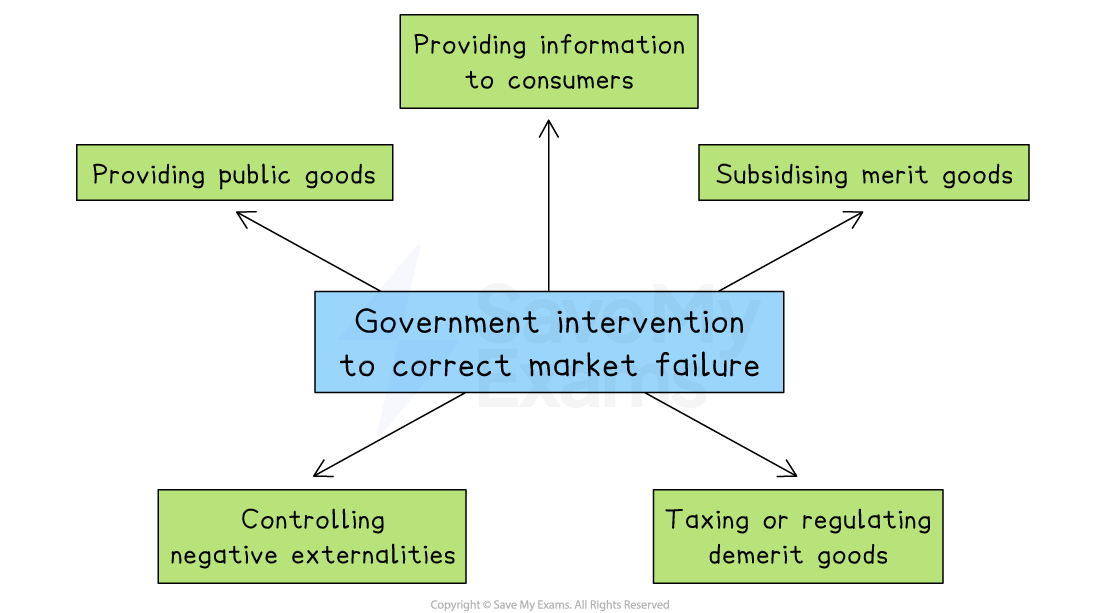

How government might deal with market failure

Market failure happens when the free market fails to allocate resources efficiently or fairly

This happens when the market does not produce the right amount of goods and services or does so in a way that is unfair or harmful to society

Some goods or services are underprovided (like healthcare or education)

Others are overproduced, causing harm (like pollution or drugs)

Not everyone can access what they need (like clean water or housing)

Ways governments correct market failure

Solutions to market failure

1. Providing public goods

Public goods, like street lighting or national defence, wouldn’t be provided by private firms because there’s no way to make a profit

The government funds and provides these directly using tax revenue

E.g. Most countries provide publicly funded defence, as private business would be able to charge individuals to stay safe from attack

2. Subsidising merit goods

Merit goods (like education or vaccines) are under-consumed in a free market because people may not understand their full benefits

Governments subsidise these goods or provide them for free to encourage greater use

E.g. Ghana's government introduced free secondary education to ensure that more young people stay in school and contribute to economic development

3. Taxing or regulating demerit goods

Demerit goods, like tobacco or sugary drinks, are over-consumed because consumers ignore or underestimate the harm they cause

Governments introduce taxes or regulations to reduce consumption and raise awareness

E.g. Mexico introduced a sugar tax in 2014 to tackle rising obesity levels; soft drink sales dropped as a result

4. Controlling negative externalities

Negative externalities occur when businesses cause harm to others, like air or water pollution

Governments enforce regulations, set limits or fine businesses for pollution and environmental damage

E.g. China has introduced stricter emissions controls and shut down high-polluting factories to reduce air pollution in major cities like Beijing

5. Providing information to consumers

Consumers often lack full information to make good choices about, for example, health, finance or environmental impact

Governments can launch public awareness campaigns or require businesses to label products clearly

E.g. In Chile, food packaging must carry clear warning labels for high sugar, salt, or fat content to help consumers make informed choices

Unlock more, it's free!

Was this revision note helpful?