Syllabus Edition

First teaching 2025

First exams 2027

PED, Consumer Expenditure and Firms’ Revenue (Cambridge (CIE) IGCSE Economics): Revision Note

Exam code: 0455 & 0987

PED and total revenue

Revenue is the amount of money a firm receives from selling its goods or services

Total revenue = price x quantity

Also referred to as consumer expenditure from the buyer’s perspective

The total revenue rule states that in order to maximise revenue, firms should increase the price of products that are inelastic in demand, and decrease prices on products that are elastic in demand

Illustrating the gains using a demand curve

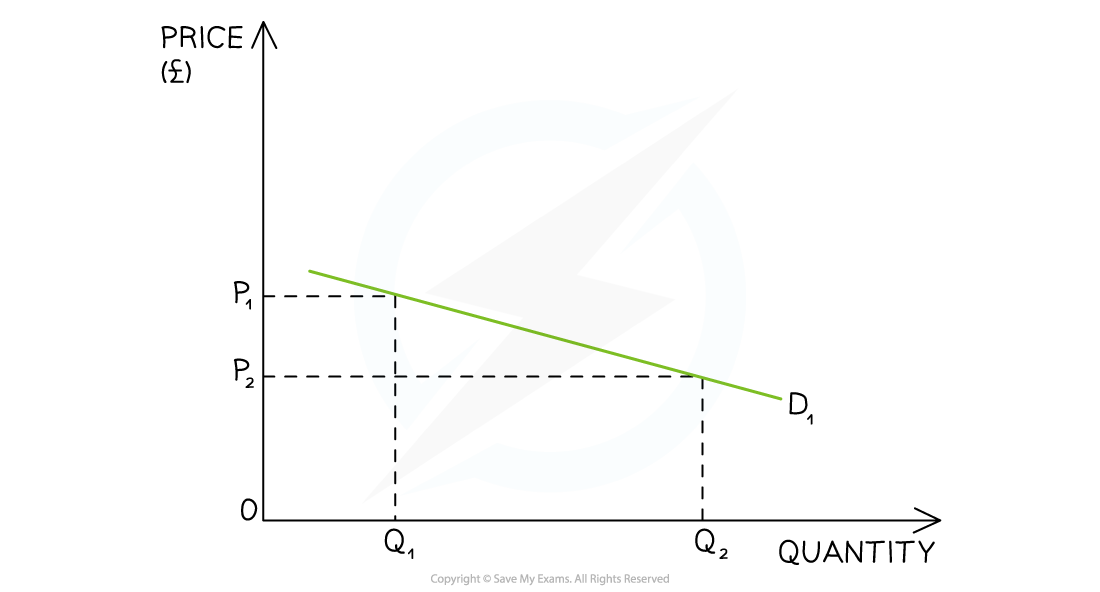

Lowering price for elastic demand

This can be illustrated using a demand curve

The demand curve is very elastic in this market

When a good or service is price elastic in demand, there is a greater than proportional increase in the quantity demanded to a decrease in price

Total revenue is higher once the price has been decreased from P1 to P2

(P2 x Q2) > (P1 x Q1)

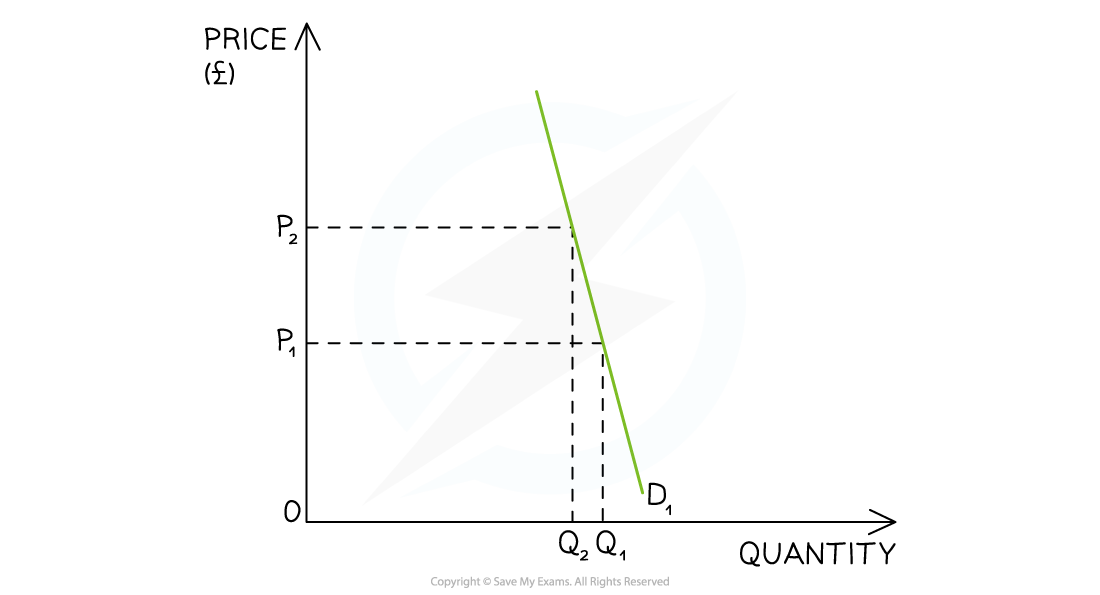

Raising price for inelastic demand

The demand curve is very inelastic in this market

The demand curve is very inelastic in this market

When a good/service is price inelastic in demand, there is a smaller than proportional decrease in the quantity demanded to an increase in price

Total revenue is higher once the price has been increased

(P2 x Q2) > (P1 x Q1)

Worked Example

A firm raises the price of its products from £10 to £15. Sales have fallen from 100 to 40 units per day. Explain if the firm has made the correct decision

Step 1: Calculate the initial sales revenue

Step 2: Calculate the sales revenue after the price change

Step 3: Explain the decision

By raising the price, total revenue has fallen by £400

This indicates that the product is price elastic in demand

The firm should have lowered their price in order to maximise revenue

Examiner Tips and Tricks

A common error students make is to say that when prices increase and the product is inelastic in demand, the quantity demanded does not fall. It does, but it is a less than proportional change than the increase in price.

When governments tax demerit goods such as cigarettes, the increase in price is greater than the decrease in QD, but QD still falls.

Unlock more, it's free!

Was this revision note helpful?