Explain the difference between effi ciency and effectiveness in business operations.

Was this exam question helpful?

Exam code: 9609

Explain the difference between effi ciency and effectiveness in business operations.

How did you do?

Was this exam question helpful?

Define the term ‘sustainability’.

How did you do?

Explain one reason why a manufacturing business might take measures to improve the sustainability of its operations.

How did you do?

Was this exam question helpful?

Designer Clothing (DC)

DC is a medium sized private limited company. It has been trading for 10 years. DC makes luxury dresses for women using job production methods. DC has an excellent reputation for quality. A DC designer has a meeting with every customer to design a dress that satisfies the customer’s individual needs, including choice of fabric and colour. Cost-based pricing is used with 50% added to the average cost of each dress.

DC’s employees are highly skilled and paid hourly rates (a time based method). Ikram, one of the designers, has just had a meeting with a new customer, Lydia. Lydia wants Ikram to design and make a new dress for her. Ikram has worked out the production data shown in Table 2.1 for the dress.

Table 2.1: Production data for the dress for Lydia

Production time | 20 hours |

Hourly rate | $10 |

Material costs | $250 |

Indirect cost allocation | $25 |

Other costs such as packaging | $25 |

Jenny, the Managing Director, wants to use DC’s excellent reputation and move into a new market. Jenny wants to create a new range of DC branded trousers for women. Jenny has developed some elements of a marketing mix for the new trousers:

Product: quality trousers aimed at women aged 25–50

Distribution channel: sold in large shops

Promotion: branded with the DC logo

Jenny will develop a business plan when she receives the market research report, which includes feedback from a focus group. Jenny thinks that the pricing strategy DC currently uses will not be appropriate for the new trousers.

The new product range would use a batch production method. The Production Director, Khaleal, has identified the machinery needed for the new production method. Khaleal is worried about the problems that introducing the new production method might cause DC’s employees.

Analyse two human resource problems that DC might experience from the introduction of a new batch production method.

How did you do?

Was this exam question helpful?

Delicious Cocoa

(DC) DC is a co-operative owned by cocoa farmers in country X. It has 500 workers. In 2022, DC produced 2000 tonnes of raw cocoa beans. Productivity is expected to increase by 5% in 2023. Although DC is profitable, it has no retained earnings.

DC focuses on the triple bottom line as its main objective. The members of the co-operative (farmers) are motivated within the current operation.

Zara, the Managing Director, has recently completed a workforce plan. She has identified that young people do not want to work on DC’s farms. Their concerns are:

lack of investment in training

most of the work is manual

lack of control over earnings.

Ranjit, the Operations Director, has identified an opportunity to create added value by investing in a capital intensive factory.

The factory will process raw cocoa beans produced by DC’s farms into cocoa butter. Cocoa butter is a premium product and attracts higher profit margins than raw cocoa beans. The processing factory will require a significant capital investment (see Table 2.1).

Table 2.1 Data for the cocoa processing factory

$ | |

Initial investment: | 100 000 |

Average variable costs per tonne | 5 000 |

Average selling price per tonne | 10 000 |

(i) Refer to lines 1–2. Calculate DC’s expected labour productivity in 2023.

[3]

(ii) Explain one reason why labour productivity is important to DC.

[3]

How did you do?

Was this exam question helpful?

Delicious Cocoa (DC)

DC is a co-operative owned by cocoa farmers in country X. It has 500 workers. In 2022, DC produced 2000 tonnes of raw cocoa beans. Productivity is expected to increase by 5% in 2023. Although DC is profitable, it has no retained earnings.

DC focuses on the triple bottom line as its main objective. The members of the co-operative (farmers) are motivated within the current operation.

Zara, the Managing Director, has recently completed a workforce plan. She has identified that young people do not want to work on DC’s farms. Their concerns are:

lack of investment in training

most of the work is manual

lack of control over earnings.

Ranjit, the Operations Director, has identified an opportunity to create added value by investing in a capital intensive factory.

The factory will process raw cocoa beans produced by DC’s farms into cocoa butter. Cocoa butter is a premium product and attracts higher profit margins than raw cocoa beans. The processing factory will require a significant capital investment (see Table 2.1).

Table 2.1 Data for the cocoa processing factory

$ | |

Initial investment: | 100 000 |

Average variable costs per tonne | 5 000 |

Average selling price per tonne | 10 000 |

Evaluate whether DC should grow its operations by opening its new cocoa processing factory.

How did you do?

Was this exam question helpful?

