Syllabus Edition

First teaching 2025

First exams 2027

Disposal Account (Cambridge (CIE) IGCSE Accounting): Revision Note

Exam code: 0452 & 0985

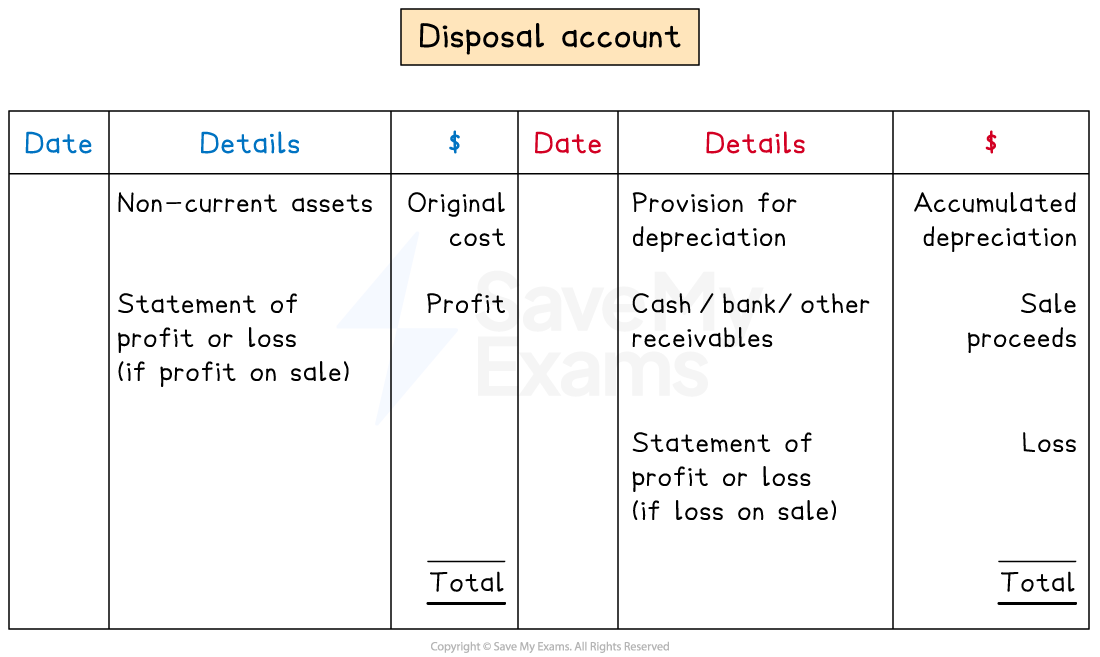

Disposal account

What is a disposal account?

A disposal account is used to show the calculation of the profit or loss on a sale of a non-current asset

The profit or loss is transferred to the statement of profit or loss

The account will then have a zero balance

How do I record the sale of a non-current asset in the ledger accounts?

The book of prime entry is the journal

Deal with each transaction one at a time

STEP 1

Reduce the non-current asset account by the original valueCredit the non-current asset account

Because the value of the assets is decreasing

Debit the disposal account

STEP 2

Reduce the provision of depreciation account by the accumulated depreciation of the non-current assetDebit the provision for depreciation account

Credit the disposal account

STEP 3

Increase the cash, bank or other receivables accountDebit the relevant asset account

Cash, if received

Bank, if money is received by cheque or bank transfer

Other receivables account if it was sold on credit

Credit the disposal account

STEP 4

Include the profit or loss of the saleIf a profit is made, then this is an income for the business

Credit the statement of profit or loss

Debit the disposal account

If a loss is made, then this is an expense to the business

Debit the statement of profit or loss

Credit the disposal account

Examiner Tips and Tricks

The disposals account should balance. If it does not balance, then check for any mistakes. Some students calculate the profit or loss by completing steps 1 to 3 and then finding the amount needed to balance the disposal account. If you use this method, be extra careful that you put the entries on the correct side.

Worked Example

Riz owes an embroidery business and owns machinery. Riz purchased an additional machine on 1 March 2022 for $30 000. Riz depreciates machinery using the straight-line method using the assumption that machinery fully depreciates after five years. Riz charges depreciation at the end of each month. Riz sells this additional machinery on 31 December 2023 and receives a cheque for $17 500. No other non-current assets were sold in the financial year ending 29 February 2024.

Prepare the disposal account for machinery for the year ended 29 February 2024.

Answer:

Calculate the profit or loss on the sale

Calculate the yearly depreciation charge

$30 000 ÷ 5 = $6 000

Calculate the monthly depreciation charge

$6 000 ÷ 12 = $500

Calculate the number of months that Riz owned the machinery

1 March 2022 to 31 December 2023 is 22 months

Calculate the total depreciation of the machinery

22 × $500 = $11 000

Calculate the net book value at 31 December 2023

$30 000 - $11 000 = $19 000

Calculate the loss on the sale

$19 000 - $17 500 = $1 500

The sale proceeds are less than the net book value so it was a loss

Fill in the disposal account

Enter the original cost on the debit side

Enter the total depreciation on the credit side

Enter the sale proceeds on the credit side

Enter the loss on the credit side

Riz

Disposal Account

Date | Details | $ | Date | Details | $ |

2023 Dec 31 |

Machinery |

30 000 | 2023 Dec 31 |

Provision for depreciation |

11 000 |

Dec 31 | Bank | 17 500 | |||

| 2024 Feb 29 |

Statement of profit or loss |

1 500 | ||

30 000 | 30 000 |

Unlock more, it's free!

Was this revision note helpful?