Syllabus Edition

First teaching 2025

First exams 2027

The Price Mechanism (Cambridge (CIE) IGCSE Economics): Revision Note

Exam code: 0455 & 0987

Understanding the price mechanism

What is the price mechanism?

The price mechanism is where the forces of demand and supply determine the prices of goods and services in a market economy

The price mechanism ensures that scarce resources are allocated efficiently in competitive markets

Prices act as signals and incentives that help answer the three fundamental economic questions:

1. What to produce?

Producers observe prices in the market to decide which goods and services are most profitable to supply

If the price of electric vehicles rises, it signals strong demand and potential profit

In response, firms are incentivised to produce more electric vehicles instead of petrol cars

2. How to produce?

Firms choose the most cost-effective method of production based on prices of inputs (labour, machinery, raw materials)

If wages rise, firms may substitute labour with machines to lower costs

If fuel prices fall, they might use more energy-intensive methods

3. For whom to produce?

Goods and services are produced for those willing and able to pay based on consumer purchasing power

If higher-income consumers demand more luxury goods, producers will respond to that market segment

This means that income distribution in the economy affects who gets access to goods

Case Study

Global Coffee Prices and Producer Response in Brazil

Scenario

In 2021, global demand for coffee surged as cafés reopened after pandemic lockdowns. At the same time, a major drought and frost in Brazil — the world’s largest coffee exporter — damaged crops and reduced supply. This caused the global price of coffee beans to rise sharply on commodity markets

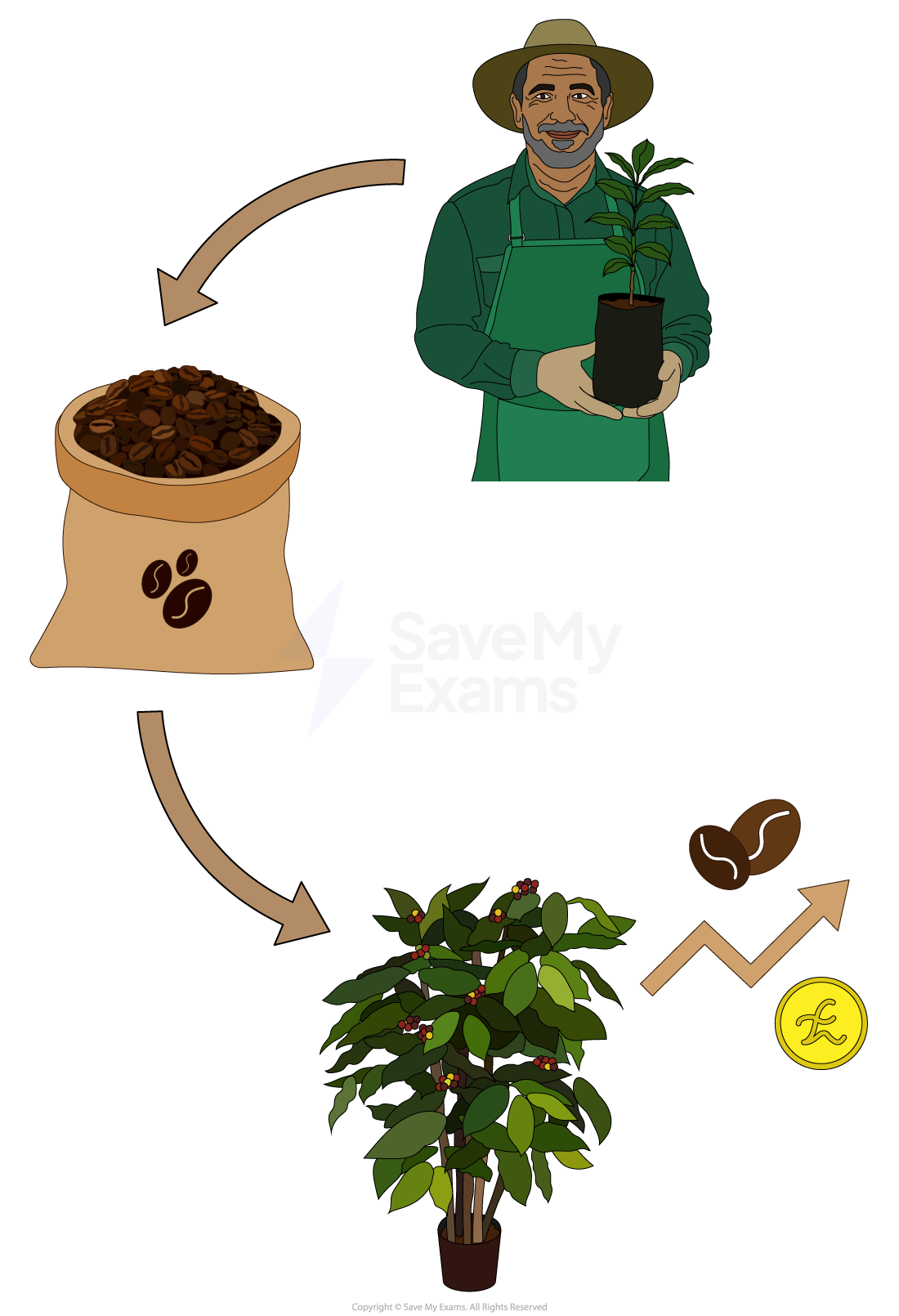

The incentive and signal

The price rise acted as a signal to coffee producers: global buyers were willing to pay more

It also served as an incentive — higher prices meant potentially greater profits for farmers

In response, producers began planting more coffee trees, investing in irrigation systems, and prioritising coffee over other crops like maize or sugarcane

The outcome

Over the next year, supply increased as new coffee plants matured and better weather returned

More producers entered the market, while existing farmers expanded production

As supply grew to meet demand, global prices began to stabilise, demonstrating how the price mechanism efficiently directed resources toward a highly demanded good

Unlock more, it's free!

Was this revision note helpful?