Analyse the advantages to a business of using mass customisation.

How did you do?

Was this exam question helpful?

Farm Produce (FP)

FP is a primary sector co-operative made up of six farms in country G. Each farm grows a range of fruit and vegetables. FP employs 26 workers across the farms and distribution centre. Each farm transports its fruit and vegetables to the distribution centre where they are packaged and sent to customers’ homes. Table 1.1 contains data about the farming industry in country G.

Table 1.1: Data about the farming industry in country G

|

FP’s customers pay for a box of seasonal fruit and vegetables that is delivered each week. Data about the different box sizes sold by FP is shown in Table 1.2.

Table 1.2: FP’s cost and price data

Box size | Variable cost per box | Allocated monthly fixed costs | Price per box | Sales in April 2022 |

Small | 8 | 2000 | 10 | 400 |

Medium | 10 | 2000 | 20 | 300 |

Large | 15 | 2000 | 35 | 150 |

FP is concerned about the profitability of the small box size. It believes it should stop selling this product.

Define the term ‘labour intensive’ (line 8).

How did you do?

Was this exam question helpful?

Clever Televisions (CTV)

CTV is a public limited company that produces and sells televisions. It has been operating in country A for 30 years. CTV owns 3 factories and has over 100 employees. CTV’s factories use a combination of capital and skilled labour to produce the televisions. The leadership style in all the factories is autocratic. Employees’ pay is based on time worked each week.

The CTV brand is known for high‑quality and reliability. It targets high‑income customers. CTV uses price skimming when it launches a new product.

In total, 6 million televisions were sold in country A in 2019. Table 2.1 shows market growth data.

Table 2.1: Television sales in country A

Year | Market growth |

2020 | +2% |

2021 | +1% |

2022 | –3% (forecast) |

The market for televisions in country A is very competitive and the business environment is dynamic. CTV plans to introduce a lower priced television brand to appeal to the mass market. This brand will be known as STV.

CTV has decided to introduce automation into one of its factories to produce the STV televisions. This will lead to redundancies in that factory.

The employees in the other two factories are concerned they might also face redundancy and so motivation is currently low. The Human Resources Director recommends that CTV should find ways in which employees can participate in the management and control of the business.

Analyse two advantages to CTV of introducing automation into one of its factories.

How did you do?

Was this exam question helpful?

Rehana Recycles (RR)

Rehana is very environmentally aware. One year ago, Rehana identified a business opportunity to reuse waste products and set up Rehana Recycles (RR) as a sole trader.

A local company sells bottled drinks and reuses the empty glass bottles that are returned by customers. It cannot reuse any damaged bottles, so they are dumped as waste. Rehana asked this company if she could have the damaged glass bottles. The company agreed she could have them at no cost.

RR melts down the glass and makes unique vases and other glassware products. RR’s mission statement is ‘Make waste beautiful’. Rehana markets her products as ‘Lovely for the planet, lovely for you’. The business has a strong local brand image. Rehana has recently invested in marketing which focuses on her unique selling point of recycling waste.

To help satisfy demand, Rehana recently employed two local artists who are also very environmentally aware. They are skilled in making handmade glass jewellery. RR currently makes handmade products using job production.

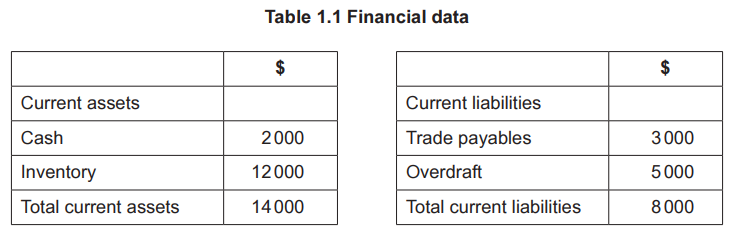

Rehana has a democratic leadership style. Rehana has produced some financial data shown in Table 1.1.

As demand has grown, Rehana needs to increase her output. Rehana has identified two ways of increasing output. She could either:

keep using job production and employ more artists to create unique glassware products using the RR brand, or

change to batch production and make a larger number of standardised glassware using the RR brand.

Evaluate whether RR should change to batch production.

How did you do?

Was this exam question helpful?

Benjamin’s Beds (BB)

Benjamin’s Beds (BB) is a large manufacturer of beds and has a strong brand image for quality. Its main channel of distribution is through the producer market (B2B) to national hotel chains. Recently, BB has also entered the consumer market (B2C) by selling online direct to customers.

