Changes to & Limitations of Break-even (DP IB Business Management): Revision Note

Changes to break-even

Changing any of the variables of break-even (selling price, variable cost per unit or total fixed costs) changes the break-even point and level of profit it can expect to achieve

Changes in variables and the break-even point

Increased selling price

An increase in the selling price reduces the break-even point

An increase in the selling price increases revenue at each level of output from R1 to R2

The break-even point falls from BEP1 to BEP2

Profit on each unit of output greater than the break-even point is increased

Decreased selling price

A decrease in the selling price increases the break-even point

A decrease in the selling price reduces revenue at each level of output from R1 to R2

The break-even point rises from BEP1 to BEP2

Profit on each unit of output greater than the break-even point is decreased

Increased variable costs

An increase in variable costs increases the break-even point

An increase in variable costs increases total costs at each level of output from TC1 to TC2

The break-even point increases from BEP1 to BEP2

Profit on each unit of output greater than the break-even point is decreased

Decreased variable costs

A decrease in variable costs decreases the break-even point

A decrease in variable costs decreases total costs at each level of output from TC1 to TC2

The break-even point falls from BEP1 to BEP2

Profit on each unit of output greater than the break-even point is increased

Increased fixed costs

An increase in fixed costs increases the break-even point

An increase in fixed costs increases total costs at each level of output from TC1 to TC2

The break-even point increases from BEP1 to BEP2

Profit on each unit of output greater than the break-even point is decreased

Decreased fixed costs

A decrease in fixed costs decreases the break-even point

A decrease in fixed costs reduces total costs at each level of output from TC1 to TC2

The break-even point falls from BEP1 to BEP2

Profit on each unit of output greater than the break-even point is increased

Benefits and limitations of break-even analysis

Break-even analysis provides valuable insights into the financial viability and performance of a business

It is particularly useful for communicating with stakeholders, including investors or lenders

It demonstrates the financial viability of the business and gives an insight into potential returns on investment

Benefits of break-even analysis

Use of break-even | Explanation |

|---|---|

Profitability assessment |

|

Cost control |

|

Pricing decisions |

|

Financial planning |

|

Sensitivity analysis |

|

Performance monitoring |

|

Decision making |

|

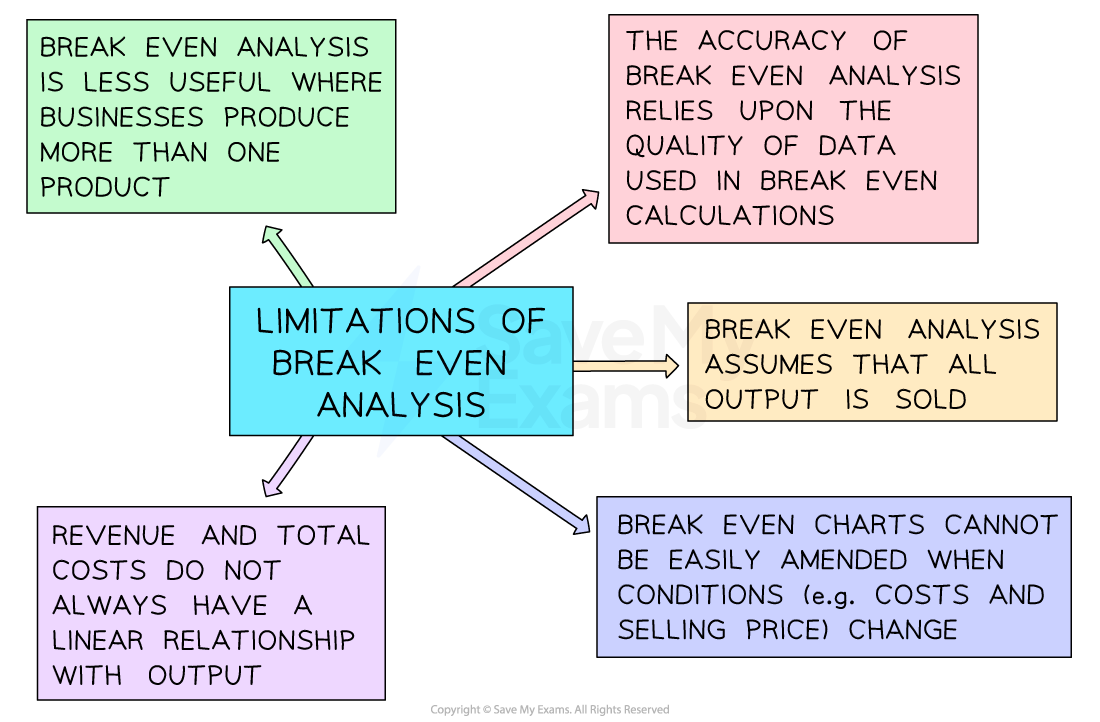

In common with other quantitative analysis tools, break even analysis has some limitations

Limitations of break-even analysis

Examiner Tips and Tricks

When evaluating break-even analysis, ensure that you explain why it has an important internal planning role, but don’t forget that it has a significant external role too.

Break-even analysis should be included in a business plan when a business is trying to secure external finance. Businesses looking to borrow money or attract investors seeking to manage their risk should take care to model the break-even point, margin of safety and level of profit (or loss) at different levels of output and be prepared to be scrutinised on the figures.

Unlock more, it's free!

Was this revision note helpful?