Economic Problems of the Weimar Republic, 1919-1933 (SQA National 5 History): Revision Note

Exam code: X837 75

Summary

Germany’s economy after World War I was very weak. The government owed huge debts and reparations, and in 1923, prices ran out of control, wiping out people’s savings.

Germany’s recovery relied on US loans; after the 1929 Wall Street Crash, the loans stopped, factories closed, and many people lost their jobs. These shocks made everyday life hard and turned many people against the Weimar government.

Economic problems, 1919-1933

War debts and reparations drained money from the German economy

In 1921, the Allies set reparations at 132 billion gold marks (about £6.6 billion)

Germany had to pay in cash and goods (e.g. coal, timber)

This meant that money and materials left the country

Little money was left to fund Germany's recovery from the war

When payments were missed, the Allies could impose sanctions

This made the economic situation even worse

Weak government finances encouraged money-printing

After the war, tax income was too small to cover spending on demobilisation, welfare and interest on debts

The government had large deficits and printed money to pay bills

This damaged confidence in the Mark and pushed prices up

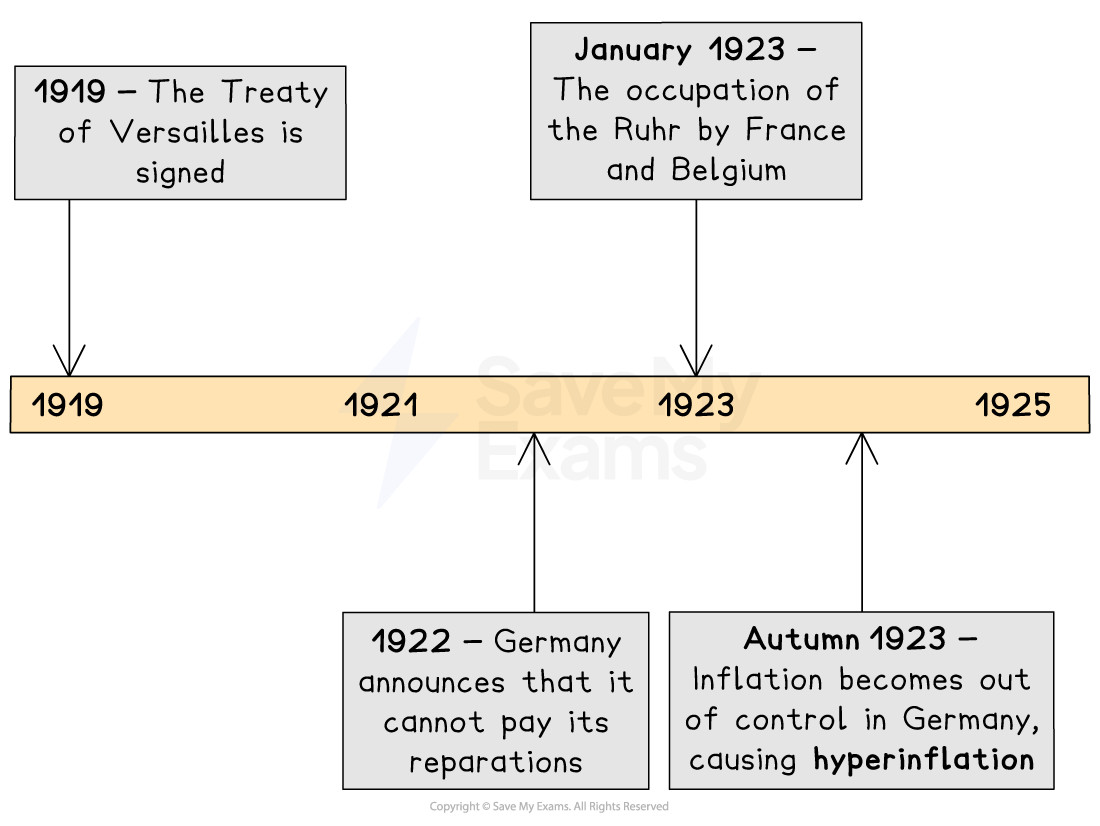

The Ruhr Crisis

When Germany fell behind on reparations, French and Belgian troops occupied the Ruhr (January 1923), the main coal/steel region

The Ruhr is in western Germany, around the Ruhr and Rhine rivers.