BB uses flow production. BB’s existing machinery is old and cannot satisfy the increased demand. The directors of BB have decided its existing machinery needs replacing. Table 2.1 shows data for existing and proposed new machinery.

Table 2.1 Data for existing and proposed new machinery

Variable cost per unit | Output per year | |

Existing machinery | 50 | 5000 |

New machinery | 40 | 7500 |

Fixed costs are $500 000 per year. Using new machinery would reduce this by 10%.

BB sales data suggests that its market share is growing rapidly. The consumer market (B2C) is becoming more important to BB because online orders are increasing. However, online demand is for a wide range of bed styles. The consumer market requires a substantial marketing budget and some retraining of employees.

Orders from national hotel chains in the producer market (B2B) are for a more limited range of bed styles. These orders remain constant with low marketing costs. However, BB is increasingly under pressure to reduce prices to hotels.

BB uses non-financial motivators and until recently had a motivated workforce. Efficiency is falling due to employees having to work longer hours because of increased demand. This is decreasing staff morale and welfare.

Explain the term ‘efficiency’ (line 21).

How did you do?

Explain one possible limitation to BB of using the proposed new machinery.

How did you do?

Was this exam question helpful?

Define the term ‘capital-intensive production’.

How did you do?

Explain two possible disadvantages for a business of labour-intensive production.

How did you do?

Was this exam question helpful?

Snappy Box (SB)

SB is owned by Ralph who is a sole trader. The business prints photographs. Ralph has one shop on the main street of city D. Customers bring their saved digital photographs into the shop and these are printed on high-quality paper.

SB uses a large printing machine that can print on almost any size of paper to produce different sized photograph prints. The process is very capital-intensive and most customers request a batch of photographs to be printed.

SB is the only shop in city D that prints photographs. However, recently a number of online competitors have started to offer low-priced photograph prints to customers. Ralph has noticed that his sales have decreased significantly because of this competition. Ralph estimates the demand for his photograph prints has a price elasticity of demand of –4.

SB already has a low profit margin and Ralph is struggling to compete with the online retailers. However, Ralph has an idea to introduce job production into his shop. He could stop printing photographs and instead focus on framing individual photographs for customers. These frames will be made for any sized photograph or picture and can be made from a variety of materials chosen by the customer.

Ralph will need specialised equipment to allow him to make the frames. The equipment would cost $10000. He has identified two possible sources of finance for this equipment.

The first possible source of finance is for Ralph to lease the equipment from the company that produces it. The lease would be for five years at a fixed cost of $400 per month.

The second possible source of finance is for Ralph to sell the photograph printing machine for at least $10000, to purchase the equipment to make frames.

Analyse one advantage and one disadvantage to Ralph of introducing job production.

How did you do?

Was this exam question helpful?

Super Candy (SC)

SC is a large public limited company that sells low-sugar candy (sweets) with natural flavourings. The candy is made using flow production in SC’s four large factories in country T.

SC uses psychographic market segmentation when planning its marketing mix.

SC has completed some secondary market research using published accounts. The data is about one of SC’s main competitors, Organic Kandy (OK) and compares the results with data about SC (see Table 2.1). OK is in the same market as SC.

Table 2.1: Secondary market research about OK and SC for 2020

OK | SC | |

Revenue | $60m | X |

Market share by revenue | 40% | 34% |

Different varieties of candy | 12 | 18 |

Main channels of distribution | Wholesalers | Wholesalers |

Target market(s) | Mass market | People with interests in:

|

There have been a number of media reports in country T about the increasing importance of corporate social responsibility (CSR). A large food manufacturing business in country T recently lost many customers due to reports about its use of plastic packaging.

The directors of SC are particularly concerned about this trend because of SC’s use of plastic in its packaging. The marketing department has been told to conduct some primary market research on this issue. The directors are planning to discuss making CSR a new business objective for SC.

Define the term ‘flow production’ (line 2).

How did you do?

Was this exam question helpful?

Read the following extract ( lines 54–56 and Table 3) before answering

Calculate for 2020 the:

labour productivity per month

How did you do?

Was this exam question helpful?

‘In a large computer manufacturing business, the operations department is more important for achieving success than the marketing department.’

Discuss the extent to which you agree with this view.

How did you do?

Was this exam question helpful?

Hannah’s Handbags (HH)

Hannah started HH six years ago. HH operates in a niche market providing unique bags. The bags are made using job production. As demand grew for the bags, Hannah took on a partner, her brother Kwom. They both agreed to keep the name ‘Hannah’s Handbags’ as it is an established, reputable and widely recognised brand.

