Measurements of Business Size (Cambridge (CIE) A Level Business): Revision Note

Exam code: 9609

Methods used to measure business size

A range of stakeholders have an interest in understanding business size

Some suppliers prefer to deal with larger businesses as they are seen as less risky than small businesses

Governments can determine which businesses may need support to grow

Investors may want to compare businesses to determine which offers the best return

In some sectors, specific variables are used to measure business size

Hotels and guesthouses measure the number of rooms or beds

Restaurants measure the number of 'covers' they can cater for

Retailers measure the number of outlets they operate

Logistics businesses measure the number of vehicles they employ

Ways to measure business size

1. Size of the workforce

A measure of how many workers are in the business

Small and medium-sized businesses (SMEs) employ less than 250 workers

Large businesses have 250 or more workers

The method of production can influence this metric

Large capital-intensive businesses employ few workers

Smaller labour intensive businesses have many employees

Different workers' contracts make this measure unreliable

Some firms hire many part-time workers, while others have fewer full-time workers

Short-term, zero hours or agency worker contracts may not be included

2. Value of capital employed

A measure of all the capital (money, equipment, and buildings) invested in a business at a specific time

It is difficult to compare businesses with labour-intensive and capital-intensive production methods

European manufacturing businesses tend to have high levels of capital, such as robots, compared to firms in countries such as Vietnam and Indonesia

Property values differ across the world and between regions

E.g. The value of property in Singapore is significantly greater than property in mainland China

Value of business sales

The total sales revenue achieved during a trading period

It is calculated using the formula

Price x Quantity sold

Businesses sell very different products

Comparing a market stall selling sweets with a retailer of luxury handbags would be unrealistic, as their prices and volumes sold are very different

Selling prices vary between markets

Businesses may sell products to customers in low-income markets at a lower price than in a higher-income market

3. Value of business output

The financial worth of goods produced, even though they may not all be sold

It is calculated using the formula

Total costs x Quantity

High value output can be produced by businesses with very few employees or with limited capital employed

E.g. A bespoke jewellery maker may produce only a few expensive items each year

The value of output does not measure how successful a business has been at selling goods produced

If goods are left unsold, they are a poor measure of business size

4. Market capitalisation

The value of a company's issued shares

It is calculated using the formula

Share price x Number of shares

Share prices fluctuate so market capitalisation is a relatively unstable method of measuring business size

Sharp increases in share price can make it appear that a relatively small business has grown very quickly

A rapid decrease in the share price may make a business appear smaller whilst employing the same number of employees

5. Market share

The portion of a market controlled by a particular company, brand or product

It is calculated using the formula

(Business Sales ÷ Market Sales) x 100

In some cases, a large business may maintain a presence in a market dominated by smaller rivals to spread risk

E.g. Dunlop continues to manufacture and sell sportwear in a market dominated by brands such as Nike and Adidas

Examiner Tips and Tricks

Profit is not a measure of business size, though it can be used to measure business success.

A business with many employees may make a loss whilst a business with just one employee may make a profit. This does not mean that the business with one employee is the larger of the two.

Evaluating small businesses

In the European Union (EU) small businesses are classified as those employing 50 or fewer workers

In 2022, small businesses were responsible for approximately 49 percent of employment in the EU's economy

Italy, France, Spain and Germany had the highest number of small businesses in the trade bloc, concentrated in the retail sector

Reasons why small firms succeed

Personalised Service | Agile | Operate in Nice Markets |

|---|---|---|

|

|

|

Operating as a small business has a number of advantages:

They are easy to set up and, in many cases, require little start-up capital

They are managed by their owners, who maintain control of the business and determine its strategic direction

Owners are likely to have close working relationships with workers, encouraging loyalty

However, remaining as a small business can have some disadvantages:

Few sources of finance may be available, as owners are keen to retain full control and lenders consider them higher risk than larger firms

The business owner typically takes on all of the responsibility for decision-making, which can put them under significant pressure

There is little opportunity to achieve benefits of economies of scale

Strengths and weaknesses of family businesses

Many businesses are owned by more than one member of the same family

Some family businesses have traded for a very long time

Berenberg Bank was founded in 1590 and is one of the few remaining independently owned banks in Germany

Akerblads is a hotel in Tällberg, Sweden that is currently run by members of the 21st generation of the family after which it is named

