Government Spending (Edexcel GCSE Citizenship Studies): Revision Note

Exam code: 1CS0

The role of the Chancellor of the Exchequer

The Chancellor of the Exchequer is the government minister responsible for managing the UK’s economy and public finances

The Chancellor's role

The Chancellor leads the Treasury

The Treasury advises the government on economic policy, growth and financial stability

The Chancellor plays a key role in managing economic risks

This includes responding to inflation, recession and changes in global economic conditions

The Chancellor oversees taxation and public spending

This includes deciding how much money is raised through taxes and how it is allocated to public services

The Chancellor presents the Budget to Parliament

In the 2025 Budget, the government announced that its spending priorities for 2026–27 would focus on the NHS, education, defence, welfare support and improvements to infrastructure

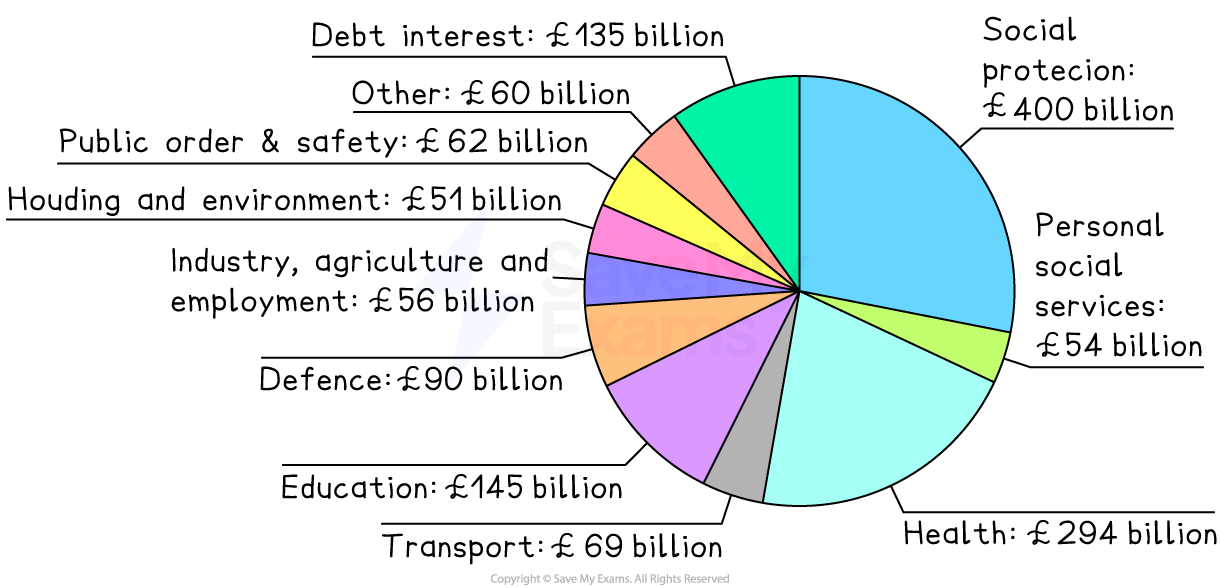

Expected expenditure 2026-2027

The largest areas of spending are

Social protection

Social protection spending pays for welfare benefits and support, such as pensions, disability benefits and unemployment support

Health

Health spending mainly funds the National Health Service (NHS), including hospitals, doctors, nurses and public health services

Education

Education spending covers schools, colleges and universities, as well as funding for teachers, buildings and support services for children and young people

Debt interest

Debt interest is the money the government must pay on loans it has borrowed in the past, reducing the amount available to spend on public services

Welfare spending

Welfare spending has increased significantly since the COVID-19 pandemic

More people rely on benefits due to job insecurity, low wages and rising living costs

A large number of people claiming Universal Credit are in work

Having a job does not always guarantee a sufficient income.

The government wants to reduce welfare spending, but this is difficult

Spending cuts often affect the poorest in society, which is politically and morally controversial

Raising the National Minimum Wage could reduce reliance on benefits

However, some employers may be unable to afford higher wages and could reduce staff

Governments generally agree the best long-term solution is more people in secure, well-paid work

The challenge is creating jobs that generate income tax and National Insurance without increasing unemployment

Health spending

The NHS is one of the most popular public institutions in the UK

Any major reform risks public opposition due to strong support for the NHS

Health spending continues to rise, but productivity has not increased at the same rate

New treatments and medicines are often very expensive

Changes in primary care have led more patients to seek help via A&E, increasing pressure

The UK has an ageing population

People live longer but often need more medical treatment later in life

Governments face difficult reform choices, including:

Whether to introduce charges for GP visits or missed appointments

Whether to encourage private medical insurance

Whether to devolve health responsibilities to directly elected mayors

Spending on care of the elderly

An ageing population means higher spending on pensions and social care

The state pension is paid to almost all elderly people

The pension age has increased over time to reduce costs

The triple lock guarantee ensures pensions rise by the highest of inflation, wages or 2.5%, whichever is the highest

This has helped reduce pensioner poverty

Politicians are reluctant to change it because older people vote in high numbers

Social care costs are mainly paid by individuals until their savings fall below a low threshold

Many elderly people worry about having to sell their homes to pay care costs

Governments face pressure to reform social care but struggle to find a fair and affordable system

Spending on education

School funding is decided using a national funding formula

Many schools, especially in rural areas, argue they receive less funding per pupil

Spending on SEND (Special Educational Needs and Disabilities) has increased sharply

This has forced the government to lend money to some councils to cover costs

University tuition fees have risen in recent years

Despite this, many universities report financial difficulties

The government has recently placed VAT on private school fees

This was intended to raise money to improve education for the 90% of students who receive a state education

Ongoing debates include:

Whether schools need more central control or greater freedom

Whether university fees should be reviewed regularly or spending monitored more closely

Why SEND spending is rising and how the system can be made sustainable

Unlock more, it's free!

Was this revision note helpful?