Syllabus Edition

First teaching 2025

First exams 2027

The Double Entry System (Cambridge (CIE) IGCSE Accounting): Revision Note

Exam code: 0452 & 0985

The double entry system

What is the double entry system?

The double entry system is used by book-keepers

The double entry system is used to improve the accuracy of financial statements

The double entry system is closely linked to the accounting equation

Assets = Liabilities + Capital

The equation is always balanced

Each transaction causes both sides of the equation to:

increase

or decrease

or remain the same

Each transaction is entered into two accounts

One is called a debit entry

One is called a credit entry

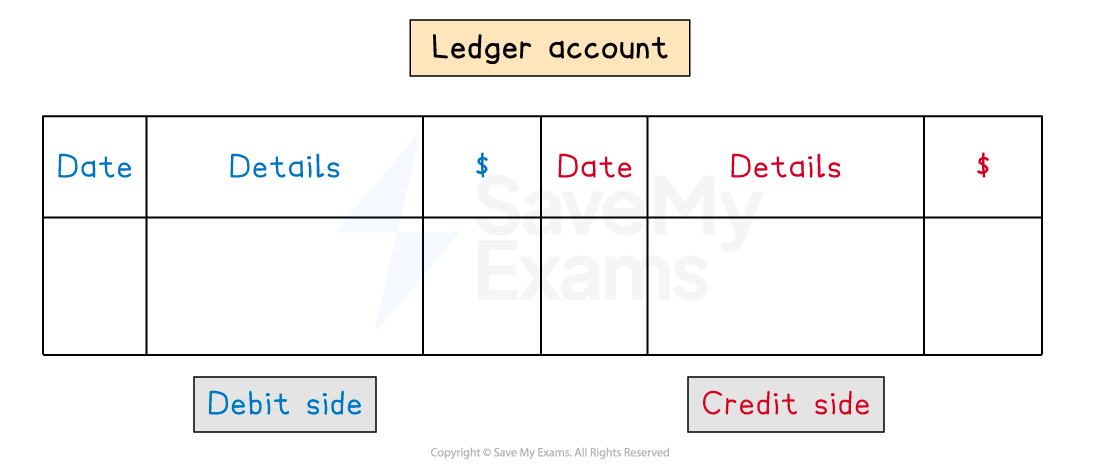

What is the layout of a ledger account?

Each account will be split into two sides

The debit entries appear on the left

This side is sometimes labelled as Dr

The credit entries appear on the right

This side is sometimes labelled as Cr

When you make an entry you need to include:

The date of the transaction

The details of the transaction

This is normally the name of the other account involved

The value of the transaction

What are the advantages of maintaining double entry records?

