Operating and Trading Internationally (AQA A Level Business): Revision Note

Exam code: 7132

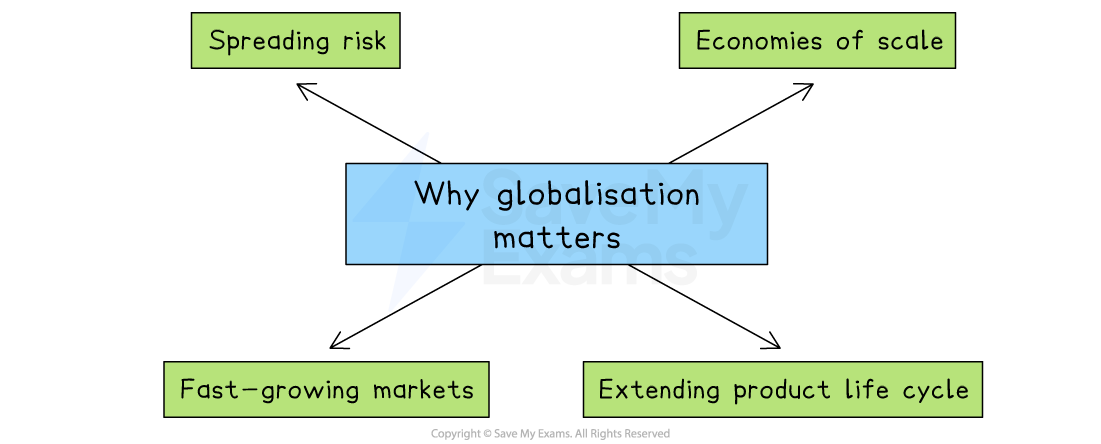

Reasons for targeting international markets

Businesses looking to grow often look at overseas markets for a variety of reasons

Targeting international markets

Pursuing sales growth in larger or faster-growing markets

When demand in the home market begins to level off, entering overseas markets allows a firm to attract new groups of customers to keep revenue rising

E.g. Apple expanded aggressively into China and, more recently, India; international sales now account for well over half of its total turnover

Spreading risk through market diversification

Operating in several economies means that an economic downturn or a government policy change is less likely to threaten the whole business

E.g. Starbucks relied on rising sales in China and the Asia–Pacific region to offset periods of weaker sales in North America

Gaining economies of scale and lower unit costs

Supplying a global customer base supports longer production runs, bulk purchasing and shared research and development

E.g. Toyota builds cars like the Corolla on shared global designs, making them in large numbers for sale worldwide, which lowers the cost of each car

Extending the product life cycle

A product that is mature at home may still be in its introduction or growth phase abroad, allowing the firm to generate additional revenue without having to change the product's design

E.g. Netflix launched its streaming service in South America and Africa after US subscriber growth slowed

Exporting

Exporting is the act of selling goods or services produced in one country to customers located in another country.

A business manufactures or supplies the product at home

It finds overseas buyers, usually through agents, distributors, trade fairs or online platforms

The firm handles (or outsources) tasks such as packaging for international transport, arranging shipping, completing export paperwork and complying with foreign regulations

Exporting is the simplest step into international trade

The product is still made in the home country; only marketing and delivery cross national borders

Advantages and disadvantages of exporting

Advantages | Disadvantages |

|---|---|

|

|

|

|

|

|

|

|

Licensing

Licensing is a legal arrangement where a business (the licensor) grants a foreign company (the licensee) the right to make or sell its product, use its brand name or make use of technology in return for a fee or royalty payment

The product is usually made and marketed by the licensee in its own country.

The licensee follows set standards to protect the licensor’s brand or patents

The licensor monitors quality and may exert some influence on strategy in the new market

Case Study

Kurkure is a popular Indian snack brand owned by PepsiCo

In some parts of India, especially in smaller towns and rural areas, PepsiCo licenses the production and distribution of Kurkure to local food manufacturers

PepsiCo allows local manufacturers to produce and sell Kurkure under its brand.

The local firms must follow PepsiCo’s strict quality and branding standards.

In return, these firms pay royalties to PepsiCo for the right to use the Kurkure brand

Advantages and disadvantages of licensing

Advantages | Disadvantages |

|---|---|

|

|

|

|

|

|

|

|

Strategic alliances

A strategic alliance is a formal agreement where two (or more) separate businesses team up to work on a specific task, while each business keeps full ownership of itself

Examples include designing a new product, making it, selling it or distributing it

The partners agree on clear goals

E.g. how they will enter a new country together, how research costs will be shared or how savings or profits will be split

Each firm brings something it already does well so the combined effort is stronger than going alone

Examples include ideas, production, sales outlets, or a strong brand

They do not set up a new joint company

They stay independent and follow a contract that sets out who does what and how the rewards are shared

Advantages and disadvantages of strategic alliances

Advantages | Disadvantages |

|---|---|

|

|

|

|

|

|

|

|

Direct investment

Direct investment, often called foreign direct investment (FDI), is when a business sets up or buys assets, such as factories, offices or shops, in another country

Typical forms include

Greenfield investment: building a brand-new site from the ground up

Acquisition: buying an existing foreign firm to gain its sites, staff and customers in one go

Major expansion: turning a small overseas branch into a full production base

Examples of UK businesses making direct foreign investments

Business | Explanation |

|---|---|

Jaguar Land Rover  |

|

Tesco  |

|

Advantages and disadvantages of direct investment

Advantages | Disadvantages |

|---|---|

|

|

|

|

|

|

|

|

Unlock more, it's free!

Was this revision note helpful?