HH operates from a small workshop and showroom. Customers are encouraged to visit the showroom to discuss design and materials with either Hannah or Kwom.

HH employs four highly skilled specialist production staff. Table 2.1 shows an extract from the latest income statement.

Table 2.1: Extract of financial data for HH (year ended 30 October 2019)

$000 | |

Revenue | 980 |

Cost of sales | 588 |

Expenses | 245 |

A new product

Hannah and Kwom would like to expand the business by producing a limited number of batch produced bags to sell online. Hannah has noticed other bag producers do this successfully. The new market has many more competitors, with 15 large businesses and many small ones. The bags would have to be priced competitively. Kwom estimates that this new venture would require additional finance of $350000. HH would also require a specialist IT provider to set up a website and a marketing agency to run a viral marketing campaign.

Analyse one advantage and one disadvantage to HH of using job production.

How did you do?

Was this exam question helpful?

Market Solution (MS)

MS is a public limited company in the tertiary sector. MS advises businesses on elements of the marketing mix. Most of its customers are small businesses who cannot afford their own marketing department. MS designs marketing materials for these businesses to use.

Although MS uses computer aided design (CAD), the business is labour intensive. MS employs specialist marketing workers as well as administrative support workers. Table 2.1 shows some data about employees of MS.

Table 2.1: MS employee data

Specialist marketing workers | Administrative support workers | |

Average number of workers in 2019 | 40 | 88 |

Payment method | Salary plus bonus | Performance related pay plus bonus |

Number of workers who left in 2019 | 2 | 11 |

Average pay (compared to national average) | High | Low |

Main need of the workers | Achievement | Affiliation |

Main hygiene factors |

|

|

Is a bonus expected in 2020? | Yes | No |

MS has recently employed Hetti as the new Human Resources Manager. Hetti thinks that the ideas of the motivational theorists are important when managing employees. She is particularly worried about the labour turnover of the administrative support workers.

MS has recently taken on a new customer, named Books Outlet (BO). BO has an objective to increase its revenue by targeting a younger market segment. BO has provided MS with the following information about its current marketing mix (see Table 2.2).

Table 2.2: Current marketing mix for BO

Product

| Price

|

Promotion

| Place

|

Explain one possible advantage to MS of being labour intensive.

How did you do?

Was this exam question helpful?

Flight Food (FF)

FF is a large secondary sector business that supplies airlines with in-flight meals. Meals are manufactured using batch production. A different variety of meal is made each hour with a five minute changeover time between batches. FF makes use of Just in Time (JIT) to manage inventory wherever possible. Trucks arrive each hour and deliver the materials needed for production.

The market for airline meals is very competitive. FF uses market segmentation when deciding which meals are most likely to appeal to different airlines. FF must adapt to changes in tastes and the demands of each airline.

FF is a labour intensive business. The workers are employed with short-term (six month) employment contracts. They are only offered new contracts if they meet their production targets. Table 2.1 shows some production data for FF’s two work teams.

Table 2.1: Worker data for FF

Team A | Team B | |

Number of workers | 100 | 50 |

Productivity (per worker per day) | 300 meals | 240 meals |

The Board of Directors of FF is considering changing the manufacturing process to flow production. This would require purchasing Computer Aided Manufacturing (CAM) equipment and using a capital intensive production process. Production targets would no longer be used for employees because the machinery would be set at a specific production rate.

Sabrina, the Operations Director, has put forward the following advantages for moving to flow production:

more products made each hour

lower employment costs

improved quality.

Ben, the Human Resource Director, is worried about the change from a labour intensive process to a capital intensive process.

(i) Refer to Table 2.1. Calculate the total number of meals per day produced by both teams.

[2]

(ii) Explain two ways in which FF may be affected by the lower productivity of employees working in Team B.

[4]

How did you do?

Evaluate the possible effects on FF of a change from a labour intensive process to a capital intensive process.

How did you do?

Was this exam question helpful?

Define the term ‘productivity’.

How did you do?

Was this exam question helpful?

Define the term ‘effectiveness’.

How did you do?

Explain two ways a business might raise productivity levels.

How did you do?

Was this exam question helpful?

Define the term ‘intellectual capital’.

How did you do?

Explain two functions of an operations management department.

How did you do?

Was this exam question helpful?

Discuss the view that it is more important for a manufacturer of bicycles to be effective than it is to be efficient.

How did you do?

Was this exam question helpful?

