Syllabus Edition

First teaching 2025

First exams 2027

Income Accounts with Accruals & Prepayments (Cambridge (CIE) IGCSE Accounting): Revision Note

Exam code: 0452 & 0985

Income accounts with accruals & prepayments

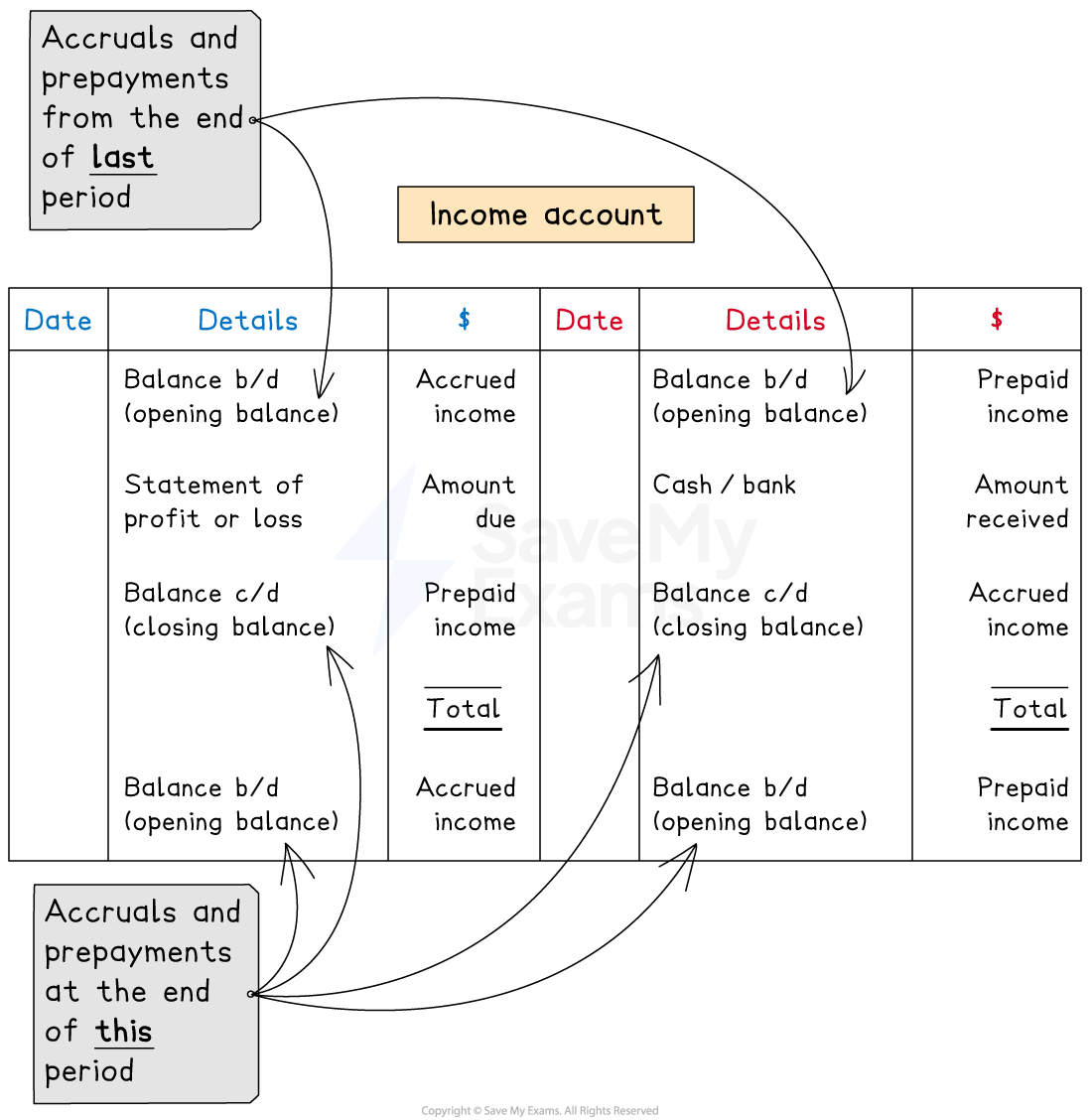

How do I complete an income account?

Put the opening balance on the correct side

Debit side if the amount is an accrual

Credit side if the amount is a prepayment

Put the amount received on the credit side

Label this as cash or bank

Put the amount due on the debit side

Label this as statement of profit or loss

Put the closing balance on the correct side

Credit side if the amount is an accrual

Debit side if the amount is a prepayment

Examiner Tips and Tricks

Students sometimes get confused about where to put the closing balances. A good way to make sure that you put them on the correct side, is to also include the opening balances for the following year. Then the closing balances will be on the opposite side.

How do I calculate a missing value in an income account?

You can use a ledger account to find any missing value

Fill in the amounts that you know on the correct sides

Find the missing value which balances the account

You can use this method to find

the amount received

the amount to transfer to the statement of profit or loss

the amount accrued or prepaid at the end of the year

Worked Example

Hussain receives rent from Sayid.

On 1 January 2023, Sayid owed Hussain three months’ rent.

On 1 March 2023, Hussain receives a cheque from Sayid for $8 400 for 16 months’ rent.

Prepare the rent receivable account in the ledger for Hussain for the financial year ended 31 December 2023. Balance the account and bring down the balances on 1 January 2024. Clearly show the amount that is transferred to the statement or profit or loss.

Answer:

Sayid paid for 16 months:

12 months for the financial year

three months for the arrears at the start

one month prepaid for the next year

Find the accrual at the start of the year.

STEP 1: Divide the payment by 16 to get the monthly rent

$8 400 ÷ 16 = $525

STEP 2: Multiply the monthly rent by 3 to find the accrual at the start of the year

$525 × 3 = $1 575

Find the amount due for the year ended 31 December.

Multiply the monthly rent by 12

$525 × 12 = $6 300

Identify which side of the rent receivable account to post each transaction:

The payment from Sayid will be credited to the rent receivable account

Because it will be debited to the cash book

There is an accrual at the start of the year, which represents an asset

Therefore the opening balance will be on the debit side of the rent receivable account

The amount for the year is credited to the statement or profit or loss

Therefore the rent receivable account will be debited

There is a prepayment at the end of the year, which represents a liability

Therefore there will be an opening balance on the credit side for the next year

Therefore, the closing balance will be on the debit side for this year

Hussain

Rent Receivable Account

Date | Details | $ | Date | Details | $ |

2023 Jan 1 |

Balance b/d |

1 575 | 2023 Jan 1 |

Bank |

8 400 |

Dec 31 | Statement of profit or loss | 6 300 | |||

Dec 31 | Balance c/d | 525 |

| ||

8 400 | 8 400 | ||||

2024 Jan 1 |

Balance b/d |

525 |

Unlock more, it's free!

Was this revision note helpful?