Syllabus Edition

First teaching 2025

First exams 2027

Solutions to Market Failure: Maximum & Minimum Prices (Cambridge (CIE) IGCSE Economics): Revision Note

Exam code: 0455 & 0987

Intervention to address market failure

Four of the most commonly used methods to address market failure in markets are

maximum prices

minimum prices

indirect taxation

subsidies

Additional methods of intervention include regulation, nationalisation, privatisation, and government (state) provision of public goods

Maximum prices

A maximum price is set by the government below the existing free market equilibrium price and sellers cannot legally sell the good/service at a higher price

Governments will often use maximum prices in order to help consumers.

Sometimes they are used for long periods of time e.g. housing rental markets.

Other times they are short-term solutions to unusual price increases e.g. petrol

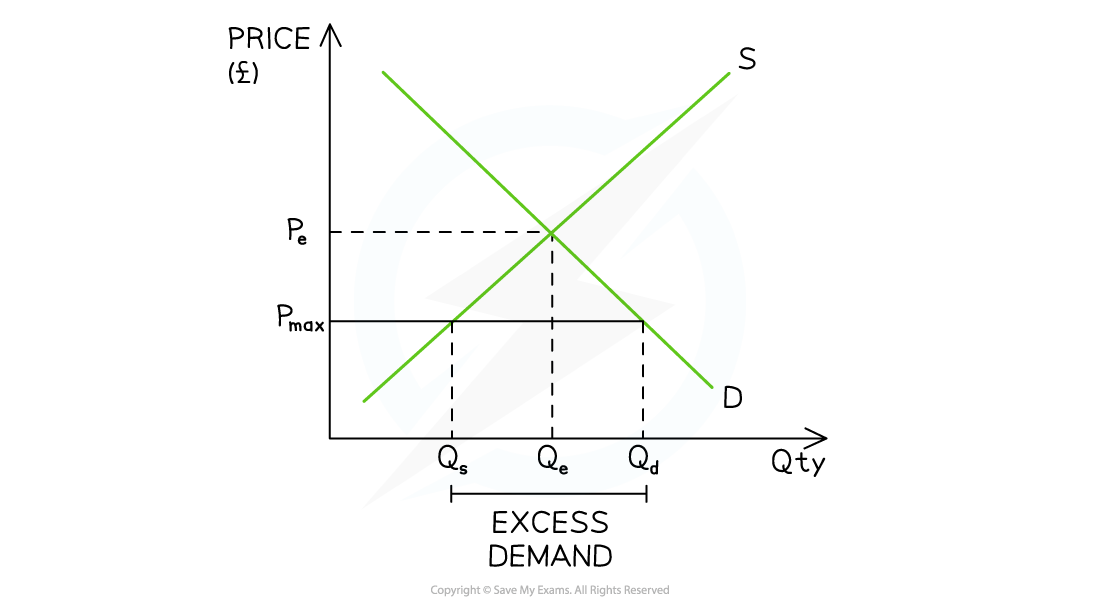

Diagram analysis

The initial market equilibrium is at PeQe

A maximum price is imposed at Pmax

The lower price reduces the incentive to supply and there is a contraction in QS from Qe → Qs

The lower price increases the incentive to consume and there is an extension in QD from Qe → Qd

This creates a condition of excess demand equal to QsQd

Evaluating the use of maximum prices

Advantages | Disadvantages |

|---|---|

|

|

Minimum prices

A minimum price is set by the government above the existing free market equilibrium price and sellers cannot legally sell the good or service at a lower price

Governments will often use minimum prices in order to help producers or to decrease consumption of a demerit good such as alcohol