The Neame family remains in control of Shepherd Neame, Britain’s oldest brewery, which was founded in 1664

In some countries, family-owned businesses make up a significant proportion of enterprises

Globally, 90% of businesses are family-owned, contributing significantly to GDP and employing many millions of workers

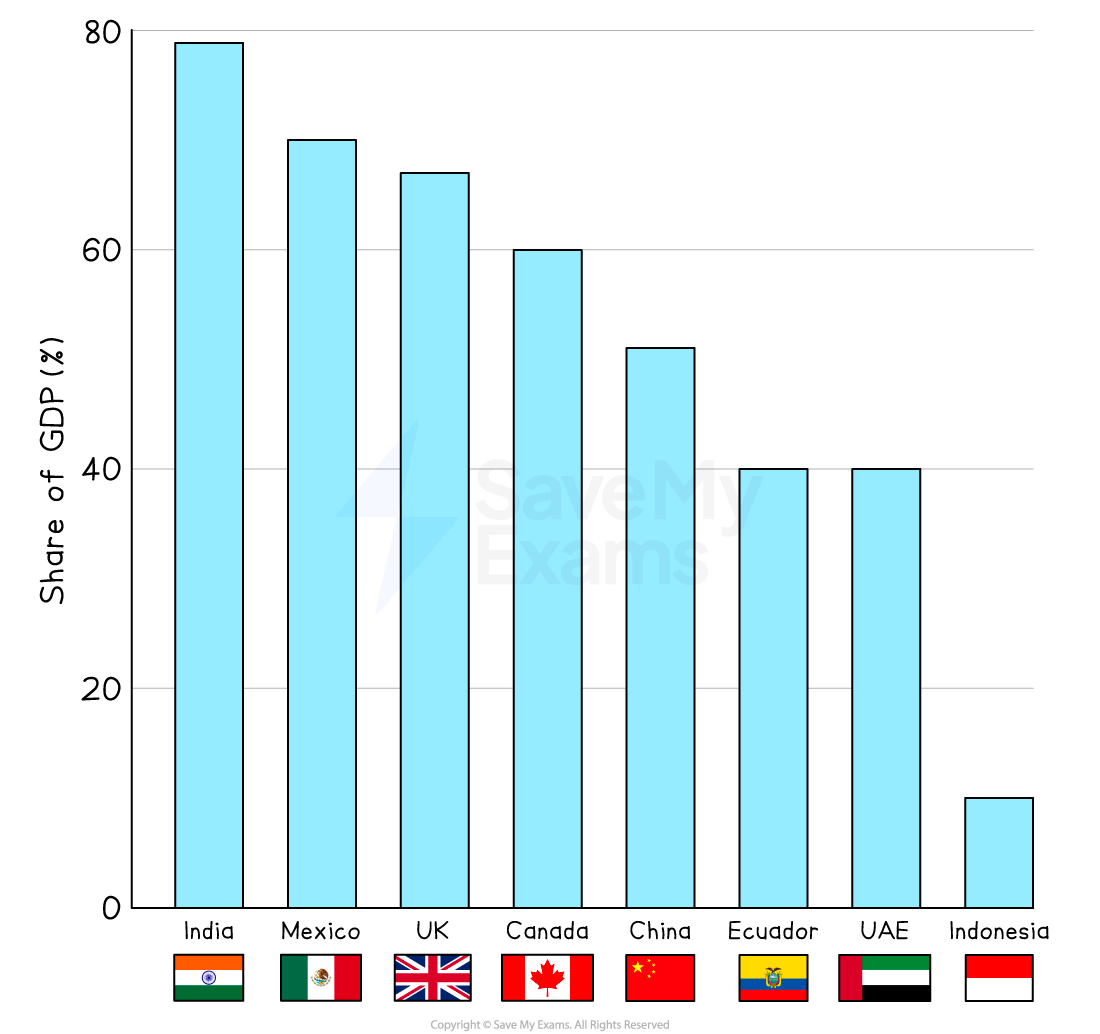

In India more than 79% of GDP is generated by family-owned businesses

Its largest example is Reliance Industries, founded in 1973 and run by the Ambani family

