Syllabus Edition

First teaching 2025

First exams 2027

Accrued & Prepaid Incomes (Cambridge (CIE) IGCSE Accounting): Revision Note

Exam code: 0452 & 0985

Accrued income

What is an accrued income?

An accrued income is an income that is still owed to the business at the end of a financial period

This is also called an accrual

The income is in arrears

Accrued income can occur at the end of a financial period when a business receives less than the amount due in that period

This commonly happens when the invoice period of an income does not align with the financial period of the business

The business might receive payment at the end of the invoice period

However, this might be after the end of the current financial period

An accrued income is an asset to the business

The business is owed money by its customers

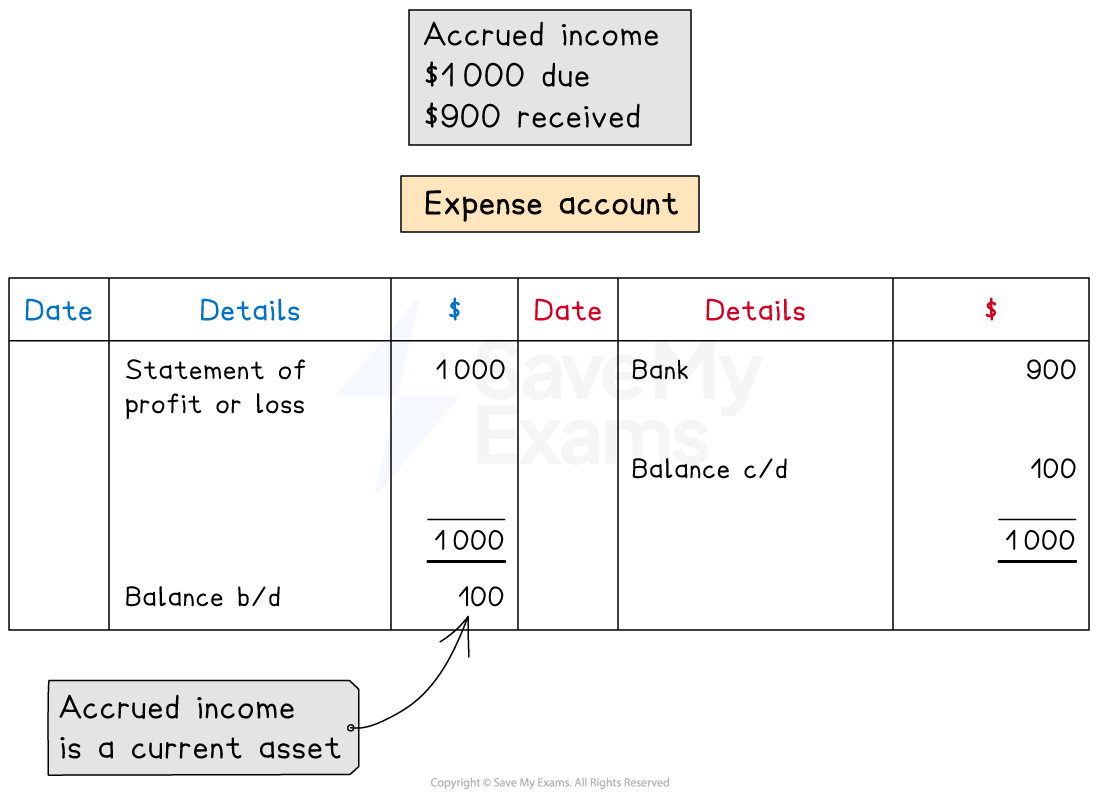

How do I record accrued income?

The income account will have a debit balance if there is an accrual at the end of the financial period

This indicates that it is an asset, as the business is still owed money from customers for that period

The full amount that is due for the period is stated on the statement of profit or loss

The amount that is accrued appears on the statement of financial position as a current asset

It is included in the amount for other receivables

Prepaid income

What is a prepaid income?

A prepaid income is an income for the next financial period that is received in advance during the current end of a financial period

This is also called a prepayment

Prepaid income can occur at the end of a financial period when a business receives more than the amount due in that period

This commonly happens when the invoice period of an income does not align with the financial period of the business

The business might receive payment in full as soon as they issue an invoice

However, this invoice might also cover part of the next financial period

A prepaid income is a liability to the business

The business has received too much from the customer for that period

Technically, the business owes that money to the customer for that period

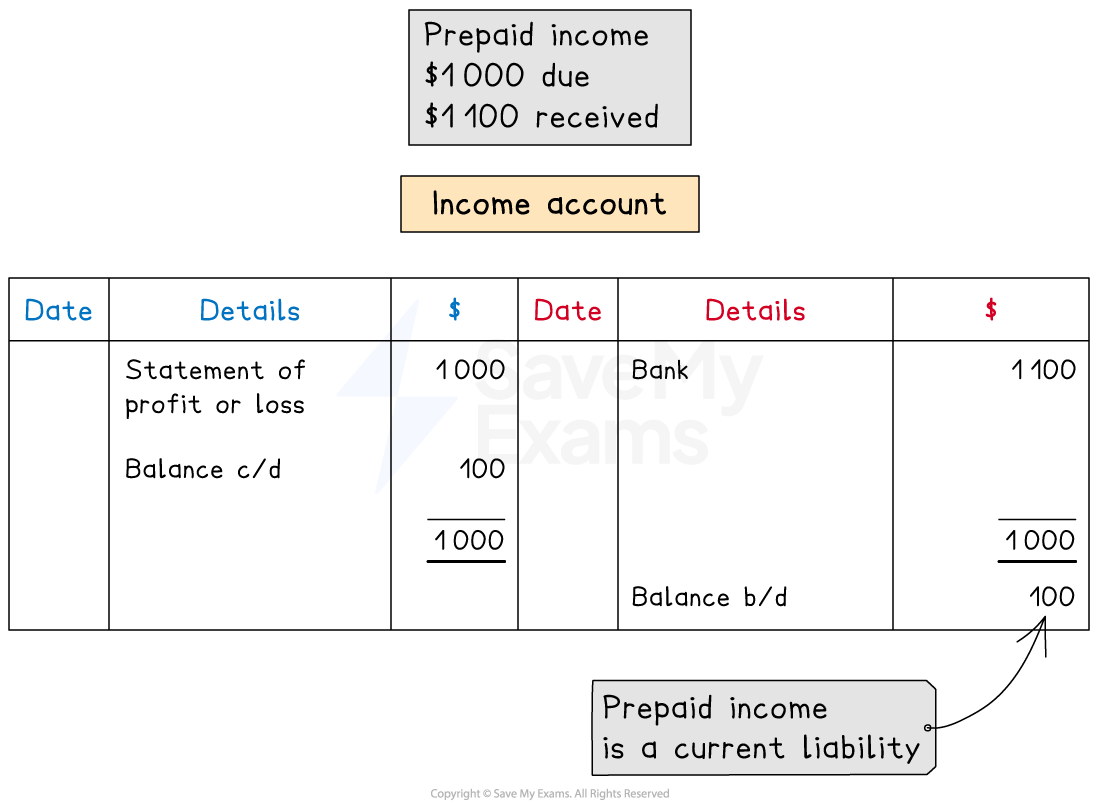

How do I record prepaid income?

The income account will have a credit balance if there is a prepayment at the end of the financial period

This indicates that it is a liability

The full amount that is due for the period is stated on the statement of profit or loss

The amount that is prepaid appears on the statement of financial position as a current liability

It is included in the amount for other payables

Unlock more, it's free!

Was this revision note helpful?