Syllabus Edition

First teaching 2025

First exams 2027

Statement of Profit or Loss (Cambridge (CIE) IGCSE Accounting): Revision Note

Exam code: 0452 & 0985

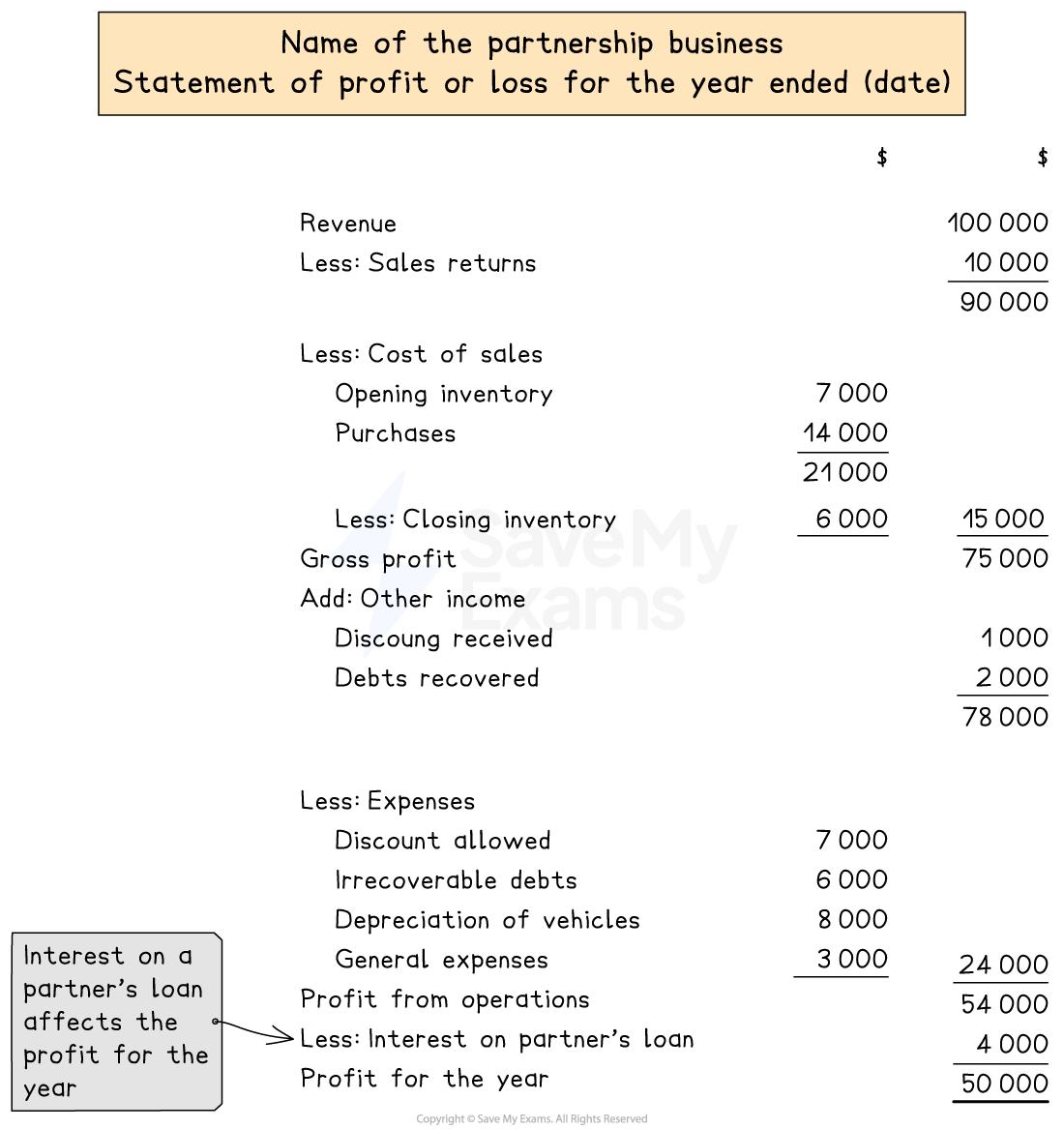

Statements of profit or loss for partnerships

What is the layout of the statement of profit or loss of a partnership?