It is straightforward to prepare financial statements

It can help give an accurate calculation of the profit or loss

It reduces the possibility of fraud

It gives easy access to information for the bank or other lenders

Debits & credits

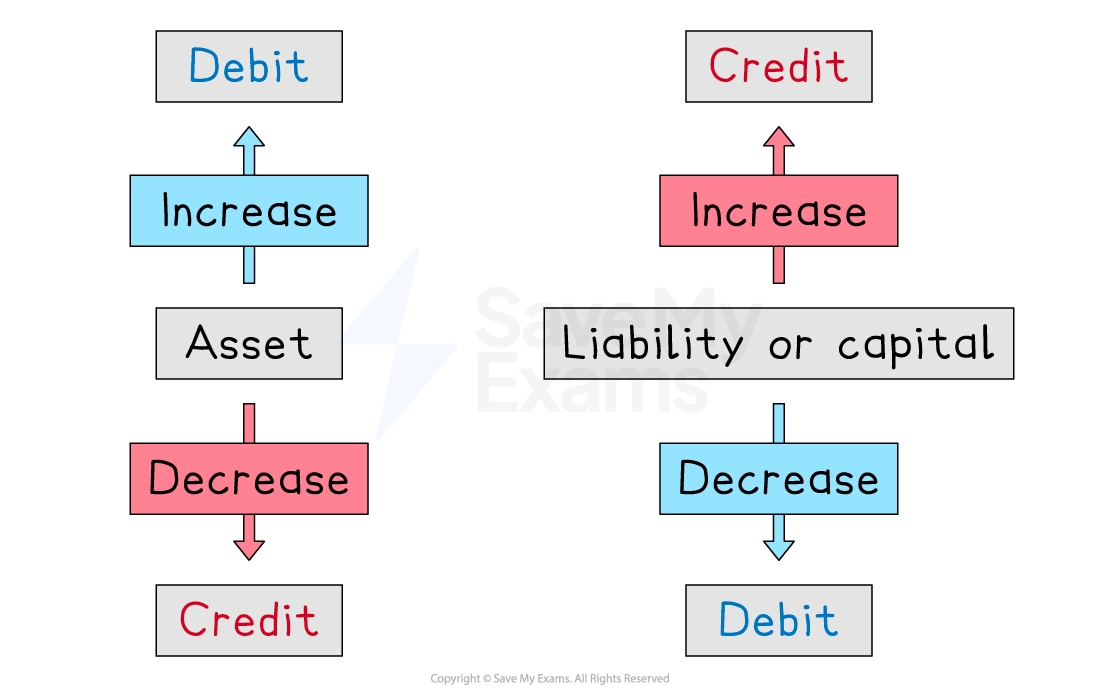

What is a debit entry?

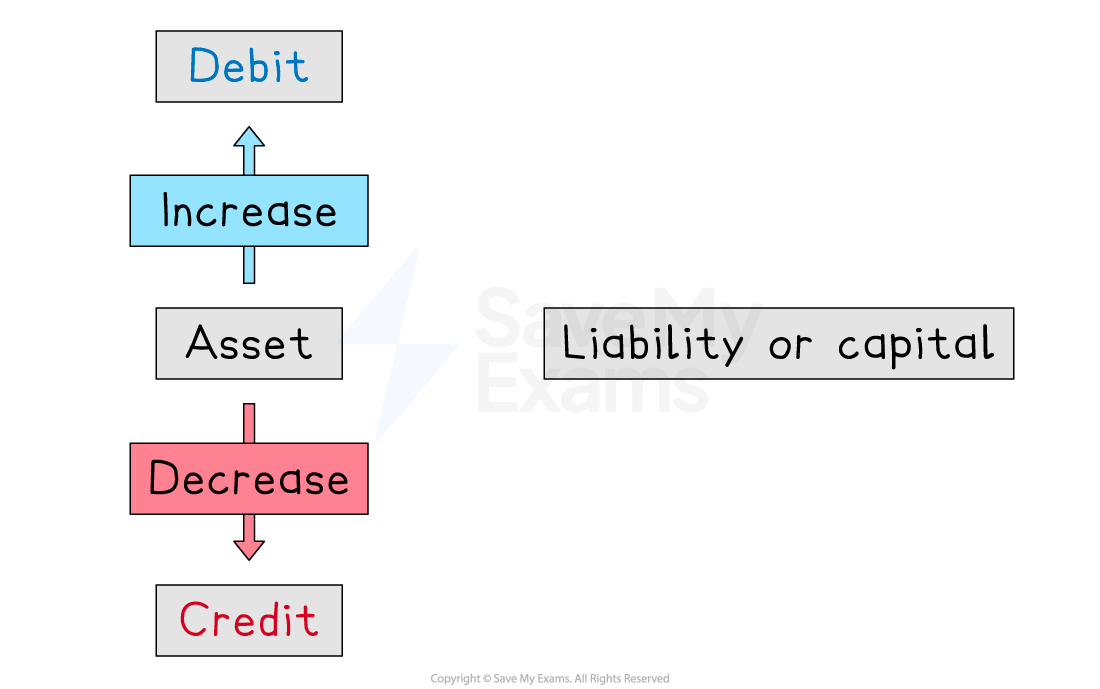

A debit entry is used to:

