Syllabus Edition

First teaching 2025

First exams 2027

Taxation (Cambridge (CIE) IGCSE Economics): Revision Note

Exam code: 0455 & 0987

The classification of taxes

The main source of government revenue is taxation

Direct taxes are taxes imposed on income and profits

They are paid directly to the government by the individual or firm

E.g., income tax, corporation tax, capital gains tax, national insurance contributions and inheritance tax

Indirect taxes are imposed on spending

The less a consumer spends, the less indirect tax they pay

Examples of indirect tax include Value Added Tax (19% VAT rate in the European Union in 2022), taxes on demerit goods and excise duties on fuel

Progressive, regressive and proportional tax systems

Tax systems can be classified as progressive, regressive or proportional

Most countries have a mix of progressive (direct taxation) and regressive (indirect taxation) taxes in place

Progressive tax system

As income rises, a larger percentage of income is paid in tax

In the diagram, when personal income rises from Y1 to Y2, the tax rate rises from T1 to T2

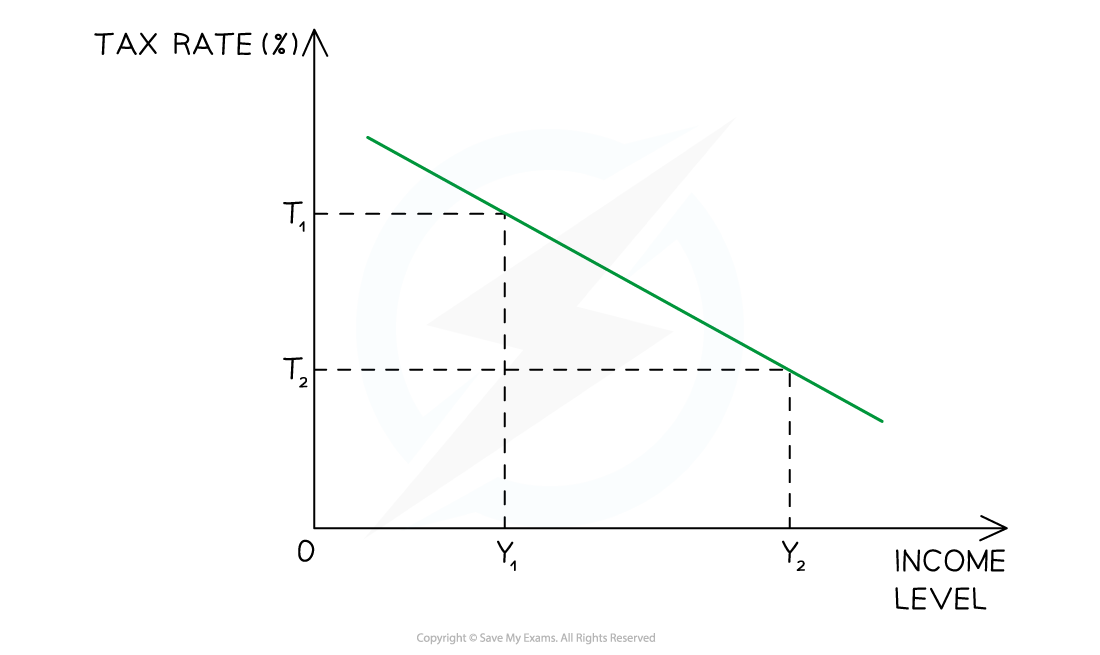

Regressive tax system

As income rises, a smaller percentage of income is paid in tax

In the diagram, when personal income rises from Y1 to Y2, the tax rate falls from T1 to T2

All indirect taxes are regressive

In the USA, Federal income tax is progressive but almost all State taxes are regressive (the bottom 20% of income earners pay as much as 6x the % of their income than the top 20%)

Proportional tax system

As income rises, the same percentage of income is paid in tax

In the diagram, when personal income rises from Y1 to Y2, the tax rate remains constant at 20%

In 2022, Bolivia was using this system with a proportional tax rate of 13%

Examiner Tips and Tricks

MCQ frequently test your knowledge of the different tax systems by presenting you with a table and asking you to identify the type of tax system illustrated

Identify the type of tax system illustrated below:

Weekly Income ($) | 100 | 150 | 200 | 250 |

Weekly Tax ($) | 20 | 30 | 40 | 50 |

It is a proportional tax system with a constant tax rate of 20%

The impact of taxation

Impact on consumers

Higher prices

Indirect taxes increase the price of goods and services, reducing consumers’ purchasing power

Reduced consumption

Higher prices may cause people to buy less, especially for non-essential goods

Behaviour changes

High taxes on harmful goods (e.g. cigarettes) can discourage consumption

Lower disposable income

Direct taxes (e.g. income tax) reduce the amount of income consumers can spend or save

Impact on workers

Lower take-home pay

Income tax reduces the amount workers keep from their wages

Reduced incentive to work

Higher taxes may discourage overtime or seeking higher-paid jobs

Impact on employment

If firms cut costs to pay higher taxes, jobs may be lost or wage growth may slow

Impact on producers/firms

Higher costs of production

Indirect taxes (e.g. VAT) make production more expensive

Reduced sales

Higher prices can lower demand, especially for price-sensitive goods

Lower profits

Increased costs and reduced sales can reduce profitability

Business decisions

Firms may relocate to countries with lower taxes or invest less in expansion

Impact on the government

Revenue generation

Taxation is the main source of government income for funding public services (e.g. healthcare, education)

Economic control

Taxes can discourage harmful consumption (e.g. sugar tax) or reduce imports (e.g. tariffs)

Redistribution of income

Progressive taxes (higher rates for higher earners) can reduce income inequality

Impact on the economy

Reduced spending and investment

High taxes can slow economic growth if they reduce consumption and business activity

Inflationary pressures

Indirect taxes can raise prices, contributing to inflation

Improved public services

Tax revenue allows the government to invest in infrastructure, education and healthcare, which can boost productivity in the long term

Balancing effects

The overall impact depends on tax rates, how revenue is used and the state of the economy

Unlock more, it's free!

Was this revision note helpful?