The statement of profit or loss for a partnership is very similar to that for a sole trader

The statement of profit or loss for a partnership will have one new addition, for the interest on a partner’s loan

A partner may choose to lend money to the partnership

If this is the case, interest on the loan is a finance cost and an expense to the business

The following do not appear on the statement of profit or loss

Interest on partners' capital

Interest on partners' drawings

Partners' salaries

You may have to make adjustments to a statement of profit or loss

This is the same idea as when preparing a statement of profit or loss for a sole trader

Worked Example

Tam and Pan are in partnership providing car repair services in their local area. The following is a list of their balances for the year ended 30 June 2023.

| $ |

Income from repair services | 101 260 |

Salaries of employees | 30 400 |

Electricity | 2 420 |

Telephone | 3 110 |

Rent and rates | 10 000 |

Trade payables | 12 190 |

Trade receivables | 14 220 |

Discount allowed | 1 400 |

Office expenses | 10 610 |

Supplies for repairs | 41 570 |

Irrecoverable debts | 1 200 |

Machinery and Equipment at cost | 52 000 |

Provision for depreciation on machinery and equipment | 20 800 |

Tam:

|

60 000 430 20 600 |

Pan

|

30 000 300 15 700 |

Bank | 21 750 |

Additional information 30 June 2023:

Depreciate the office equipment at 20% per year using the straight-line method

On 1 July 2022, Pan loaned $5 000 to the partnership with loan interest at 5% per annum

Pan is to receive an annual partnership salary of $12 000

Remaining profits and losses are shared as follows: Tan ⅔, Pam ⅓

5% interest is allowed on partners’ capital accounts

10% interest is charged on partners’ drawings

Prepare the statement of profit or loss for Tam and Pan for the year ended 30 June 2023.

Answer:

Identify which balances affect the statement of profit or loss

| $ | Statement of profit or loss? |

Income from repair services | 101 260 | SoPoL |

Salaries of employees | 30 400 | SoPoL |

Electricity | 2 420 | SoPoL |

Telephone | 3 110 | SoPoL |

Rent and rates | 10 000 | SoPoL |

Trade payables | 12 190 | |

Trade receivables | 14 220 | |

Discount allowed | 1 400 | SoPoL |

Office expenses | 10 610 | SoPoL |

Supplies for repairs | 41 570 | SoPoL |

Irrecoverable debts | 1 200 | SoPoL |

Machinery and Equipment at cost | 52 000 | |

Provision for depreciation on machinery and equipment | 20 800 | |

Tam:

|

60 000 430 20 600 | |

Pan

|

30 000 300 15 700 | |

Bank | 21 750 |

Deal with the additional information.

Depreciate the machinery and equipment at 20% per year using the straight-line method

Find the year's depreciation by multiplying the cost by 20%

$52 000 × 20% = $10 400

On 1 July 2022, Pan loaned $5 000 to the partnership with loan interest at 5% per annum

Find the year's interest by multiplying the loan amount by 5%

$5 000 × 5% = $250

Pan is to receive an annual partnership salary of $12 000

This does not affect the statement of profit or loss

Remaining profits and losses are shared as follows: Tan ⅔, Pam ⅓

This does not affect the statement of profit or loss

5% interest is allowed on partners’ capital accounts

This does not affect the statement of profit or loss

10% interest is charged on partners’ drawings

This does not affect the statement of profit or loss

Prepare the statement of profit or loss using the required format

Note that it is a service business so will not have a trading section

Tam and Pan Statement of Profit or Loss for the year ended 30 June 2023 | ||

$ | $ | |

Income from repair services | 101 260 | |

Less: Expenses | ||

Supplies for repairs | 41 570 | |

Salaries | 30 400 | |

Offices expenses | 10 610 | |

Irrecoverable debts | 1 200 | |

Rent and rates | 10 000 | |

Electricity | 2 420 | |

Telephone | 3 110 | |

Discount allowed | 1 400 | |

Depreciation on machinery and equipment | 10 400 | 111 110 |

Loss from operations | (9 850) | |

Less: Loan interest (Pan) | 250 | |

Loss for the year | (10 100) | |

Unlock more, it's free!

Was this revision note helpful?