Syllabus Edition

First teaching 2025

First exams 2027

Three-Column Running Balance Format (Cambridge (CIE) IGCSE Accounting): Revision Note

Exam code: 0452 & 0985

Three-column running balance format

What is the three-column running balance format?

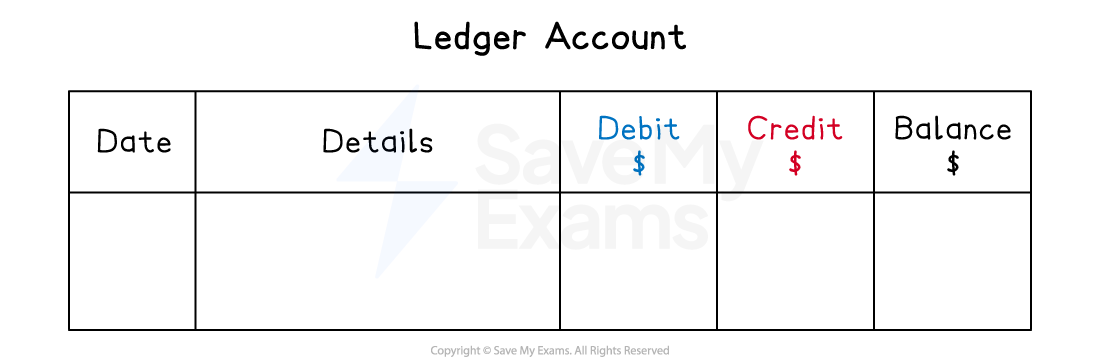

The three-column running balance format is an alternative to the usual double-sided ledger account

Bank statements and accounting software usually use this format

There are five columns

Date

Details

Debit

Credit

Balance

An advantage of using the three-column format is that the business can always see the balance of the account

A disadvantage of using the three-column format is that the business cannot easily see the total debits and total credits of the account

How do I fill in an account using the three-column format?

You fill in the date and details as normal

You enter the amount in either the debit or credit column

You use the same rules as for the normal format

You update the balance after each entry

Examiner Tips and Tricks

If the balance changes between debit and credit, such as the bank account, then the words "debit" and "credit" are written after each balance.

If the balance is always a debit or always a credit, then the account might not write this next to the balances.

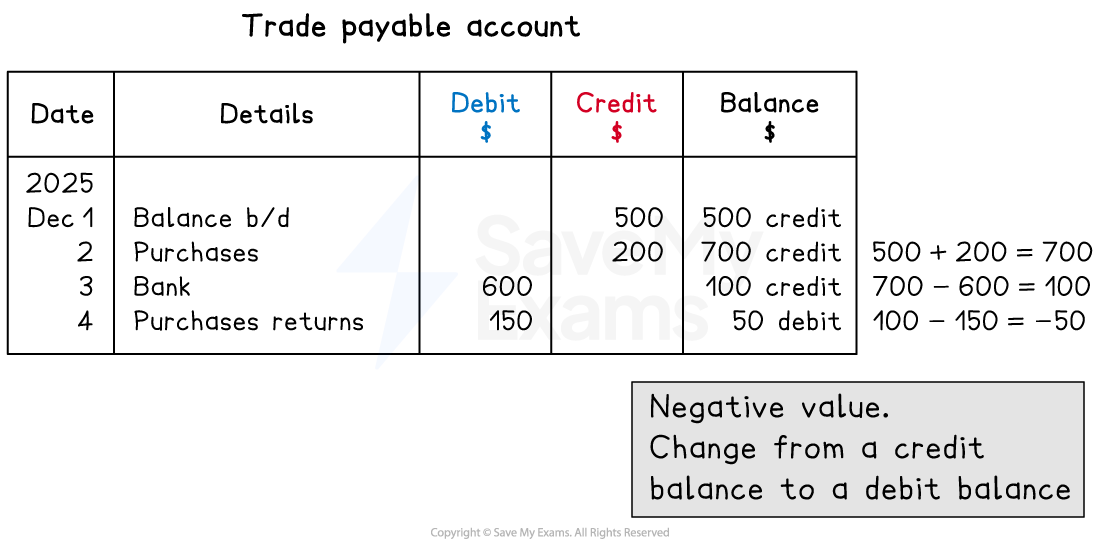

How do I find the balance after each transaction?

If the entry and the current balance are both debits or both credits:

add the amount to the balance

If the entry is different to the current balance

subtract the amount from the balance

If the new balance is a negative number

change between a debit balance and a credit balance

Worked Example

Kamala is a trader. Bruno is a credit customer. At 1 December 2025, Bruno owes Kamala $550.

The following transactions take place in December 2025:

3 Dec: Bruno settles an invoice for $500 by paying $475 by bank transfer

5 Dec: Bruno purchases goods with list price $230 on credit

13 Dec: Bruno returns unpaid goods with list price $70

Complete Bruno's account in the books of Kamala.

Bruno

Date | Details | Debit | Credit | Balance |

2025 | ||||

Dec 1 | Balance b/d | 550 | 550 |

Answer:

3 Dec: Bruno settles an invoice for $500 by paying $475 by bank transfer

$475 is paid into Kamala's bank

$25 is discount allowed by Kamala

Reduce the amount Bruno owes

These are credit entries as the asset is decreasing

5 Dec: Bruno purchases goods with list price $230 on credit

Increase the amount Bruno owes

This is a debit entry as the asset is increasing

13 Dec: Bruno returns unpaid goods with list price $70

Reduce the amount Bruno owes

These are credit entries as the asset is decreasing

Bruno

Date | Details | Debit | Credit | Balance |

2025 | ||||

Dec 1 | Balance b/d | 550 | 550 | |

3 | Bank | 475 | 75 | |

Discount allowed | 25 | 50 | ||

5 | Sales | 230 | 280 | |

13 | Sales returns | 70 | 210 |

Worked Example

At 1 December 2025, Kamala is £150 overdrawn on her bank account.

The following transactions take place in December 2025:

3 Dec: Kamala receives $475 from Bruno by bank transfer

11 Dec: Kamala pays $200 for rent by cheque

18: Kamala receives a cheque for $180 from Amy

Complete Kamala's bank account. State whether each balance is a debit or credit balance.

Bank

Date | Details | Debit | Credit | Balance |

2025 | ||||

Dec 1 | Balance b/d | 150 | 150 credit |

Answer:

3 Dec: Kamala receives $475 from Bruno by bank transfer

This is a debit entry as the bank is increasing

The current balance is a credit so subtract

A negative answer means the balance changes from a credit to a debit

11 Dec: Kamala pays $200 for rent by cheque

This is a credit entry as the bank is decreasing

The current balance is a debit so subtract

18: Kamala receives a cheque for $180 from Amy

This is a debit entry as the bank is increasing

The current balance is also a debit so add

Bank

Date | Details | Debit | Credit | Balance |

2025 | ||||

Dec 1 | Balance b/d | 150 | 150 credit | |

3 | Bruno | 475 | 325 debit | |

11 | Rent | 200 | 125 debit | |

18 | Amy | 180 | 305 debit |

Unlock more, it's free!

Was this revision note helpful?