Syllabus Edition

First teaching 2025

First exams 2027

Reducing Balance Method of Depreciation (Cambridge (CIE) IGCSE Accounting): Revision Note

Exam code: 0452 & 0985

Reducing balance depreciation

What is the reducing balance method of depreciation?

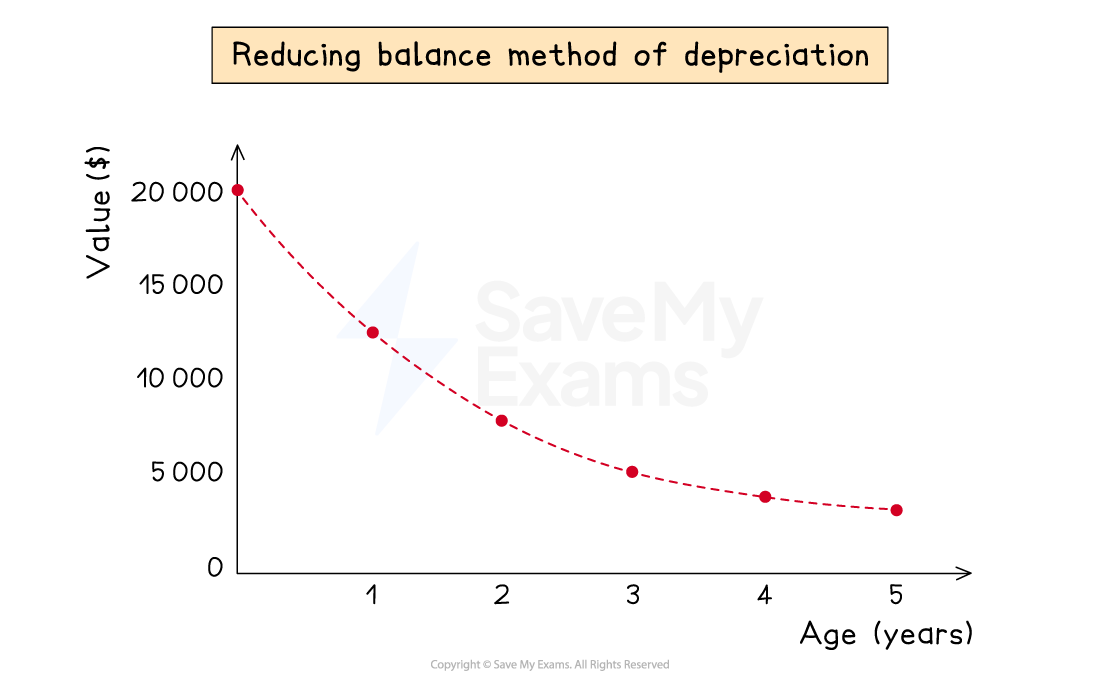

The reducing balance method of depreciation assumes that the non-current asset loses value at a rate proportional to its current value

This means that the expense for its depreciation gets smaller each year as the current value decreases

You will be told the percentage of the current value to use for depreciation

This method is usually used when a non-current asset initially loses value at a fast rate

e.g. vehicles, etc

How do I calculate depreciation using the reducing balance method?

Find the percentage of the current net book value

This will be the depreciation charge for that year

If you need to calculate the depreciation for multiple years, then calculate one year at a time

Find the depreciation charge for one year using the net book value at that start of the year

Subtract this amount from the net book value at the start of the year to find the new net book value

Find the depreciation charge for the next year using the net book value at the start of that year

Continue this process

If you just need to find the current net book value then you can use some maths skills

Subtract the percentage from 100%

Write this as a decimal

Raise this to the power of the number of years

Multiply this by the original value

Examiner Tips and Tricks

The reducing balance method is similar to compound interest calculations used in maths.

Amounts should always be given to the nearest dollar in exams.

Worked Example

Abi purchases a vehicle for $16 000. Machinery is depreciated at 25% per annum using the reducing balance method.

Calculate the net book value of the machinery after 3 years.

Answer:

Method 1: Year-by-year

Find the depreciation charged in each year by finding the percentage of the net book value at that time

Subtract that year’s depreciation from the net book value to find the net book value at the end of the year

End of year | Depreciation charge | Net book value |

0 | - | $16 000 |

1 | 25% × $16 000 = $4 000 | $16 000 - $4 000 = $12 000 |

2 | 25% × $12 000 = $3 000 | $12 000 - $3 000 = $9 000 |

3 | 25% × $9 000 = $2 250 | $9 000 - $2 250 = $6 750 |

Method 2: Compound interest

Subtract the percentage from 100%

100% - 25% = 75%

Write this as a decimal

75% = 0.75

Raise this to the power of the number of years

0.753

Multiply this by the original value

$16 000 × 0.753 = $6 750

Unlock more, it's free!

Was this revision note helpful?