GDP contribution of family businesses

Strengths and weaknesses of family-owned businesses

Strengths | Weaknesses |

|---|---|

|

|

The role of small businesses in the economy

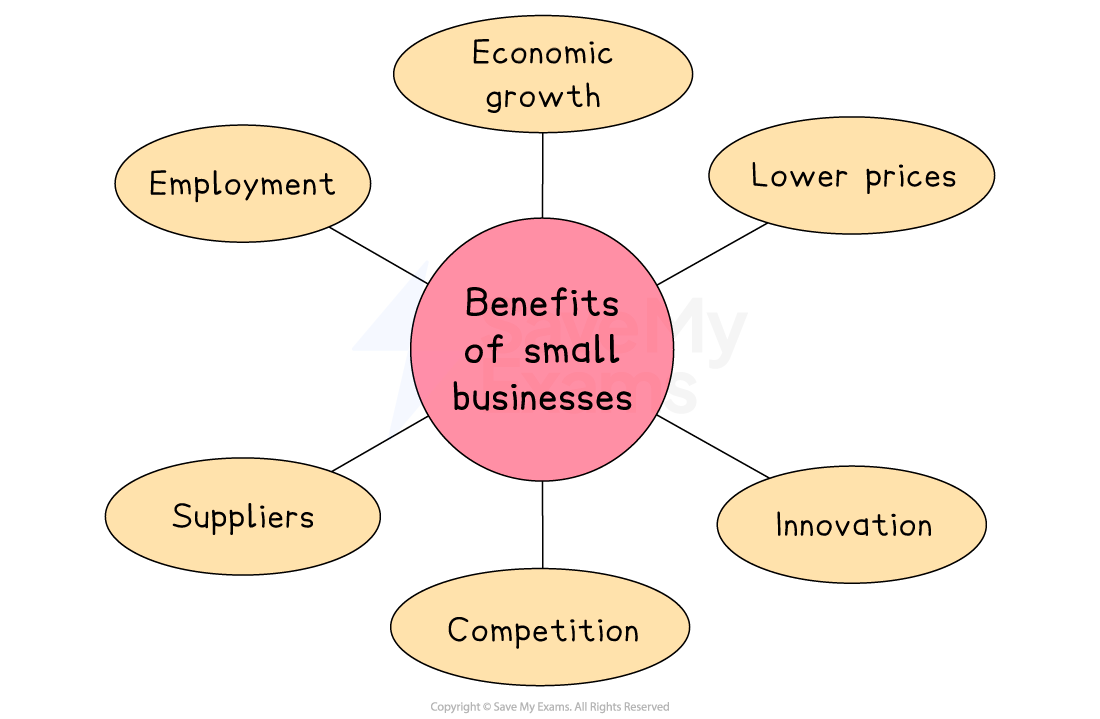

Small businesses bring a range of benefits to an economy

Employment

Small businesses employ a large proportion of the workforce in most economies

They account for 60 to 70 per cent of jobs in most OECD countries, with a particularly large share in Italy and Japan

In developing economies, small businesses create around 80% of new jobs

Economic growth

Growth in countries or regions with few large businesses is fuelled by small and growing businesses

UK government policies, including enterprise zones, encourage small businesses to set up in areas of industrial decline, such as South Wales and the North East

Lower prices

Small businesses often have lower wage and administration costs than large businesses

This may lead to lower prices for customers

Innovation and competition

Small businesses are often set up and run by creative entrepreneurs, whose ideas and problem-solving abilities bring new products and services to the market

This increases choice for customers and creates competition for larger firms

Suppliers

Small businesses can be important suppliers to large firms, offering innovative components, flexibility and adaptability, which can help them develop a strong unique selling point

E.g. Mark Levison supplies tailored audio equipment to luxury car manufacturer Lexus

The role of small businesses in different industrial sectors

Small businesses are particularly important in some industries

In the USA, small businesses make up a large proportion of firms operating in

Accommodation and food services, including hotels, restaurants and catering

Beauty and hairdressing services

EdTech, including online tuition and learning platforms

Retail, including small scale shops and online stores

Construction, including builders and services such as plumbers and electricians

Some industries, such as power generation and shipping, are dominated by larger businesses

Significant barriers to entry such as the level of capital investment or technical expertise, exclude small businesses

However, small businesses often provide tertiary functions for large businesses, such as accounting, property maintenance and market research

Unlock more, it's free!

Was this revision note helpful?