Using Operations Data (AQA A Level Business): Revision Note

Exam code: 7132

Effectively using operations data

A range of operations data can be used to assess how well a business is performing

Data can be analysed over time to determine whether performance is improving or worsening

They may also be compared with the performance of similar firms

Case Study

JetCool Manufacturing Ltd

Business Overview

JetCool is a UK-based manufacturer of energy-efficient air conditioning units. It operates a single large factory in Leeds and supplies retail chains and construction firms across the UK and Ireland

Scenario

In early 2024, JetCool’s senior managers noticed that profit margins were shrinking despite stable sales revenue. To investigate, the operations team analysed key performance data:

Analysis

The drop in labour productivity indicated inefficiencies on the production line. On further inspection, the company found that new employees hired in late 2023 had not completed full training

The rising defect rate led to increased returns and warranty claims, damaging customer satisfaction and raising repair costs

Lower capacity utilisation suggested that the factory was underused, possibly due to slower production and more rework time per unit

Business response

JetCool introduced a refreshed training program for all floor staff, focusing on quality control and assembly speed

It installed a real-time monitoring system to track defects and trigger line adjustments mid-shift

The production schedule was adjusted to focus on the company’s fastest-selling model to improve throughput and boost capacity utilisation

Outcomes within 3 months

Labour productivity improved by 9%

Defect rate dropped to 2.8%

Capacity utilisation recovered to 76%

Warranty costs fell by £22,000 compared to the previous quarter

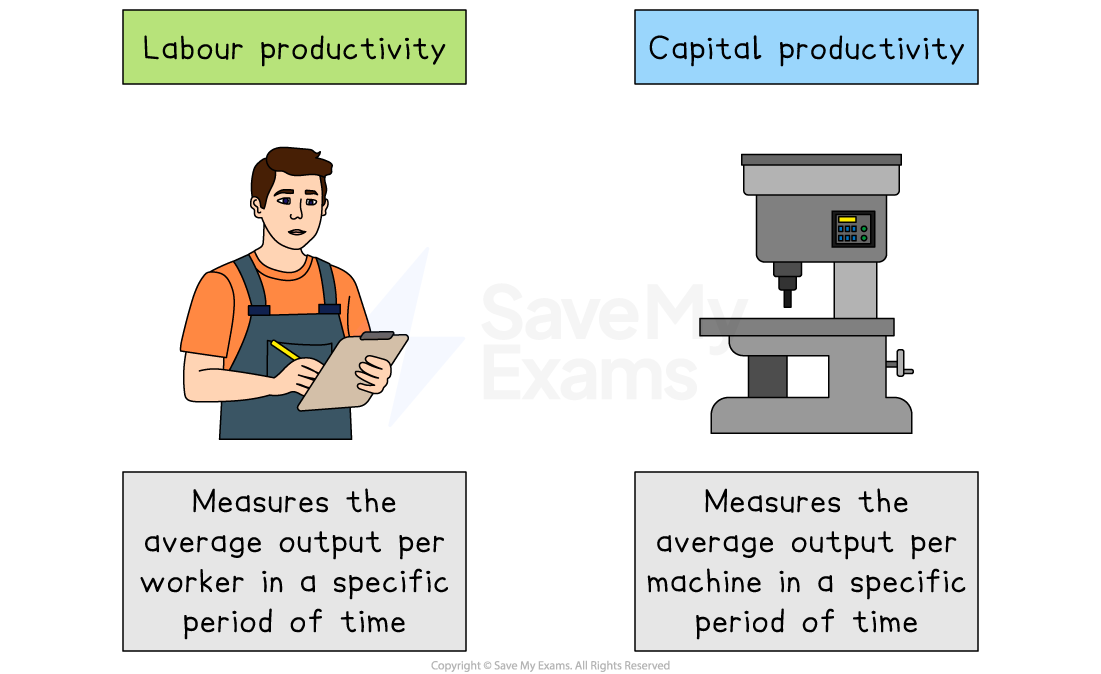

Using productivity data

Productivity measures how well a business uses its resources to produce output

Higher levels of productivity are likely to lead to lower unit costs as fixed costs are spread across more units of output

