Syllabus Edition

First teaching 2025

First exams 2027

The Government Budget (Cambridge (CIE) IGCSE Economics): Revision Note

Exam code: 0455 & 0987

Key government budget terms

Government budget

A statement of the government’s planned revenue (mainly from taxation) and expenditure (spending) over a specific period, usually one year

Shows the government’s fiscal policy intentions

Government budget deficit

Occurs when government expenditure exceeds government revenue in a given period

Indicates that the government must borrow to finance the shortfall

For example, UK public sector net borrowing in 2023/24 was around £120 billion

Government budget surplus

Occurs when government revenue exceeds government expenditure in a given period.

May be used to repay debt or saved for future spending

For example, Norway often runs budget surpluses due to high oil revenues

Fiscal policy

The use of government spending and taxation to influence the economy

It can be:

Expansionary – increasing spending or reducing taxes to stimulate growth

Contractionary – reducing spending or increasing taxes to slow inflation

Calculating the surplus or deficit

The budget balance is calculated using the following formula:

If budget balance > 0 → surplus

If budget balance < 0 → deficit

Worked Example

Government revenue = $800 billion

Government expenditure = $900 billion

Calculate the budget balance and determine if it in surplus or deficit

Step 1: Substitute the values into the formula

Step 2: Calculate the answer and state if it is a surplus or deficit

Reasons for government spending

Public expenditure (government spending) represents a significant portion of the total (aggregate) demand in many economies

Spending happens for the following reasons:

1. Provision of public goods

Goods that the market would not supply effectively due to the free rider problem

E.g. national defence, street lighting, flood barriers

2. Provision of merit goods

Goods/services that would be under-consumed without government intervention

E.g. education, healthcare, vaccination programmes

3. Welfare and social protection

Direct financial support to vulnerable groups to improve living standards

E.g. unemployment benefits, pensions, disability support

4. Infrastructure investment

Building and maintaining transport, energy, water and digital networks

Supports business activity and long-term productivity growth

5. Debt interest payments

Servicing existing government borrowing

Prevents default and maintains credibility in financial markets

6. Environmental protection projects

Funding for conservation, pollution control, and climate change adaptation

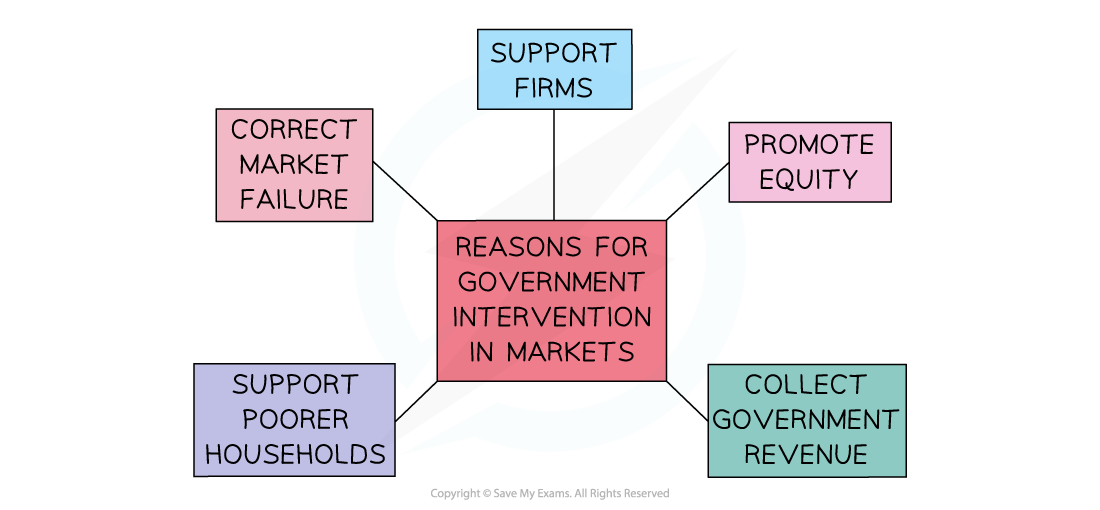

Reasons for taxation

Nearly every economy in the world is a mixed economy and has varying degrees of government intervention

One of the main forms of government intervention is taxation and there are many reasons why it is necessary

Correct market failure

In many markets there is a less than optimal allocation of resources from society's point of view

The government aims to subsidise merit goods and tax demerit goods to address this market failure

Earn government revenue

Governments need money to provide essential services and public and merit goods

Revenue to fund this is raised through taxation

Promote equity

The wealthy are taxed to provide funds that can be utilised in reducing the opportunity gap between the rich and poor

Support firms

In a global economy, governments choose to support key industries so as to help them remain competitive and taxation provides the funds to do this

Support poorer households

Poverty has multiple impacts on both the individual and the economy

Intervention seeks to redistribute income (tax the rich and give to the poor) so as to reduce the impact of poverty

Unlock more, it's free!

Was this revision note helpful?