Syllabus Edition

First teaching 2025

First exams 2027

Revaluation Method of Depreciation (Cambridge (CIE) IGCSE Accounting): Revision Note

Exam code: 0452 & 0985

Revaluation depreciation

What is the revaluation method of depreciation?

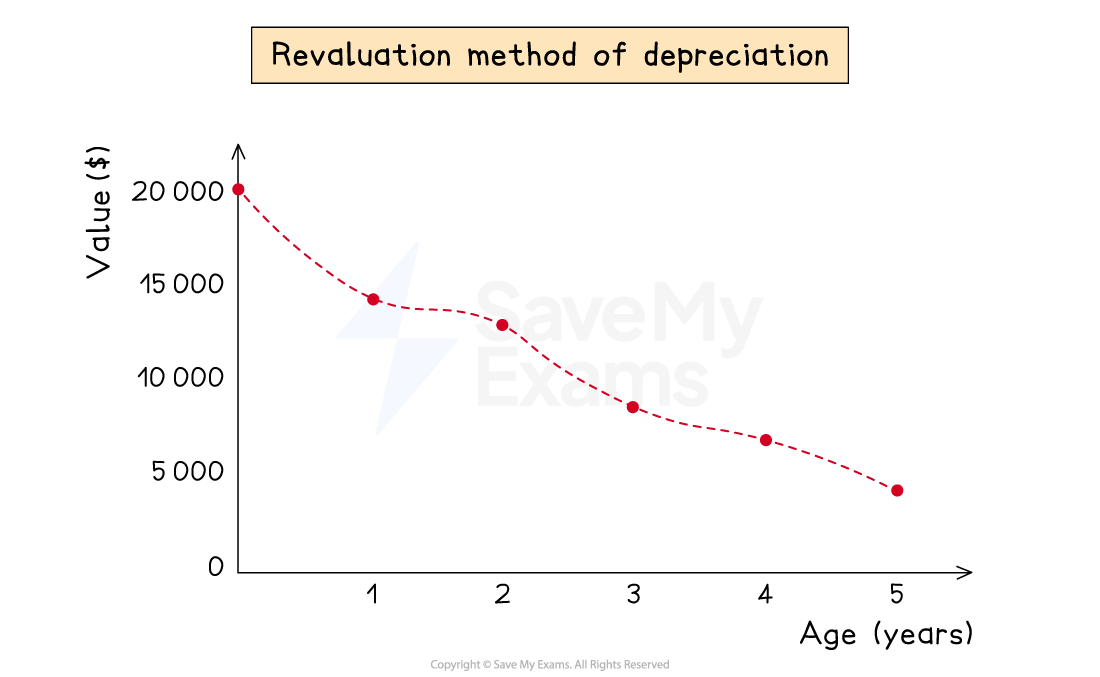

The revaluation method of depreciation involves performing a valuation of assets at the end of the financial year to determine the reduction in value

This method is commonly used for assets of smaller value

Such as loose tools, packing cases

How do I calculate depreciation using the revaluation method?

A revaluation of the non-current asset will be given in the question

You need to identify two numbers:

The net book value before the revaluation

The net book value after the revaluation

The depreciation charge is the value before minus the value after

Worked Example

Abi purchased fixtures and fittings for $5 000 on 1 March 2023. On 29 February 2024, at the end of the financial year, the fixtures and fittings were valued at $3 650.

Calculate the depreciation charged for the financial year ending on 29 February 2024.

Answer:

Value before the revaluation is $5 000

Value after the revaluation is $3 650

Calculate the difference

$5 000 - $3 650 = $1 350

Unlock more, it's free!

Was this revision note helpful?