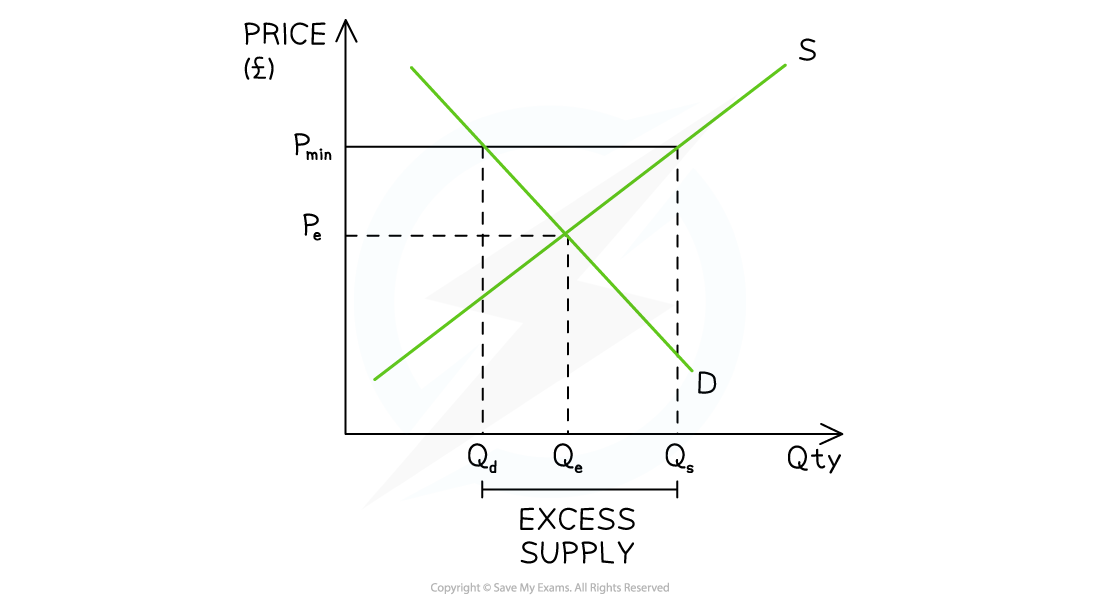

Diagram analysis

The initial market equilibrium is at PeQe

A minimum price is imposed at Pmin

The higher price increases the incentive to supply and there is an extension in QS from Qe → Qs

The higher price decreases the incentive to consume and there is a contraction in QD from Qe → Qd

This creates a condition of excess supply QdQs

Evaluating the use of minimum prices in product markets

Advantages | Disadvantages |

|---|---|

|

|

Minimum prices in labour markets

Minimum prices are also used in the labour market to protect workers from wage exploitation

These are called national minimum wages

A national minimum wage (NMW) is a legally imposed wage level that employers must pay their workers

It is set above the market rate

The minimum wage per hour varies based on age

Diagram analysis

The demand for labour (DL) represents the demand for workers by firms

The supply of labour (SL) represents the supply of labour by workers

The market equilibrium wage and quantity for truck drivers in the UK is seen at WeQe

The UK government imposes a national minimum wage (NMW) at W1

Incentivised by higher wages, the supply of labour increases from Qe to Qs

Facing higher production costs, the demand for labour by firms decreases from Qe to Qd

This means that at a wage rate of W1 there is excess supply of labour and the potential for unemployment equal to QdQs

Evaluating the use of a minimum wage in labour markets

Advantages | Disadvantages |

|---|---|

|

|

Examiner Tips and Tricks

The material in this topic is frequently examined in the Paper 2 structured questions. You will be asked to evaluate the effectiveness of taxes, subsidies, maximum or minimum prices.

To do so:

1. Consider the advantages and disadvantages of each method of intervention

2. Explain that several methods of intervention are likely to be more effective than a single method e.g. smoking is taxed and highly regulated (age restrictions, packaging restrictions, display restrictions)

3. Consider different market segments and their responsiveness e.g. wealthy consumers will less responsive (inelastic demand) to tax increases than poorer consumers (elastic demand)

Unlock more, it's free!

Was this revision note helpful?