Syllabus Edition

First teaching 2025

First exams 2027

Mergers (Cambridge (CIE) IGCSE Economics): Revision Note

Exam code: 0455 & 0987

How do businesses grow?

Many firms start small and will grow into large companies or even multi-national corporations

E.g. Amazon and Dell both started in entrepreneurs' garages

Business growth can be separated into two broad categories, internal and external business growth

Internal growth

Internal growth (organic growth) is driven by expansion using resources from inside the business, such as reinvested profits

It is usually achieved by:

Gaining a greater market share

Product or market diversification

Opening new outlets

International expansion (new markets)

Investing in new technology or production machinery

External growth

External business growth (inorganic growth) is when a business expands by joining with or buying other businesses rather than growing on its own

External growth takes place in the form of a merger or a takeover

A merger occurs when two or more companies combine to form a new company

The original companies cease to exist and their assets and liabilities are transferred to the newly created entity

A takeover occurs when one company purchases another company, often against its will

The acquiring company buys a controlling stake in the target company's shares (>50%) and gains control of its operations

Types of mergers and takeovers

Firms will often grow organically to the point where they are in a financial position to integrate with others

Integration speeds up growth but also creates new challenges

Integration can happen in one of three ways

1. Vertical integration

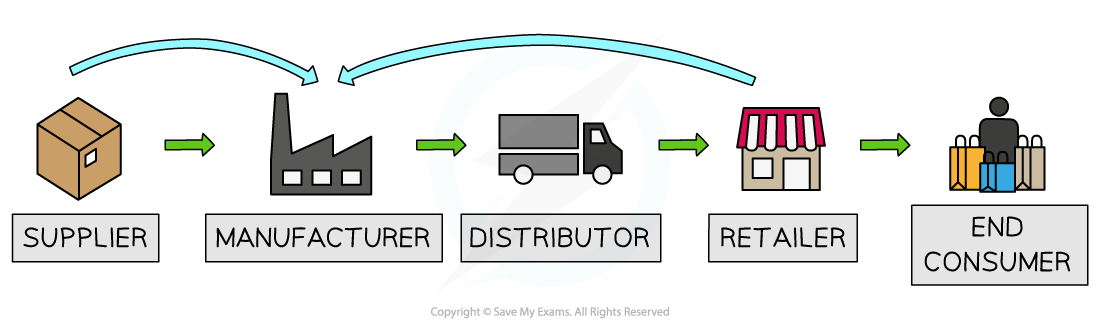

Vertical integration refers to the merger or takeover of another firm in the supply chain or different stage of the production process

Forward vertical integration involves a merger with or takeover of a firm further forward in the supply chain

E.g. A dairy farmer merges with an ice cream manufacturer

Backward vertical integration involves a merger with or takeover of a firm further backwards in the supply chain

E.g. An ice cream retailer takes over an ice cream manufacturer

Evaluating vertical integration

Advantages | Disadvantages |

|---|---|

|

|

Case Study

Nestlé (Backward Integration)

Nestlé, one of the world’s largest food manufacturers, has vertically integrated by acquiring coffee farms and cocoa plantations. This gives it greater control over the supply of raw materials like coffee beans and cocoa

By owning parts of the supply chain, Nestlé ensures consistent quality, reduces dependence on suppliers, and lowers production costs by cutting out middlemen

2. Horizontal integration

Horizontal integration is the merger or takeover of a firm at the same stage of the production process

E.g. An ice cream manufacturer merges with another ice cream manufacturer

Evaluating horizontal integration

Advantages | Disadvantages |

|---|---|

|

|

Case Study

Facebook acquires Instagram (2012)

In 2012, Facebook (now Meta) acquired Instagram for $1 billion. Both companies operated in the social media industry, offering similar services such as photo sharing and user-generated content.

This horizontal integration allowed Facebook to quickly grow its user base, eliminate a major competitor, and benefit from shared expertise, marketing, and advertising platforms, all while achieving economies of scale.

3. Conglomerate integration

Conglomerate integration occurs when a firm merges with or takes over another company in an unrelated industry—one that operates in a completely different market

It is a type of diversification strategy that helps firms spread risk by expanding into different sectors, so that poor performance in one market may be offset by success in another

Evaluating conglomerate integration

Advantages | Disadvantages |

|---|---|

|

|

Case Study

Virgin Group

Virgin Group is one of the best-known conglomerates, having expanded from the music industry into airlines (Virgin Atlantic), financial services (Virgin Money), gyms (Virgin Active), and space travel (Virgin Galactic).

This strategy of conglomerate integration allows the Virgin brand to spread risk across completely unrelated sectors. A downturn in one area (e.g., air travel) can be balanced by performance in another (e.g., financial services).

Unlock more, it's free!

Was this revision note helpful?