Syllabus Edition

First teaching 2025

First exams 2027

The Accounting Process (Cambridge (CIE) IGCSE Accounting): Revision Note

Exam code: 0452 & 0985

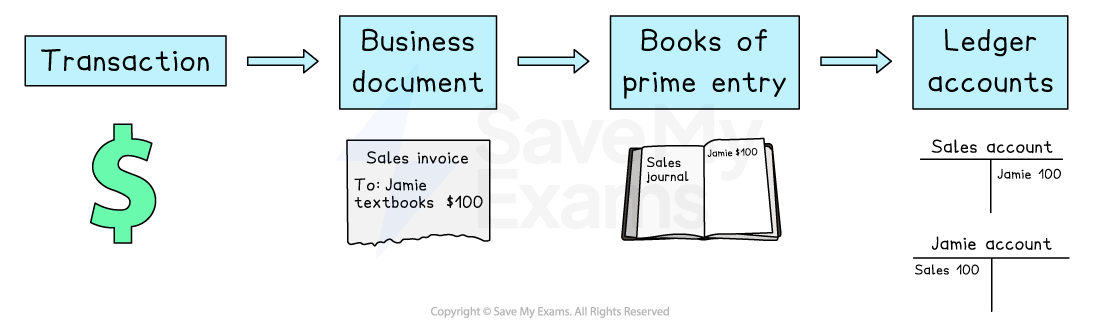

The accounting process

What is the accounting process?

Stage 1: Transaction

A transaction takes place

Examples include:

The sale or purchase of goods, a service or an asset

Withdrawing or depositing cash

Paying an expense or receiving income

Stage 2: Business document

A business document is issued or received

This is a record of the transaction

Stage 3: Book of prime entry

The amount is entered into a book of prime entry

This collates the different types of transactions

Stage 4: Ledger account

The entries from the books of prime entry are entered into the ledger accounts

These are part of the double-entry accounting system

Examiner Tips and Tricks

The aim of the accounting process is to have the information in the ledger accounts so that financial statements can be produced at the end of the accounting period.

Purpose of business documents

What are business documents?

Business documents are used to keep records of all transactions

They are used as sources of information

The amounts are then entered into the books of prime entry

They can be used to check potential errors

What business documents do I need to know?

Invoices

Debit notes

Credit notes

Statements of account

Cheques

Cheque counterfoils

Receipts

Paying-in slips

Bank statements

Petty cash vouchers

Are business documents produced and recorded manually or digitally?

Business documents can be produced and recorded either manually or digitally

They can be produced and recorded manually by:

physical receipts and invoices

paper-based bank statements and statements of account

cheques

They can be produced and recorded digitally by:

electronic receipts and invoices

electronic bank statements and statements of account

Purpose of books of prime entry

What are books of prime entry?

Books of prime entry are used to record the details of a transaction

Older terminology for these books includes

Subsidiary books

Books of original entry

Daybooks

Information is taken from the business documents and entered into the books of prime entry

The details are then transferred from the books of prime entry to the ledger accounts

The seven books of prime entry are:

Sales journal

Purchases journal

Sales returns journal

Purchases returns journal

Cash book

Petty cash book

General journal

What are the advantages of using books of prime entry?

Books of prime entry are another stage which can be used to check for errors

They can help in the preparation of control accounts to check the accuracy of the ledger accounts

Each book of prime entry collects the same type of transaction

The books allow managers to see the totals for different types of transactions easily

Therefore, there are fewer entries in some of the ledger accounts

Bigger businesses may have multiple book-keepers

Different book-keepers can be responsible for different books of prime entry without any risk of work being duplicated or missed

What are the benefits and limitations of using manual or digital methods for entering transactions into books of prime entry?

The books of prime entry can be updated manually or digitally

Manually means the transactions are entered into physical books

Digitally means the transactions are entered into spreadsheets or accounting software

Benefits | Limitations | |

|---|---|---|

Manual entry |

|

|

Digital entry |

|

|

Unlock more, it's free!

Was this revision note helpful?