Sources of Finance for Small Businesses (SQA National 5 Business Management): Revision Note

Exam code: X810 75

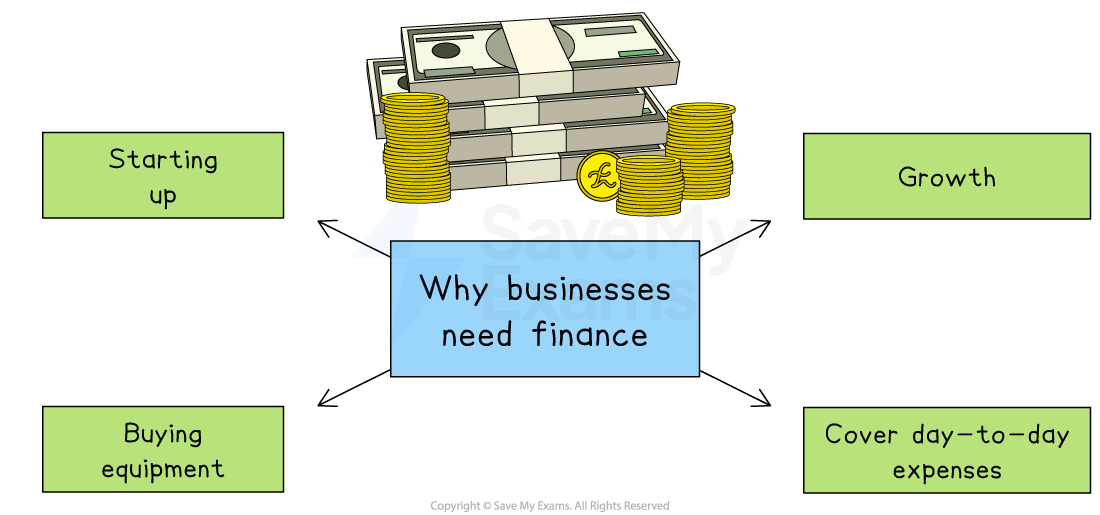

Introduction to sources of finance

All businesses need finance to get started, allow them to grow, fund capital investments and their continuing activity

Start-up capital

Is the finance needed by a new business to pay for fixed assets and current assets before it can begin trading

A business usually estimates the amount of start-up capital they need in the business plan

Many small new businesses will get a start-up loan to cover these initial costs

Funds for growth

As a business grows more finance may be needed for capital expenditure

It may require more equipment, buildings, IT equipment or vehicles, which will allow the business to increase output

If a business wants to grow by developing a new product, it will need to spend large amounts of capital on research and development (R&D)

Owner's capital

Personal savings are a key source of funds when a business starts up

Owners may introduce their savings or another lump sum, e.g. money received following a redundancy

Owners may invest more as the business grows or if there is a specific need, e.g. a short-term cash flow problem

Taking on a new partner means new owner's capital is introduced into a small business

Evaluating the use of owner's capital

Advantages | Disadvantages |

|---|---|

|

|

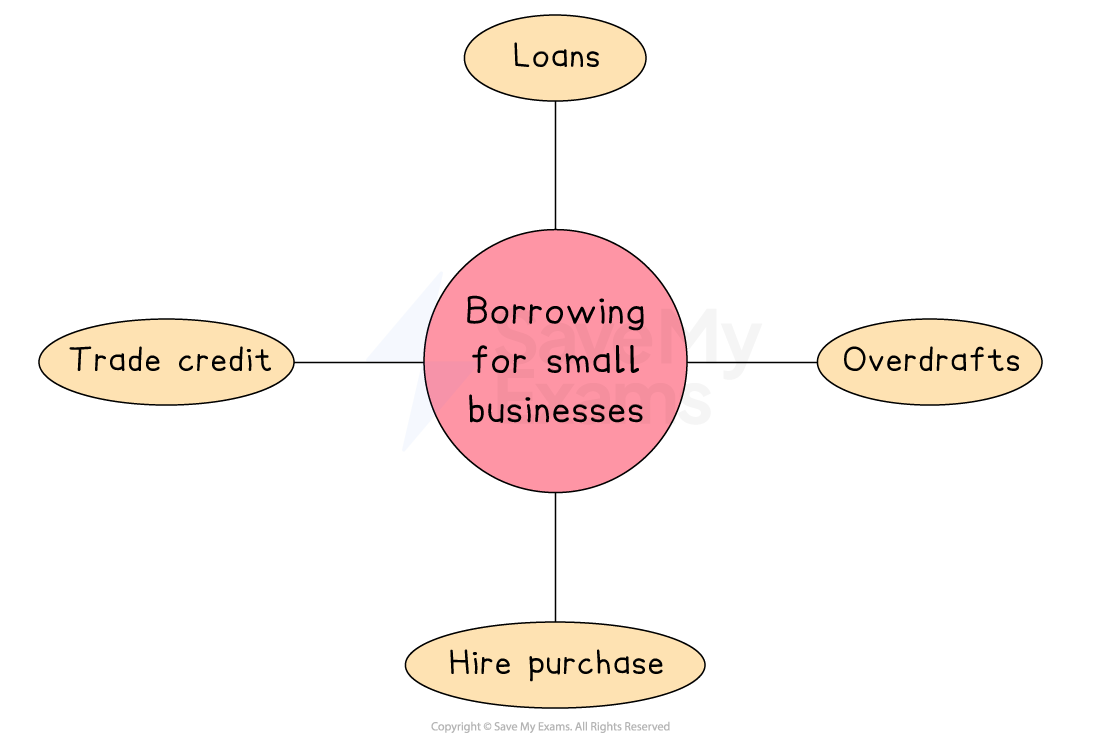

Where do small businesses secure finance from?

Many small businesses rely on short-term borrowing methods that operate internally within their banking arrangements, such as overdrafts or loans secured against business assets

1. Bank overdraft

An overdraft allows a business to withdraw more money than is in its account, up to an agreed limit

Advantages | Disadvantages |

|---|---|

|

|

2. Bank loan

A bank loan provides a fixed amount of money that is repaid with interest over a set period

Advantages | Disadvantages |

|---|---|

|

|

3. Trade credit

Trade credit is when suppliers allow a business to buy goods now and pay later, usually within 30–60 days

Advantages | Disadvantages |

|---|---|

Helps improve short-term cash flow. | Missed payments may damage supplier relationships. |

No interest if paid within the agreed period. | May lose early payment discounts. |

Allows businesses to sell goods before payment is due. | Usually only available to trusted or established firms. |

4. Hire purchase

Hire purchase allows a business to buy an asset and pay for it over time, while using it immediately

Advantages | Disadvantages |

|---|---|

|

|

Examiner Tips and Tricks

Students often overlook why small businesses struggle to raise funds. Banks may see them as risky; they lack collateral, and investors prefer larger firms. Examiners reward answers that explain these barriers rather than simply listing unavailable finance options

Unlock more, it's free!

Was this revision note helpful?