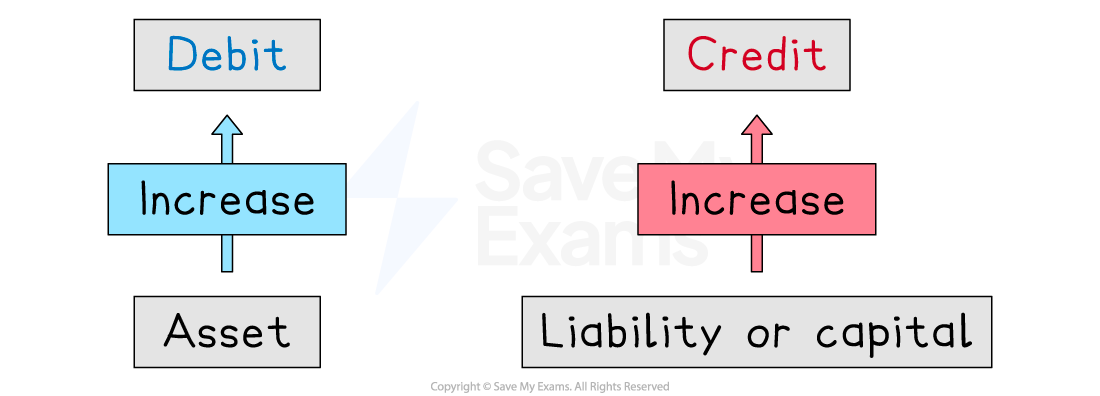

increase the value of an asset

The left-hand side of the accounting equation increases

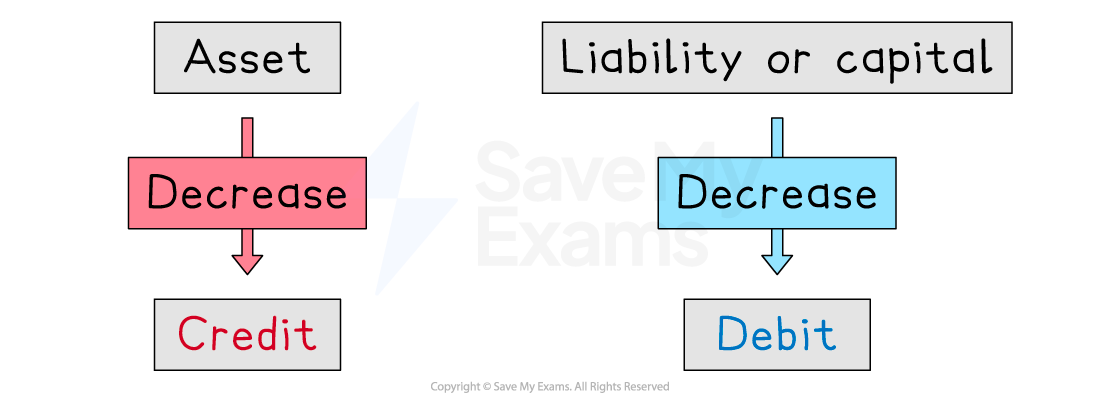

decrease the value of a liability or the capital

The right-hand side of the accounting equation decreases

What is a credit entry?

