The Functions of the Price Mechanism (Cambridge (CIE) A Level Economics): Revision Note

Exam code: 9708

The functions of the price mechanism

The price mechanism is the interaction of demand and supply in a market economy that allocates scarce resources amongst competing needs and wants

Adam Smith referred to the functions of the price mechanism as the 'invisible hand of the market'

The price mechanism fulfils three functions in the relationship between buyers and sellers which include rationing, incentivising and signalling

When any of these functions breaks down, market failure can occur

Explaining each function

Rationing

When resources become scarce, the price will rise. Only those who can afford to pay for them will receive them. If there is a surplus, then prices fall and more consumers can afford them

E.g The price of plane tickets might rise as seats are sold, because spaces are running out. This is a disincentive to some consumers to purchase the tickets, which rations the tickets

Incentive

The incentive function encourages producers to increase or decrease output to increase profits

When prices for a good/service rise, it incentivises producers to reallocate resources from a less profitable market in order to maximise their profits

Falling prices incentivise reallocation of resources to new markets

Signalling

A change in price provides a signal to consumers and producers about where resources are wanted (markets with increasing prices) and where they are not (markets with decreasing prices)

This allows consumers and producers to make informed decisions

High prices signals to a producer to produce more of that good/service and would signal to other producers to enter the market

A falling price signals to consumers to purchase more of a product

Case Study

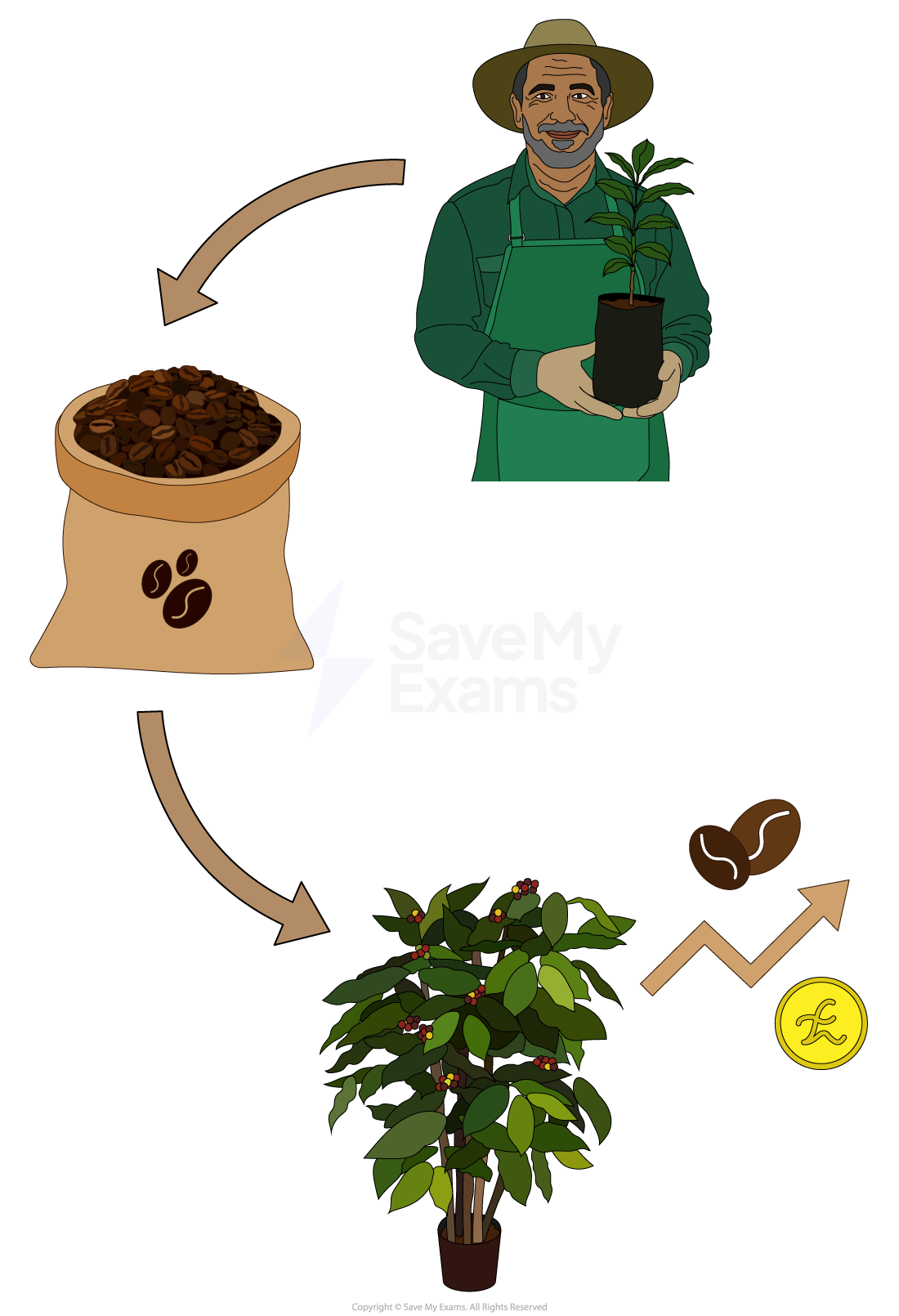

Global Coffee Prices and Producer Response in Brazil

Scenario

In 2021, global demand for coffee surged as cafés reopened after pandemic lockdowns. At the same time, a major drought and frost in Brazil - the world’s largest coffee exporter - damaged crops and reduced supply. This caused the global price of coffee beans to rise sharply on commodity markets

The incentive and signal

The price rise acted as a signal to coffee producers: global buyers were willing to pay more

It also served as an incentive - higher prices meant potentially greater profits for farmers

In response, producers began planting more coffee trees, investing in irrigation systems, and prioritising coffee over other crops like maize or sugarcane

The outcome

Over the next year, supply increased as new coffee plants matured and better weather returned

More producers entered the market, while existing farmers expanded production

As supply grew to meet demand, global prices began to stabilise, demonstrating how the price mechanism efficiently directed resources toward a highly demanded good

Examiner Tips and Tricks

Remember that all three functions are built on the principle of self-interest. This will help you to explain each function

Lower prices incentivise consumers to purchase more of the product with the same income. Conversely, the incentive for producers is the opposite, encouraging them to reallocate their factors of production to producing more profitable products

The price mechanism in action

Cash crops such as wheat, oats, barley, soy, corn, sunflowers, etc. can be grown using the same factors of production

Many countries export excess crops into the world market

Producers use world prices to guide their production decisions

Diagram analysis

Farmers in France have been producing corn for many years, and the market price is $2/kg

The price of potatoes in global markets has been steady at $2/kg

Due to a change in one of the determinants of demand (possibly an increase in global population), the demand for potatoes has increased from D1→D2 and the price has increased from $2/kg to $3/kg

What happens?

The higher price serves to ration the potatoes

Those consumers who can afford to purchase it for $3, receive it

The higher price incentivises producers to allocate more factors of production to producing potatoes and this is evident from the extension in supply from Q1 to Q2

The shift in global demand signals to producers in France that demand for potatoes is strong and they should consider switching some of their production from corn to potatoes

Unlock more, it's free!

Was this revision note helpful?