Syllabus Edition

First teaching 2025

First exams 2027

Monetary Policy Measures (Cambridge (CIE) IGCSE Economics): Revision Note

Exam code: 0455 & 0987

Understanding monetary policy

Monetary policy involves adjusting the money supply so as to influence total (aggregate) demand

The money supply is the amount of money in an economy at any given moment in time

It consists of coins, banknotes, bank deposits and central bank reserves

The Central Bank in each economy is responsible for setting monetary policy

The Bank's Monetary Policy Committee usually meets 4-8 times a year to set policy

The three main instruments of monetary policy

1. Changes in interest rates

The central bank can raise interest rates to make borrowing more expensive and saving more attractive, slowing total demand and inflation

It can lower interest rates to make borrowing cheaper, encouraging spending and investment and boosting growth

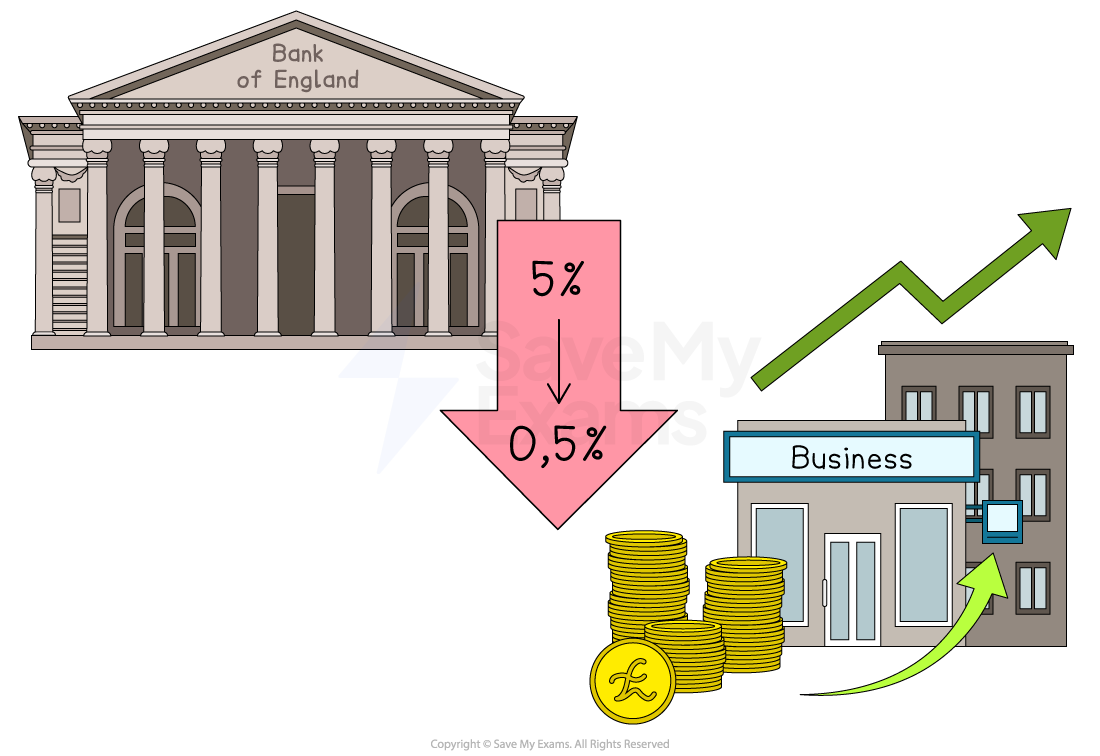

Case Study

UK, 2009

Following the global financial crisis, the Bank of England cut its base interest rate from 5% in 2008 to 0.5% by 2009.

This made borrowing cheaper for households and businesses, encouraging spending and helping the economy recover from recession

2. Changes in the money supply

Increasing the money supply (e.g., through quantitative easing) can encourage more lending and spending

Reducing the money supply can slow down total demand and help control inflation

Case Study

Eurozone, 2015

The European Central Bank introduced a €60 billion-per-month quantitative easing programme to increase the money supply. This aimed to stimulate borrowing and investment, raise demand, and push inflation back towards the 2% target

3. Changes in the foreign exchange rate

A lower exchange rate makes exports cheaper for foreign buyers and imports more expensive, boosting total demand for domestic goods and improving the balance of payments

A higher exchange rate makes imports cheaper, which can reduce inflation but may hurt export competitiveness