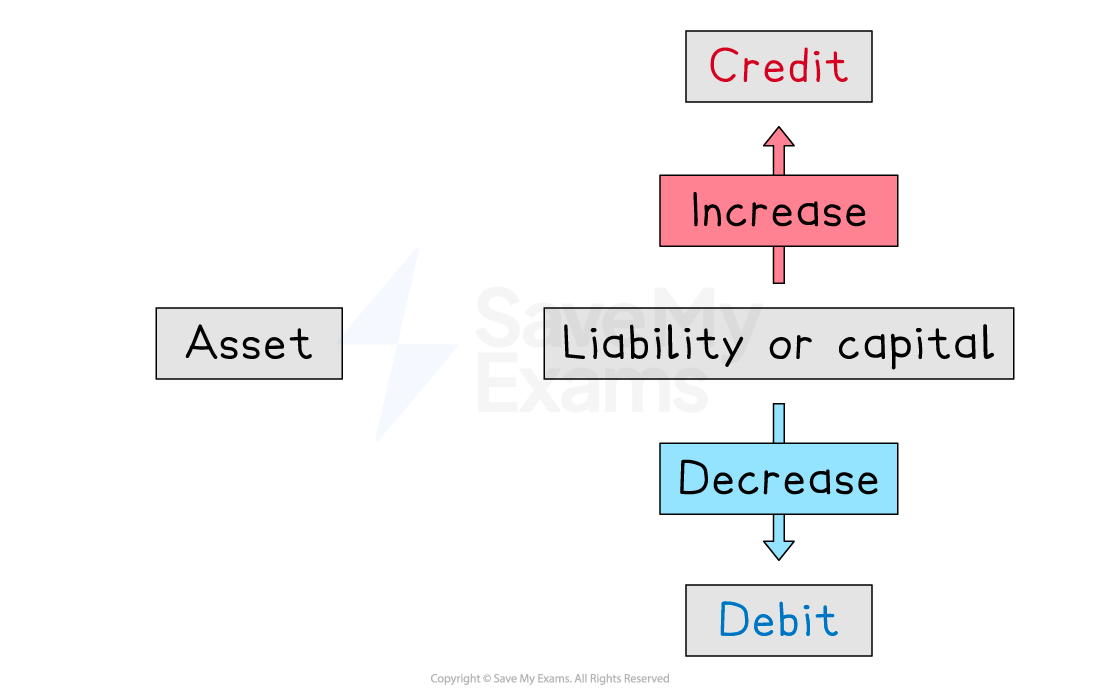

A credit entry is used to:

increase the value of a liability or the capital

The right-hand side of the accounting equation increases

decrease the value of an asset

The left-hand side of the accounting equation decreases

Which accounts should I debit?

Debit an asset account when its value is increasing

You receive cash

Debit the cash account

A customer buys goods on credit

Debit their trade receivables account

Debit a liability account when its value is decreasing

You make a repayment on a bank loan

Debit the bank loan account

You pay an invoice to a credit supplier

Debit their trade payables account

Debit other accounts when the transaction decreases the capital

You take assets from the business for personal use

Debit the drawings account

You pay an expense which decreases the profit

Debit the relevant expense account

Such as purchases, rent paid, discount allowed, etc

Which accounts should I credit?

Credit a liability account when its value is increasing

You take out a bank loan

Credit the bank loan account

You buy goods on credit from a supplier

Credit their trade payables account

Credit an asset account when its value is decreasing

You pay rent by bank transfer

Credit the bank account

A credit customer pays their invoice

Credit their trade receivables account

Credit other accounts when the transaction increases the capital

You put more personal assets (such as money) into the business

Credit the capital account

You receive income which increases the profit

Credit the relevant income account

Such as sales, rent received, discount received, etc

How do I enter the transactions into the accounts using the double-entry system?

STEP 1

Identify the accounts involved in the transactionOne is usually cash, bank, trade receivables or trade payables

STEP 2

Identify whether each account affects the assets, liabilities or capitalUsually this is cash, trade receivables or trade payables

STEP 3

Determine whether the value of each account is increasing or decreasingSTEP 4

Debit or credit the accountDebit the account if:

It is an asset account and its value is increasing

It is a liability or the capital account and its value is decreasing

Credit the account if:

It is an asset account and its value is decreasing

It is a liability or the capital account and its value is increasing

Examples where assets increase and liabilities or capital increase

Transaction | Debit | Credit |

|---|---|---|

Credit sale to a customer | Trade receivables

| Sales

|

The business takes out a bank loan | Bank

| Bank loan

|

The business receives money for rent from a tenant | Bank

| Rent received

|

The owner deposits some of their personal money into the business bank account | Bank

| Capital

|

Examples where assets decrease and liabilities or capital decrease

Transaction | Debit | Credit |

|---|---|---|

The owner takes money out of the business bank account for personal use | Drawings