UPlane Components (UC)

UC is a private limited company providing engine parts for commercial aircraft. It uses batch production in factory A and flow production in factory B. As part of UC’s commitment to corporate social responsibility (CSR), it provides a training scheme for the long-term unemployed, based in factory A.

UC’s products are sold to aircraft engine manufacturers. Demand for aircraft engines has increased by 45% over recent years. The aircraft engine manufacturers want inventory just when needed and are demanding a reduction in prices.

In 2017, UC opened factory B which is 5km away from factory A. Factory B has a high level of automation, resulting in low unit costs for the parts produced there. Production is capital intensive. UC has a plan to automate factory A. The production workers are not happy about this proposal and have asked for more details. The workers’ representatives have asked for a meeting with the human resource manager.

In December 2019 a fault was discovered in one of the engine components supplied by UC and produced in factory A. UC had to recall 2000 parts at a cost of $200000. This has had an impact on part of its triple bottom line and UC is unlikely to meet its targets. Table 1.1 shows some financial data for UC.

Table 1.1: Financial data for UC

Year ending 30 November 2019 | Year ending 30 November 2020 | |

Revenue | 5.8 | 6.4 |

Cost of sales | 2.3 | 3.4 |

Expenses | 1.3 | 1.6 |

Cost of recall | - | 0.2 |

Amjit, the human resource manager, believes that the fault was caused by the negligence of Jack, one of the production supervisors. Jack claims that he was made to work overtime to try and meet production targets. This caused him to become tired and make a mistake in one batch of parts. Amjit wants to dismiss Jack.

Recommend whether UC should automate factory A. Justify your recommendation.

How did you do?

Was this exam question helpful?

Electric Cars (EC)

EC is a public limited company producing electric cars. Market research suggests that electric cars are in the early stage of the product life cycle. The demand for electric cars is likely to increase substantially in the next 10 years. EC is based in country X, where it is one of three electric car manufacturers. However, other manufacturers could start to produce electric cars if the forecast market growth is correct.

EC’s promotion has only been aimed at high income groups. The government of country X recently announced that it will support the use of electric cars. This will help EC to achieve its objective to increase sales volume by 50% over the next two years.

One year ago, EC invested $10m in new production facilities. The investment was funded by a long-term bank loan. Interest payments on the bank loan have reduced EC’s profit margin from 9% to 4%. EC will need to cut unit costs through increased efficiency.

EC initially launched its cars using a price skimming strategy but sales growth has been slow. If EC can achieve a 50% growth in sales over the next two years, it will be in a strong financial position. This means it will be able to spend more on the development of a larger product portfolio of electric cars.

Jancie, the Finance Director, has produced forecasts for EC’s financial data over the next two years, as shown in Table 2.1.

Table 2.1: Extract from EC’s forecast financial data

2020 ($m) | 2021 ($m) | |

Inventories | 30 | 50 |

Cash | 10 | 20 |

Trade receivables | 10 | 20 |

Trade payables | 25 | 30 |

Current ratio | 2 | X |

Define the term ‘efficiency’ (line 11).

How did you do?

Was this exam question helpful?

Aashna’s Pies (AP)

AP produces and sells high quality pies. Aashna set up AP five years ago when she spotted a gap in the market. AP is a private limited company and Aashna is the majority shareholder. All of the pies use the AP branding which is growing in popularity.

AP owns a factory where all the pies are produced. Pies are packaged and sold individually. The range of pies produced by AP is shown in Table 1.1.

Table 1.1: AP’s product portfolio

Name of pie | Filling | Price per pie | Annual change in sales quantity (2018 to 2019) | Stage on the product life cycle |

Meaty Marvel | Chicken and lamb | $2.80 | +3% | Maturity |

Vegetarian Victory | Broccoli, cheese and carrot | $2.50 | –10% | Decline |

Fishy Fortunes | Cod, prawns and cheese | $3.00 | +20% | Growth |

The pastry case of each pie is exactly the same no matter what filling is used. All of AP’s pastry is made using flow production. However each filling is made by specialist workers who use batch production.

Aashna is concerned about the sales of Vegetarian Victory pies and she is considering stopping production of this pie. However, the Operations Director has pointed out that AP might lose its economies of scale if the business reduces the total number of pies produced.

The Marketing Director would like Aashna to read his report about developing products in the future. He has done some market research (see Fig. 1.1).

|

Fig. 1.1: Market research to aid developing products in the future

Explain what is meant by the term ‘flow production’ (line 16).

How did you do?

Was this exam question helpful?