Why and How Businesses Grow (AQA A Level Business): Revision Note

Exam code: 7132

Why do businesses grow?

Business growth involves a business increasing its size, scope or scale

Their leaders or owners may have ambitions for growth for a range of reasons

Reason | Explanation | Example |

|---|---|---|

Rising customer demand |

|

|

Economies of scale |

|

|

Entering new markets or products |

|

|

Organic growth

Organic growth is growth driven by internal expansion using reinvested profits, owners' capital or loans

Organic growth (internal) is usually generated by

Gaining greater market share

Product diversification

Opening a new store

International expansion

Investing in new technology/production machinery

Firms will often grow organically to the point where they are in a financial position to integrate with others

Integration speeds up growth but also creates new challenges

Evaluating organic growth

Advantages | Disadvantages |

|---|---|

|

|

External growth

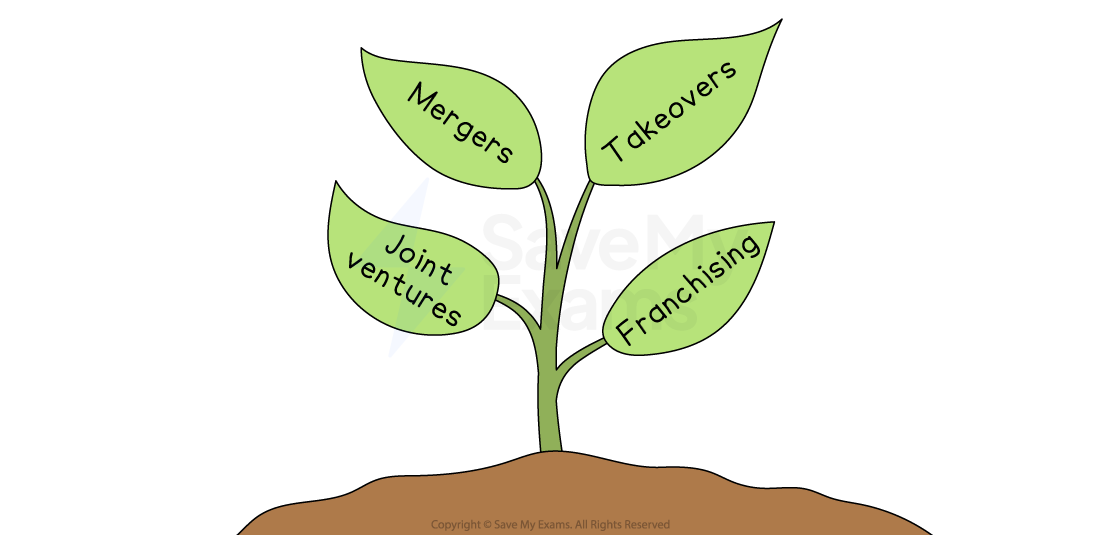

Integration in the form of mergers, takeovers, joint ventures or franchising results in rapid business growth and is referred to as external (or inorganic) growth

Methods of external growth

A merger occurs when two or more companies combine to form a new company

The original companies cease to exist and their assets and liabilities are transferred to the newly created entity

A takeover occurs when one company purchases another company, often against its will

The acquiring company buys a controlling stake (more than 50% of shares) in the target company's shares and gains control of its operations

A joint venture occurs when two businesses join together to share their knowledge, resources and skills to form a separate business entity, usually for a limited period of time

E.g. The mobile network EE is in a joint venture formed by the French mobile network, Orange and the German mobile network, T-Mobile

Franchising is where a successful business lets other people open and run their own branches using its name, products and way of doing things

In return, franchisees pay an upfront fee and ongoing royalties, helping the original company grow quickly without having to invest all the money itself

For a more detailed discussion of each of these methods, visit the revision note page Types of External Growth

Why pursue external growth?

Reason | Explanation | Example |

|---|---|---|

Strategic fit |

|

|

Economies of scale |

|

|

Synergies |

|

|

Elimination of competition |

|

|

Shareholder value |

|

|

Retrenchment

Retrenchment is when a business deliberately reduces the size or scope of its operations

This could involve closing unprofitable branches, cutting staff, selling off assets or withdrawing from certain markets

The aim is to lower costs, improve cash flow and focus on its strongest, most profitable activities

Common reasons for retrenchment

Financial strain or losses

When profits fall or debts rise too high, companies close unprofitable sites or cut back to save cash

Thomas Cook shut many of its shops and flights before collapsing in 2019 due to mounting losses

Intense competition

If rivals undercut prices or offer better products, a firm may exit markets where it can’t compete

Nokia scaled down its mobile-phone business when Apple and Samsung took most of the market

Refocusing on core activities

To improve efficiency, businesses sell off or close side-lines and concentrate on their strongest operations

eBay sold PayPal so each company could focus on its own service - eBay on auctions and PayPal on digital payments

Unlock more, it's free!

Was this revision note helpful?