Speculation & the Wall Street Crash (Cambridge (CIE) IGCSE History): Revision Note

Exam code: 0470 & 0977

How Far Was Speculation Responsible for the Wall Street Crash?

Summary

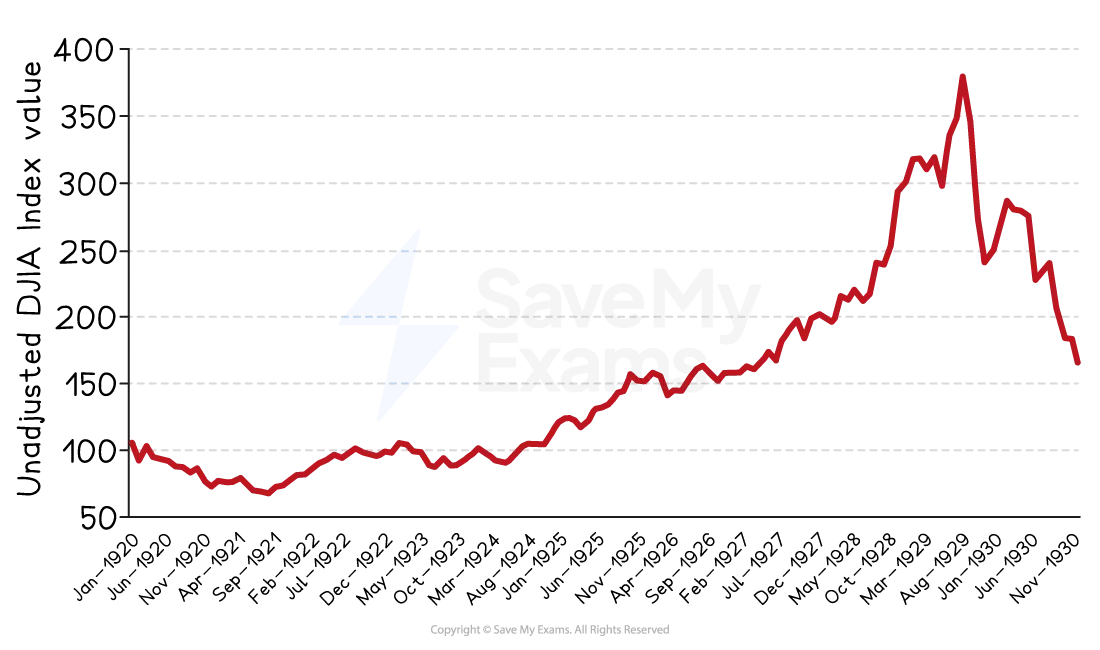

The Wall Street Crash of 1929 triggered the Great Depression. Wall Street is the name given to the US Stock Exchange, and in the 1920s, many Americans had grown wealthier by speculating on shares. This meant that they purchased shares on the stock market and sold the shares after they increased in value. A decade of economic growth led to seemingly endless increases in share prices; people bought more and more shares and took ever greater financial risks.

Once the US economy began to slow down, fears of a drop in share prices caused people to sell their shares. Panic gripped the market, and mass selling of shares triggered a collapse or crash in the stock market in October 1929.

What does speculation mean?

Speculation is when a person buys something with the hope that its value will increase

They then try and sell the item at a higher price to make a profit

Speculation on the stock market became very popular in America in the 1920s

Share prices had boomed during the first half of the decade

Many people assumed that this would continue

Many working-class people joined in buying shares in the hope of getting rich

Many purchased shares “on the margin”

This meant that they only paid for about 10 per cent of the shares and borrowed the money to pay for the rest

They hoped and expected that the value of the shares would be greater than the debt when they came to sell them

Speculation was incredibly risky — especially “on the margin”

There was no guarantee that shares would increase in value

If they decreased in value, people could be in serious financial trouble

Reasons for the Wall Street Crash

If people had faith that the US economy would continue to grow and therefore continued to invest in the stock market, shares would continue to rise

But if enough people started to doubt the strength of the US economy, they would sell their shares, and prices would start to fall

In 1929, some investors began to see signs that the US economy was slowing down

As a result, they started to sell rather than buy shares

What started as a trickle of investors selling their shares soon turned into a flood

Panic led many investors to try and sell their shares before they lost all value

On 24th October 1929, 13 million shares were sold on the New York Stock Exchange on Wall Street

Nearly all companies saw the value of their shares collapse

It became known as Black Thursday

Events in the Wall Street Crash

Share prices continued to fall after 24th October

Approximately, 16 million shares were sold on the 29th of October

Many people had purchased shares “on the margin” with money they had borrowed from banks

Many thousands of investors were unable to pay these loans back because their shares had suddenly become worthless

The result was 659 American banks going bust in 1929

Millions of Americans had savings in these banks

When the banks disappeared, so did people’s savings

This led to the financial ruin of many Americans and forced the closure of more businesses

Worked Example

Describe the causes of the Wall Street Crash of October 1929.

