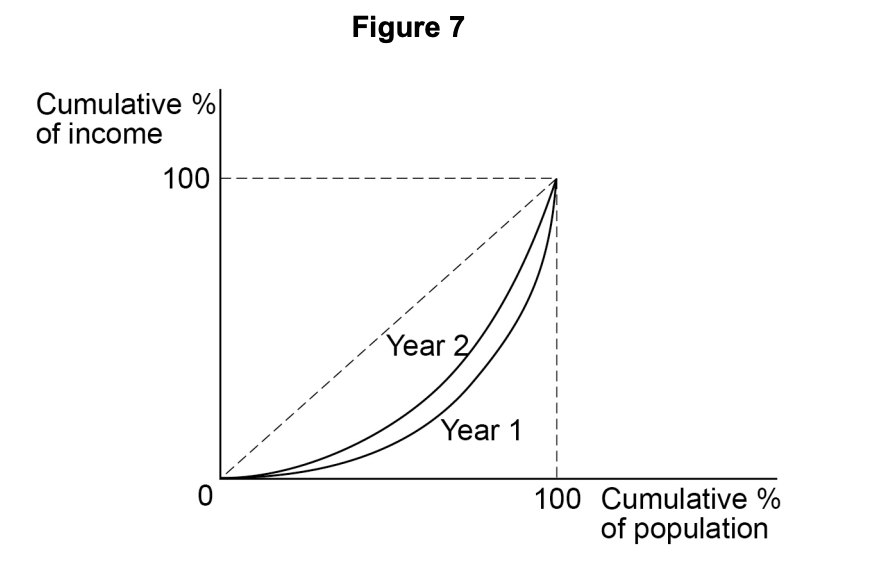

In an economy, over the last decade, each of the top five decile groups has experienced a fall in their share of total income. In contrast, the bottom five decile groups have experienced a substantial increase in their share of total income.

It can be concluded that, over this period, the distribution of income is most likely to have become

more equal.

more equal but less equitable.

more equitable.

more equitable but less equal.

Was this exam question helpful?