Syllabus Edition

First teaching 2025

First exams 2027

The Cash Book (Cambridge (CIE) IGCSE Accounting): Revision Note

Exam code: 0452 & 0985

The cash book

What is the cash book?

The cash book has two functions

It is a book of prime entry

It is a ledger account for both the cash and bank accounts

The cash book records all cash transactions

Both physical cash and cash in the bank

The cash book is part of the double entry system

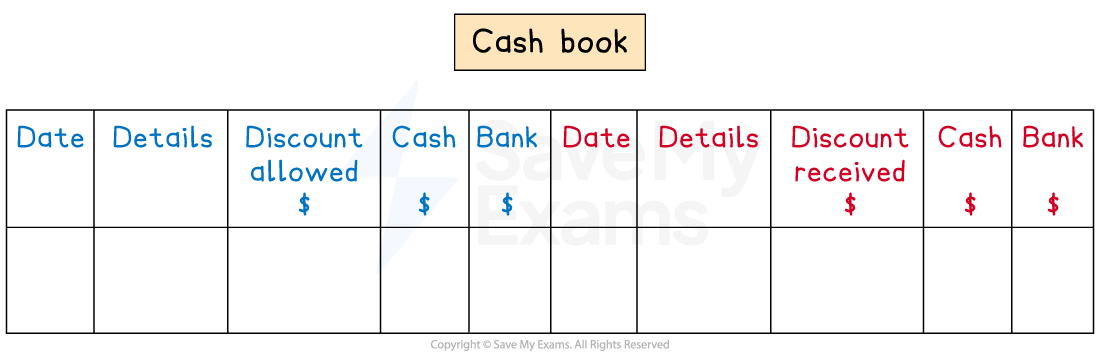

There are columns for the dates and details just like other ledger accounts

There are three columns for the value of the transaction on both sides of the cash book

Discount columns

Discount allowed on the debit side

Discount received on the credit side

Cash columns

Bank columns

Which side should the balances be on?

The balance for the cash account is always on the debit side

Cash is always an asset

It can never be a liability

The balance for the bank account can be on either side

It is on the debit side if the business has money in the bank

It is on the credit side if the business is overdrawn

How do I enter transactions into the cash book?

STEP 1

Identify whether the transaction affects the cash or bank accountSTEP 2

Decide whether the account should be debited or creditedDebit the account if the business is receiving money

Credit the account if the business is losing money

STEP 3

Include any discount that was allowed or received

What are contra entries in the cash book?

A contra entry is for a transaction that is entered into both sides of the cash book

It will be entered in the cash column on one side

It will be entered in the bank column on the other side

The two transactions which result in contra entries are:

Withdrawing cash from the business bank account for business use

Debit the cash account

Credit the bank account

Depositing cash from the business into the business bank account

Debit the bank account

Credit the cash account

Examiner Tips and Tricks

It is very easy to get confused when making contra entries into the cash book.

If the amount goes in the cash column, the details will say “bank”. If the amount goes in the bank column, the details will say “cash”.

For contra entries, remember that the name used for the details will be different to the name of the column where the entry is made.

Worked Example

Yana is a sole trader. On 1 January 2024, Yana had $20 cash in hand and $850 in the bank. During January 2024, the following transactions took place. Prepare Yana’s cash book.

Jan 2 | Purchased goods on credit, $350, from Liza |

4 | Paid electricity, $250, by telephone transfer |

6 | Sold goods on credit, $180, to Tobey |

10 | Withdrew cash, $300, from the bank for business use |

11 | Cash sales, $50, were paid directly into the bank account |

18 | Paid Liza, $320, by credit transfer, in full settlement of the invoice from 2 January 2024 |

21 | Tobey paid his account of £180 by cheque after deducting 5% cash discount |

28 | Paid rent, $500, by direct debit |

31 | Paid $200, cash, for wages |

Answer:

Jan 1 | Debit balance of $20 for cash and debit balance of $850 for bank |

2 | No entry into the cash book as there was no exchange of cash |

4 | $250 credit entry to the bank account |

6 | No entry into the cash book as there was no exchange of cash |

10 | Contra entry - debit the cash account and credit the bank account |

11 | $50 debit entry to the bank account |

18 | $350 - $320 = $30 $320 credit entry to the bank account with $30 discount |

21 | 5% × $180 = $9 and $180 - $9 = $171 $171 debit entry to the bank account with $9 discount |

28 | $500 credit entry to the bank account |

31 | $200 credit entry to the cash account |

Yana

Cash Book

Date | Details | Discount Allowed $ | Cash $ | Bank $ | Date | Details | Discount Received $ | Cash $ | Bank $ |

2024 |

Balance b/d |

20 |

850 | 2024 |

Electricity |

250 | |||

Jan 10 | Bank | 300 | Jan 10 | Cash | 300 | ||||

Jan 11 | Sales | 50 | Jan 18 | Liza | 30 | 320 | |||

Jan 21 | Tobey | 9 | 171 | Jan 28 | Rent | 500 | |||

Jan 31 | Wages | 200 |

Unlock more, it's free!

Was this revision note helpful?