[4 marks]

Answer:

One cause of the Wall Street Crash of October 1929 was speculation and investors buying “on the margin”. This meant that shares were purchased with borrowed money in the expectation that they would increase in value. However, when prices stopped increasing or started to drop, it triggered speculators to sell quickly, as they could not cover the debt they had taken on to buy the shares.

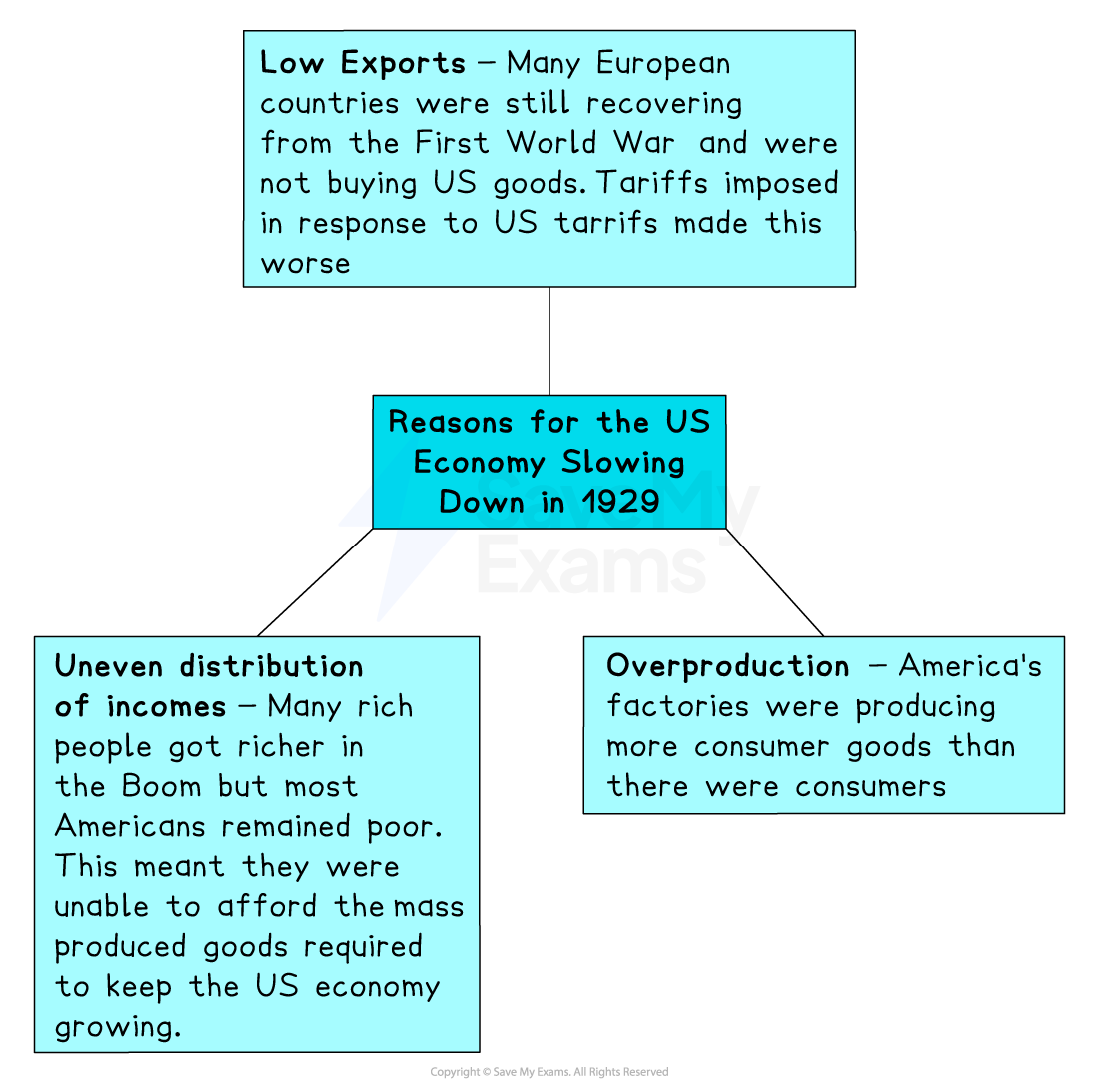

Another cause of the Wall Street Crash of October 1929 was overproduction. America’s factories were mass-producing more goods than there were consumers to buy them. This led to a drop in profits and then a drop in share prices, which triggered speculators to start selling.

Examiner Tips and Tricks

The causes of the Wall Street Crash could be the topic of a 10-mark judgement question and might take the form: “Speculation was responsible for the Wall Street Crash.” How far do you agree with this statement?

To achieve a Level 5, you must explain what speculation is and how it created the conditions for a crash — particularly with so many shares being bought “on the margin”.

You must then explain how underlying issues with the US economy, such as overproduction, a lack of exports and uneven distribution of wealth, caused it to slow and share prices to drop.

Finally, you must reach a conclusion about whether you agree with the statement and explain your reasoning.

Unlock more, it's free!

Was this revision note helpful?