Losing Ruhr coal and steel production hurt the German economy, making the Weimar Republic’s problems worse

The Weimar Republic told workers to strike (“passive resistance”)

The French responded by bringing their own workers into the Ruhr

The Weimar government could not force the soldiers out of the Ruhr because:

The Treaty of Versailles restricted Germany’s army to 100,000 men, whereas the French had 750,000 soldiers

The Ruhr Crisis and hyperinflation

Hyperinflation is when prices rise rapidly and become out of control

In hyperinflation, wages do not match the cost of living (prices of goods)

Hyperinflation can become so bad that currency loses its monetary value

Governments can print more money to try counteract the effects of hyperinflation

Prices in Germany had already risen due to the shortage of goods

The government made this situation worse because:

They continued to pay the wages of the striking Ruhr workers

They had to purchase coal from other countries to meet Germany’s demand for coal

The Weimar government decided to print more money (currency)

In 1923, there were 300 paper mills and 2,000 printers whose sole purpose was to print currency

The decision to print an excessive amount of money caused the hyperinflation crisis

By November 1923, the German currency (mark) had become worthless

Some workers received pay twice a day so they could purchase essential goods before their wages became worthless

People filled wheelbarrows full of money to buy a loaf of bread

Examiner Tips and Tricks

Inflation can be a tricky concept to understand, especially how it can cause money to lose all its value.

Imagine that you have a rare diamond necklace. It would cost a lot of money to purchase the necklace because it is so rare.

Now imagine that someone made 100 more diamond necklaces. The necklace is now not as rare, meaning it would not be worth as much as it was previously.

Applying this concept to money, the more currency there is in circulation, the less it is worth. As a result, printing money can limit the impact of inflation but overprinting money can be dangerous to an economy.

The Dawes and Young plans

By the mid-1920s, the recovery of the German economy was fragile and dependent on loans from other countries

The Dawes Plan, 1924

The Dawes Plan (1924):

A temporary reduction of reparations to £50 million a year

Reorganised payments

Brought in short-term US loans that funded industry and housing

Germany borrowed heavily (tens of billions of marks, 1924–29), so growth depended on continued American credit

The Young Plan, 1929

Reparations were later eased by the Young Plan (1929)

Reduction of the total reparations bill from £6.6 billion to £2 billion

The Allies extended the time that Germany had to repay their reparation debts until 1988

The economy was still exposed if loans stopped

The Wall Street Crash and the Great Depression

In 1929, the Wall Street Crash led to American banks suddenly demanding their money back

The banks stopped giving out new loans, so the stream of money coming from the USA to other countries (like Germany) quickly stopped

The banks also recalled their loans

The Wall Street Crash led to the Great Depression, which affected countries worldwide

Trade slowed

Governments increased tariffs

Impact on Germany

In Germany, factories closed and industrial output plunged

It was about 40% down by 1932

Unemployment reached about 6 million

Banks collapsed in 1931

The government made cuts to public spending on things like pensions and local services

This hurt people, so many turned against the Weimar government

Worked Example

Describe the economic problems which the Weimar Republic faced between 1919 and 1933.

[4 marks]

Germany had to pay reparations set in 1921 at 132 billion gold marks, which drained government finances and trade. [1]

In 1923, French and Belgian troops occupied the Ruhr after payment delays; Germany’s passive resistance and money-printing helped trigger hyperinflation that wiped out people’s savings. [1]

Although the economy improved later, recovery depended on large, mostly short-term foreign (especially US) loans, leaving Germany exposed if credit was withdrawn. [1]

After the 1929 Wall Street Crash, US credit dried up; industry slumped and unemployment rose to over six million by early 1932. [1]

Examiner Tips and Tricks

For a 4-mark 'Describe' question, make four clear factual points (or two developed points); there’s no need to explain causes in depth. Keep each sentence a separate, specific problem.

Unlock more, it's free!

Was this revision note helpful?