Cash Flow Problems: Causes & Solutions (SQA National 5 Business Management): Revision Note

Exam code: X810 75

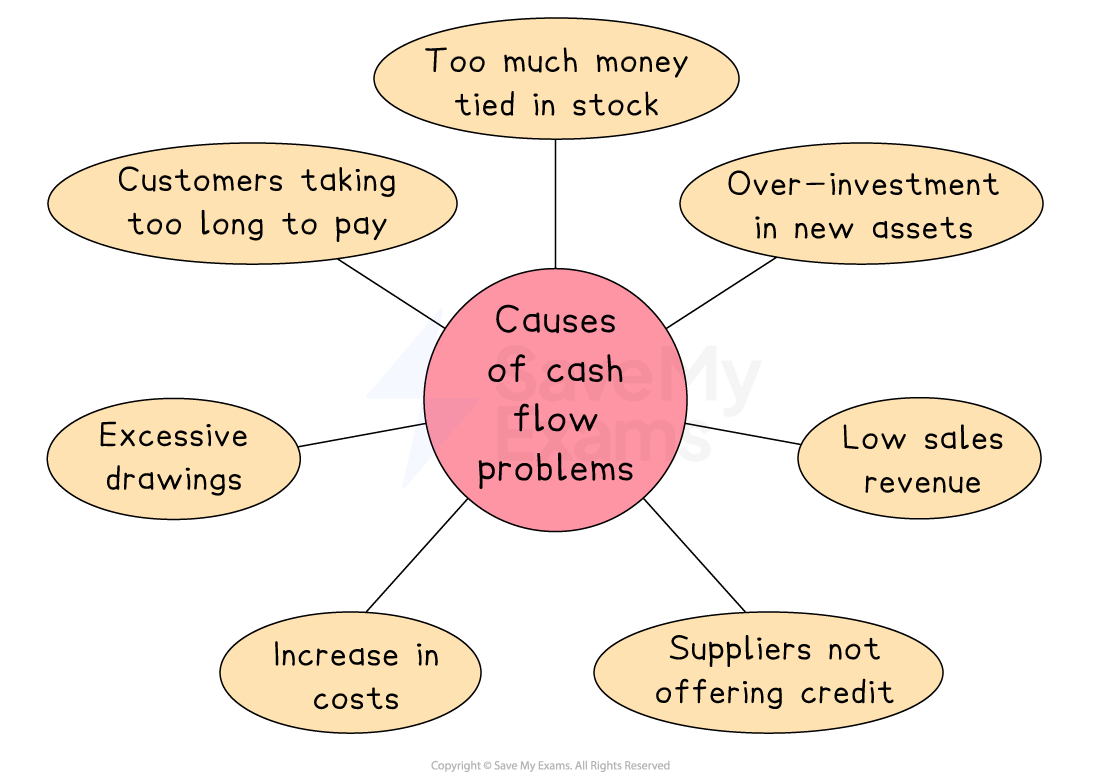

Causes of cash flow problems

Cash flow problems happen when a business does not have enough cash available to pay its bills or meet day-to-day expenses

Even profitable businesses can face cash flow difficulties if money coming in and going out is poorly managed

The main causes of cash flow problems

1. Customers taking too long to pay

If customers are given long credit terms or delay payment, the business may run short of cash

Late payments reduce cash inflow and can make it difficult to pay suppliers or wages on time

2. Too much money tied up in stock

Holding large amounts of unsold stock means that cash is locked up in products sitting on shelves rather than available for other uses

Poor stock control can lead to storage costs and spoilage, further increasing cash pressures

3. Over-investment in new assets

Buying expensive machinery, vehicles or equipment all at once can drain available funds

Although these assets may improve efficiency in the long term, they create short-term cash shortages

4. Low sales revenue

If sales fall due to reduced customer demand, increased competition or poor marketing, less money flows into the business

With fewer sales, the business may struggle to cover regular outgoings like rent, wages and supplies

5. Suppliers not offering credit

If suppliers require immediate payment or offer only a short credit period, cash can leave the business quickly

This creates a mismatch between when the business pays its suppliers and when it receives payment from customers

6. Increase in costs

Unexpected rises in costs, such as energy bills, rent or raw materials, can quickly reduce available cash

If prices charged to customers are not increased at the same time, cash can become tight

7. Excessive drawings

In small businesses, if the owner withdraws too much money for personal use (known as drawings), it can leave the business without enough funds to operate effectively

This can cause delayed payments or reliance on short-term borrowing, such as overdrafts

Solutions for cash flow problems

There are several ways in which a short-term cash-flow problem can be resolved

Solving short-term cash-flow problems

A business often uses more than one method to ensure cash-flow remains positive, e.g. combining an overdraft and reducing the time period available for their customers to pay them

Methods used to overcome short-term cash-flow problems

Method | Explanation |

|---|---|

Seek to increase the trade credit period |

|

Shorten debtor repayment periods |

|

Apply for a bank loan |

|

Delay plans to purchase new equipment |

|

Only sell in cash, not credit |

|

Overdraft facility |

|

Examiner Tips and Tricks

A common mistake is listing causes without offering fixes. Try to link each problem to a solution - for example, late customer payments → tighten credit terms; high expenses → cut unnecessary costs

Clear cause-and-solution pairs show strong understanding

Unlock more, it's free!

Was this revision note helpful?