Syllabus Edition

First teaching 2025

First exams 2027

Central & Commercial Banks (Cambridge (CIE) IGCSE Economics): Revision Note

Exam code: 0455 & 0987

The role and importance of central banks

A central bank is the main financial institution of a country, responsible for managing the nation’s currency, money supply and interest rates

The Central Bank plays a vital role in maintaining stability in the financial system

The policy tools at their disposal help to meet government economic objectives and create economic growth

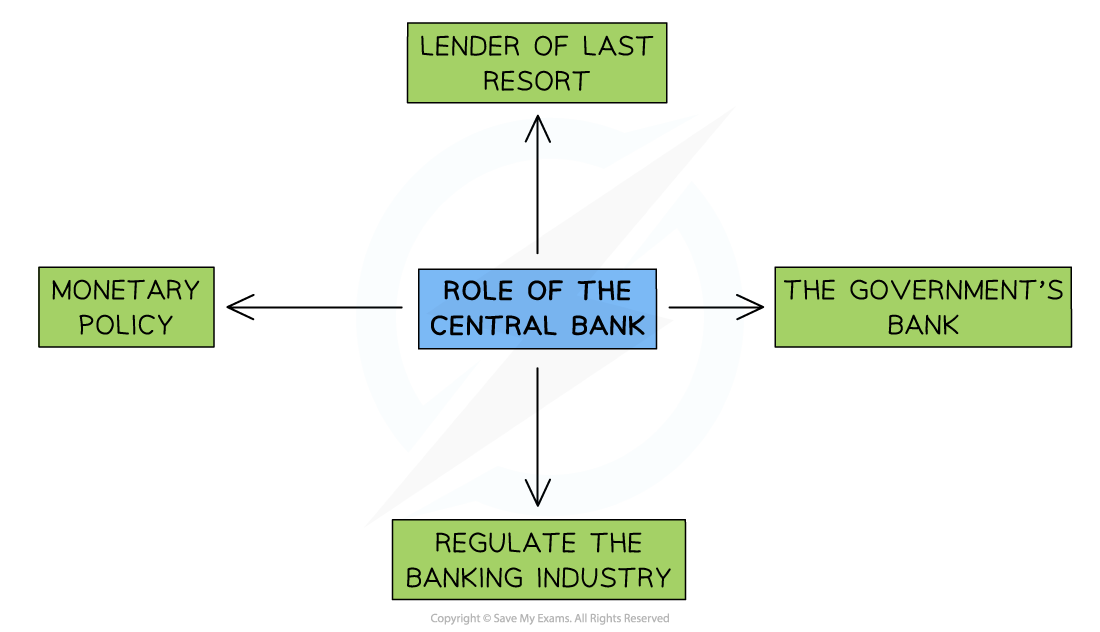

What do central banks do?

1. Implement monetary policy

Monetary policy is the adjustment of interest rates and the money supply so as to influence total demand and meet the inflation target

2. Banker for the government

The government sets the annual budget but it is the Central Bank that manages the tax receipts and payments

In 2022 there were 5.7 million public sector workers in the UK who had to be paid by the Central Bank each month

3. Banker to the commercial banks – lender of last resort

Commercial banks are able to borrow from the Central Bank when they run into short-term liquidity issues

Without this help, they might go bankrupt leading to instability in the financial system - and a potential loss of savings for many households

4. Regulation of the banking industry

Regulation is when the government sets rules or laws to control the way consumers and producers behave in a market

The high level of asymmetric information in financial markets requires that commercial banks are regulated in order to protect consumers

The role and importance of commercial banks

Commercial banks are financial institutions that accept deposits from individuals and businesses, and provide loans and other financial services for profit

Roles of commercial banks

Accepting deposits

Provide safe storage for customers’ money

Offer different types of accounts (current, savings, fixed deposit) with varying interest rates

Lending to customers

Provide loans, overdrafts, and mortgages to individuals and businesses.

Generate profit mainly through interest charged on loans

Facilitating payments

Offer payment services such as debit/credit cards, cheque clearing, and online banking

Enable domestic and international transfers (e.g. SWIFT payments)

Providing financial advice

Advise customers on investments, savings and business finance

Foreign exchange services

Exchange currencies for trade, travel or investment

Importance of commercial banks

Encourage saving

They provide a secure place for individuals and firms to save, helping to mobilise funds for investment

Support business growth

Offer credit facilities for expansion, working capital and start‑up capital.

Economic stability

Help circulate money in the economy by channelling savings into productive investments

Facilitate trade

Provide trade finance, letters of credit, and foreign currency for importers and exporters

Convenience

Offer easy access to financial services through branches, ATMs and online banking

Unlock more, it's free!

Was this revision note helpful?