This can allow a business to lower selling prices to achieve an important competitive advantage over rivals, especially those with lower levels of output

Comparing labour productivity can reveal a range of issues

When each employee delivers more output, profit should rise without the need to recruit more staff

Rising labour productivity also suggests training, motivation techniques or new technology is working, encouraging a business to make further such investments

Similarly, comparing capital productivity can provide some useful insights

High capital productivity shows the firm is getting strong returns from its investments, so it needs less new spending to grow

Investors look at output per £1 of capital employed to judge whether the company is making good use of its funds

Measuring capital productivity helps managers decide whether to upgrade, sell off underused assets or invest in new technology

Labour productivity and capital productivity calculations are covered in depth here

Using quality data

1. The defect rate

The proportion of output that is judged to be substandard in a given time period

It is expressed as a percentage and calculated using the formula

Worked Example

HomeFlex manufactures high-strength universal charging cables for mobile phones. In 2022 it manufactured and tested 14,220 cables of which 213 were found to be defective

Calculate Homeflex's defect rate in 2022.

[2]

Step 1: Divide the number of defects by the total output

(1)

Step 2: Multiply the outcome by 100 and express as a percentage

(1)

2. The returns rate

The proportion of output that is returned by customers in a given time period

It is expressed as a percentage and calculated using the formula

Businesses take steps to reduce the defect rate and returns rate for several reasons

Avoid loss of revenue as faulty products or those that have been returned can rarely be sold

Customers will likely complain about substandard products which causes dissatisfaction and impacts business reputation

Unsafe products may harm customers and could lead to legal issues

Returned products require refunds, processing and disposal

3. The wastage rate

The proportion of materials and components wasted in production in a given time period

It is expressed as a percentage and calculated using the formula

Businesses take steps to reduce the wastage rate for several reasons

Lower production costs

By reducing waste, a business uses fewer raw materials overall, which brings down the cost of making each unit

Higher profit margins

Every tonne of material saves reduced variable costs, increasing the profit earned on each sale

Improved sustainability and reputation

Cutting scrap reduces costs of disposal and the business's environmental impact and shows customers the business is committed to being green

4. Customer satisfaction

A business may carry out surveys, focus groups or interview customers to determine how happy they are with their purchase

Increasingly, businesses use data collected by research organisations such as Trustpilot to determine levels of customer satisfaction

5. Customer loyalty

Customer loyalty may be measured by reviewing the volume of repeat sales

Loyalty schemes, such as Tesco's Clubcard, have made gathering and analysing this information much more straightforward

Examples of industry measures of quality

Industry | Quality measure | Explanation |

|---|---|---|

Hotels |

|

|

Train operators |

|

|

Hospitals |

|

|

Restaurants |

|

|

Using capacity utilisation data

Capacity utilisation measures how effectively a business uses its assets to produce output

It compares current output to the maximum possible output a business can produce using all of its assets

High capacity utilisation is important for several reasons

Cost efficiency and profitability

Using more of a factory’s or machine’s capacity spreads fixed costs, such as rent and salaries, over more units of output, lowering the unit cost and increasing profit margins

Resource management

High capacity utilisation shows a business is making full use of its non-current assets, such as machines, buildings and labour, so it isn’t wasting money on idle capacity

Investment planning

Monitoring capacity utilisation helps managers decide when to invest or scale back capital expenditure

Cash‐flow forecasting

More output generally means more sales and cash coming in

A sudden drop in capacity utilisation can signal that there is likely to be an imminent shortage of cash

Quality and maintenance balance

While high utilisation is good, pushing equipment too hard can increase breakdowns and defects

The right rate of capacity utilisation balances the level of output with reliable, high‐quality production

Calculation of capacity utilisation is covered in depth here

Evaluating the use of operations data to analyse business performance

Advantages | Limitations |

|---|---|

|

|

|

|

|

|

Unlock more, it's free!

Was this revision note helpful?