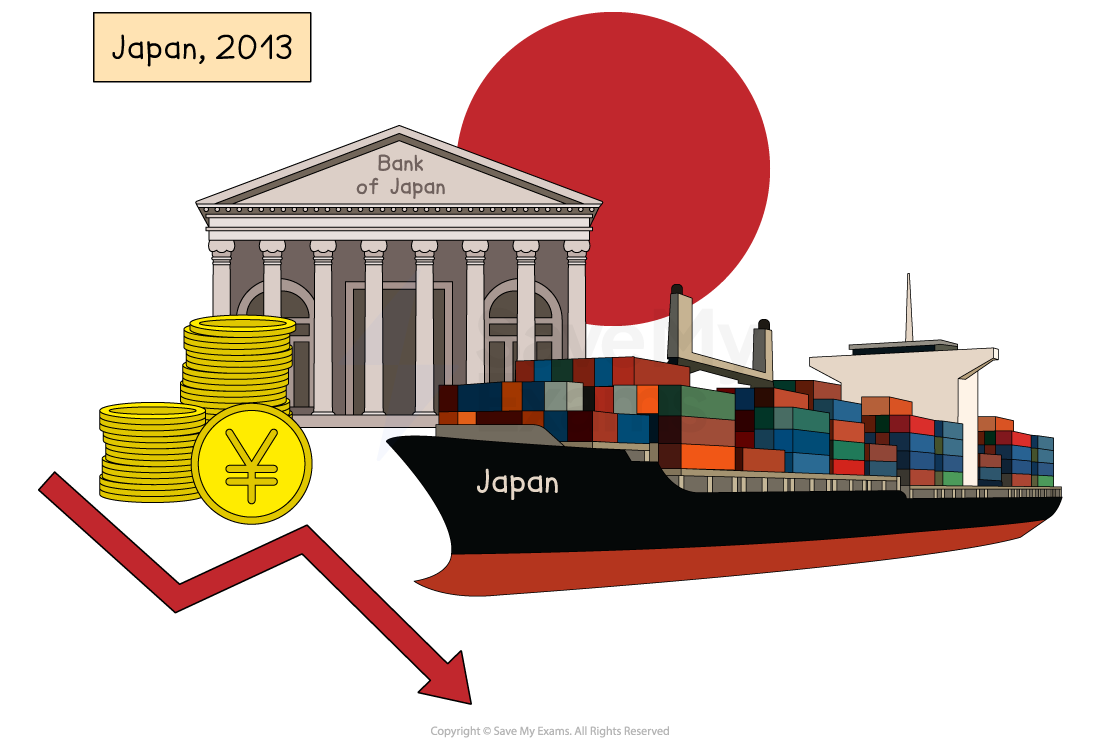

Case Study

Japan, 2013

The Bank of Japan used monetary policy to weaken the value of the yen as part of “Abenomics”.

The lower yen made Japanese exports more competitive in global markets, helping to boost growth and reduce deflationary pressures

The effects of monetary policy on government macroeconomic aims

When a policy decision is made, it creates a ripple effect through the economy, impacting the macroeconomic objectives of the government

To understand the effects of monetary policy on an economy, it is useful to know how total demand (gross domestic product) is calculated

Total (aggregate) demand = household consumption (C) + firms' investment (I) + government spending (G) + exports (X) - imports (M)

From this, it is logical that changes to monetary policy can influence any of these components – and often several of them at once

Economic growth

Lower interest rates and increased money supply boost spending and investment

Low inflation

Higher interest rates and reduced money supply can slow price rises

Low unemployment

Expansionary monetary policy creates demand, leading to job creation

Healthy balance of payments

Adjusting exchange rates can improve trade competitiveness

Sustainability

Low-interest loans for green projects or incentives for clean technology investment can support environmental goals

Examiner Tips and Tricks

In case study questions, state the policy measure, describe the action taken, and link it clearly to the macroeconomic aim it supports

Examples of monetary policy

Examples of contractionary monetary policy

Example 1 | The Central Bank increases interest rates |

|---|---|

Effect on the economy |

|

Impact on macroeconomic aims |

|

Examples of expansionary monetary policy

Example 1 | The USA Federal Reserve Bank commits to $60bn a month of quantitative easing |

|---|---|

Effect on the economy |

|

Impact on macroeconomic aims |

|

Unlock more, it's free!

Was this revision note helpful?