| Bank

|

The business pays cash for an electricity bill | Electricity

| Cash

|

The business makes a cash payment to a credit supplier | Trade payables

| Cash

|

Examples where assets increase and decrease

Transaction | Debit | Credit |

|---|---|---|

The business receives a cash payment from a credit customer | Cash

| Trade receivables

|

The business withdraws cash from the business bank account | Cash

| Bank

|

The business deposits cash into the business bank account | Bank

| Cash

|

Examples where liabilities or capital increase and decrease

Transaction | Debit | Credit |

|---|---|---|

The business purchases goods on credit from a supplier | Purchases

| Trade payables

|

Worked Example

Hina is a sole trader.

Complete the table below to show the accounts that Hina should debit and credit for each of the following transactions.

Transaction | Account to be debited | Account to be credited |

Hina sells goods on credit to Priya | ||

Hina receives a cash payment from Priya | ||

Hina pays an electricity bill by cheque | ||

Hina buys goods on credit from Dida | ||

Hina repays some of a bank loan by bank transfer | ||

Hina takes ownership of a company vehicle for her own use | ||

Hina puts some of her own money into the business bank account |

Answer:

Transaction | Account to be debited | Account to be credited |

Hina sells goods on credit to Priya | Priya

| Sales

|

Hina receives a cash payment from Priya | Cash

| Priya

|

Hina pays an electricity bill by bank transfer | Electricity

| Bank

|

Hina buys goods on credit from Dida | Purchases

| Dida

|

Hina repays some of a bank loan by bank transfer | Bank loan

| Bank

|

Hina takes ownership of a company vehicle for her own use | Drawings

| Vehicles

|

Hina puts some of her own money into the business bank account | Bank

| Capital

|

Examiner Tips and Tricks

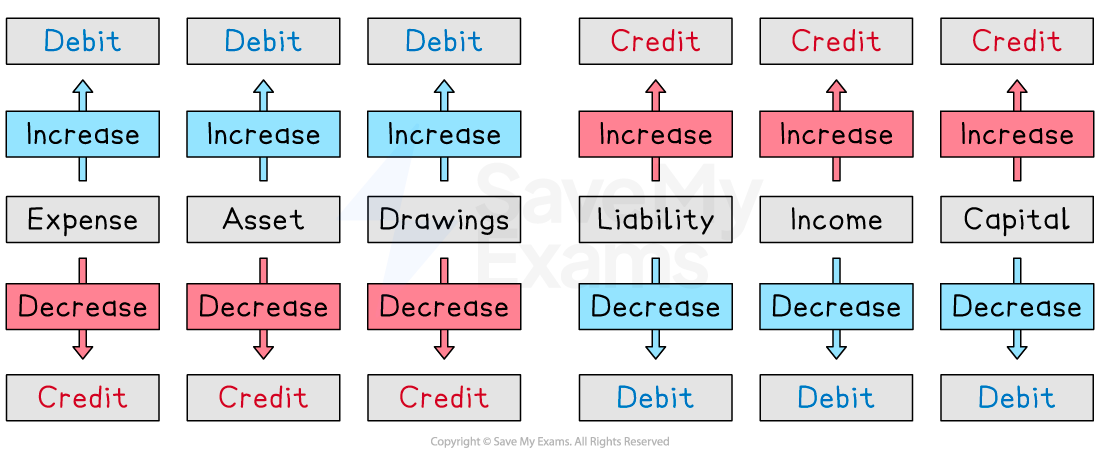

To remember which side of an account to record a transaction, you can use the acronym DEAD CLIC.

The transaction is on the debit side for expense, asset, and drawings accounts if the account is increasing.

The transaction is on the credit side for liability, income, and capital accounts if the account is increasing.

If the account is decreasing then the transaction is recorded on the opposite side!

Another set of acronyms are:

DIADL: Debits Increase Assets or Decrease Liabilities

CILDA: Credits Increase Liabilities or Decrease Assets

However, try to remember the connection to the accounting equation.

Unlock more, it's free!

Was this revision note helpful?